Over 100 Financial Institutions Trust Micronotes.ai

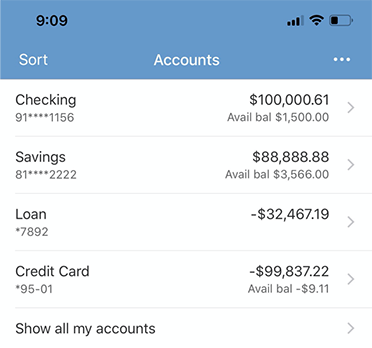

Micronotes.ai delivers cloud-based digital engagement solutions to financial institutions to:

- Start conversations

- Develop relationships

- Build trust

with new and existing customers and members across dozens of personalized use-cases that drive:

- Loan volume

- Deposits

- e-Service adoption/usage

- And dozens more…

Select a feature button to discover the benefits of Micronotes.ai

- Lower customer/member borrowing costs by refinancing mispriced debt held elsewhere.

- Engage with 15-20% of the digital banking audience every month to surface unmet needs.

- Know which campaigns are driving business, and which aren't.

- Set-and-forget campaigns knowing that Micronotes.ai is learning your customers/members preferences and adjusting dialogues accordingly.

- Compare your Net Promoter Score to your competitors, drive referrals from your promoters, and learn how to improve customer service.

- Customize your customer/member journeys to your financial institutions' voicing and infrastructure.

Ready to win back the business your customers/members have taken elsewhere?

Learn how Micronotes.ai can help your financial institution turn digital conversations with mobile and online banking customers into more revenue and deeper relationships.

Under The Hood

Surface Mispriced Debt

Personalized Digital Dialogues

Full Analytics

Automatic Machine Learning

Net Promoter Score

Flexible Targeted Content

Take the next step and fill out the form below to request a full demo. A representative will be in contact with you shortly.

We are reimagining the way Financial Institutions:

Book Loans

Our tech stack combined with Experian data automates the process of spotting and winning back mispriced loans your customers/members hold with competitive institutions through prescreen marketing.

Grow Deposits

We use AI-driven engagement to grow your deposit business by plugging deposit leaks, increasing direct deposit business, and capturing new deposit business.

Increase Retention

The more products a customer/member adopts, the less likely s/he is to leave; we ensure customers/members get more out of their banking relationship by adopting more products and services that make banking easier.