Illuminating the Path Forward: How AI-Driven Financial Institutions Are Outperforming Traditional Data Approaches

By Devon Kinkead

While recent studies highlight challenges in banking data practices, suggesting institutions are “flying in the dark,” a growing segment of forward-thinking financial institutions is proving that strategic AI implementation and advanced analytics can transform data from a burden into a competitive advantage. Rather than being grounded by imperfect data infrastructure, these institutions are soaring ahead by leveraging intelligent systems that work with real-world data conditions.

The Reality Check: Perfect Data Is a Myth

The notion that banks need “clean, structured and available” data before they can scale their business fundamentally misunderstands how modern AI and machine learning systems operate. Real-world financial institutions don’t have the luxury of waiting for perfect data infrastructure—they need solutions that can extract value from the data they have today while continuously improving over time.

Consider a recent case study from a personal loan campaign targeting debt consolidation prospects in Greater Los Angeles. Despite distributing thousands of loan offers across 42 cities and capturing only 13% of the available market initially, AI-powered post-campaign analysis quickly diagnosed specific gaps and delivered four actionable, compliance-cleared recommendations that could improve loan acquisition rates by 5-8% and increase funded volume by up to 40%.

This demonstrates that the question isn’t whether your data is perfect—it’s whether you have the right analytical tools to extract actionable insights from imperfect data.

From Data Quality to Data Intelligence

Traditional approaches to banking data focus heavily on governance, quality, and compliance—essentially building the perfect data foundation before attempting to derive value. While these elements remain important, this approach often creates analysis paralysis and delays competitive action.

Progressive financial institutions are instead embracing a different philosophy: deploy intelligent systems that can work with existing data while continuously learning and improving. Modern AI systems excel at pattern recognition within noisy, incomplete datasets—exactly the conditions most banks face today.

For instance, advanced analytics platforms can process 230 million credit records weekly, identifying untapped opportunities within a financial institution’s operating footprint and enabling targeted, personalized marketing campaigns that resonate with individual customers’ current financial situations. This level of operational capability doesn’t require perfect data—it requires intelligent systems that can extract value from available data sources.

The Engagement Revolution: From Data Hoarding to Customer Connection

Perhaps the most significant blindspot in traditional banking data approaches is the assumption that data value comes primarily from internal analysis. Leading institutions are discovering that the most valuable data insights come from direct customer engagement—not just analyzing what customers have done, but understanding what they need next.

Modern machine learning driven engagement platforms can validate individual customer needs by conducting meaningful conversations with up to 20% of online banking users monthly. This approach generates fresh, real-time data about customer intentions while simultaneously delivering personalized service. Instead of relying solely on historical transaction patterns, these systems capture forward-looking customer preferences and life event triggers.

Consider the power of this approach: when a customer makes an atypically large deposit, traditional data analysis might flag this as an anomaly. An intelligent engagement system recognizes this as a life event trigger and immediately initiates a personalized conversation to understand the customer’s needs and offer relevant solutions. Research shows that 54% of these customers typically withdraw their deposits within 90 days if not contacted—but proactive engagement can retain these significant deposits while deepening customer relationships.

Precision Over Perfection: The Competitive Advantage

While some institutions struggle with the gap between current data infrastructure and AI requirements, successful organizations are leveraging existing capabilities to gain immediate competitive advantages. The key insight is that AI systems don’t need perfect data—they need sufficient data combined with intelligent algorithms that can identify patterns and opportunities.

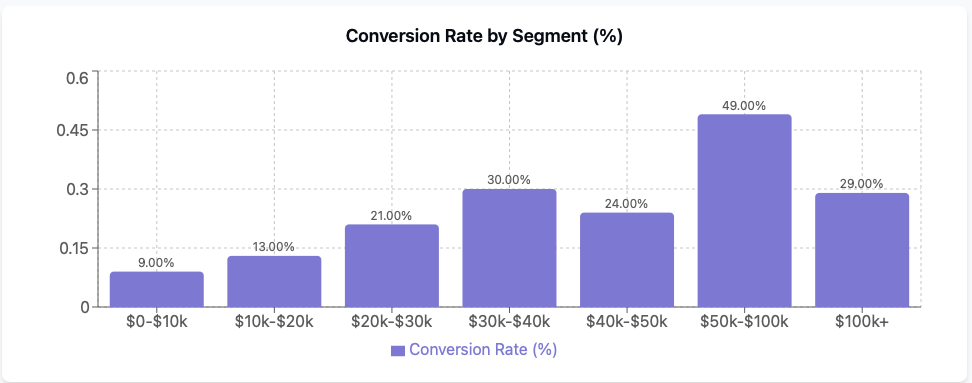

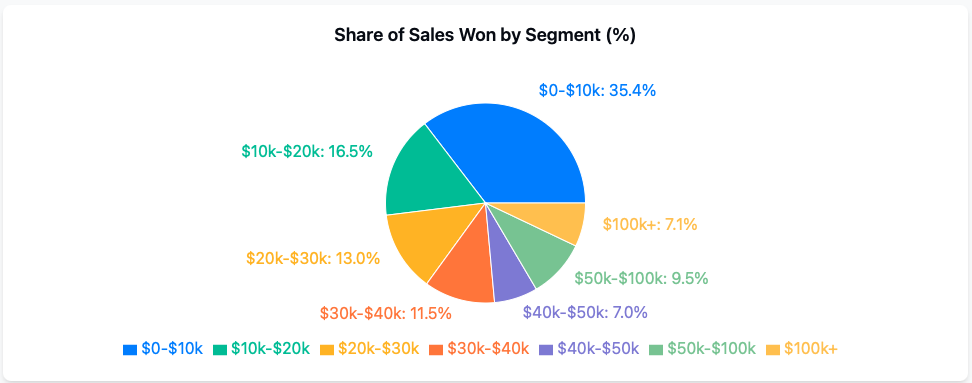

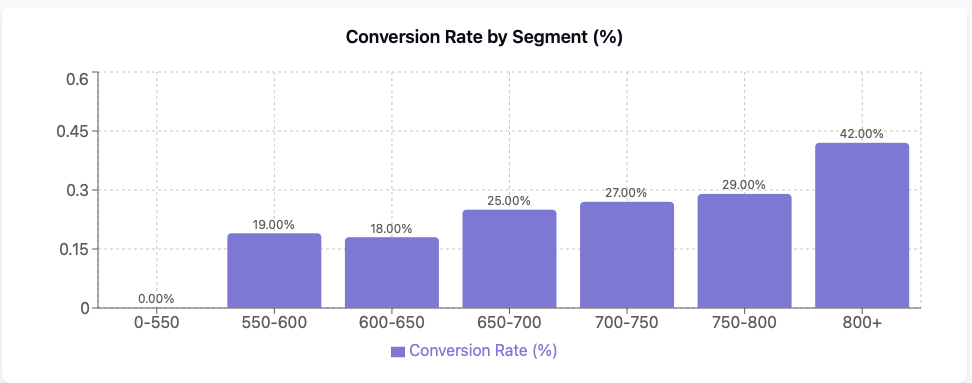

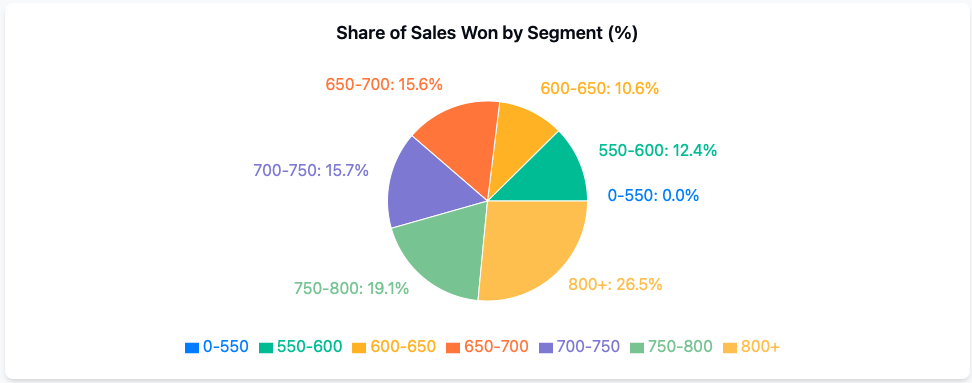

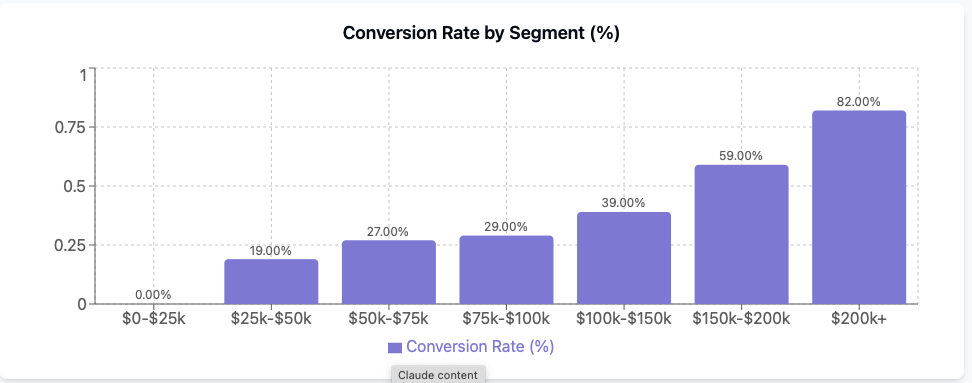

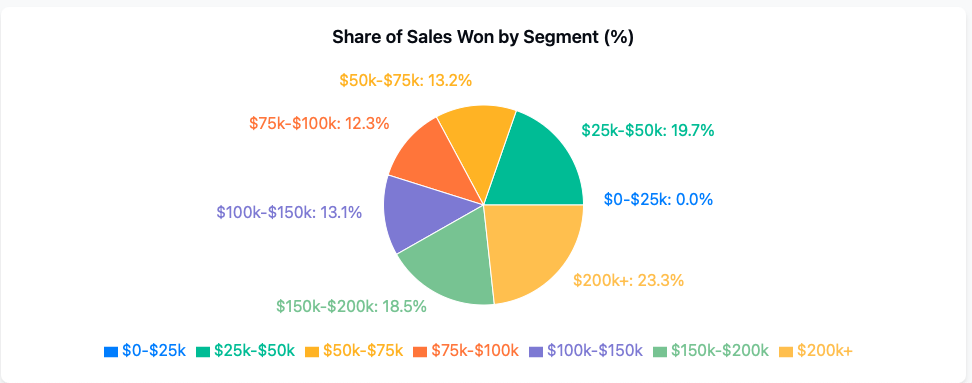

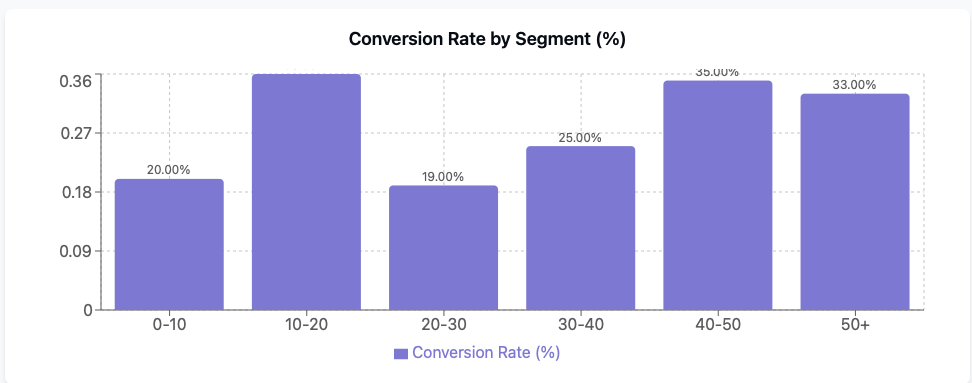

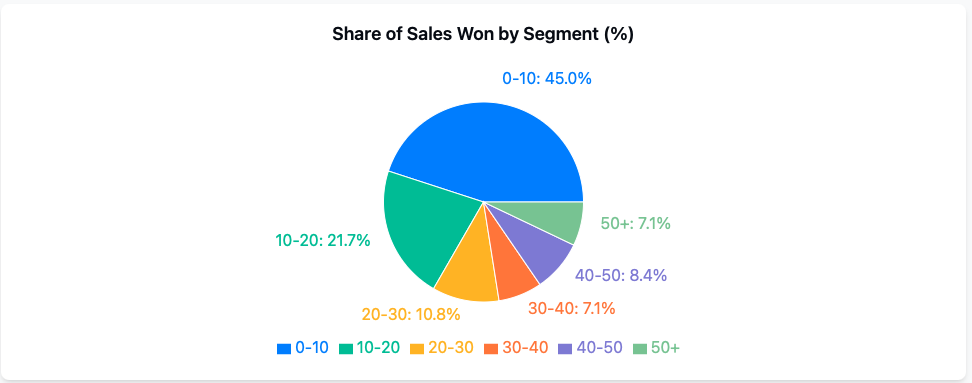

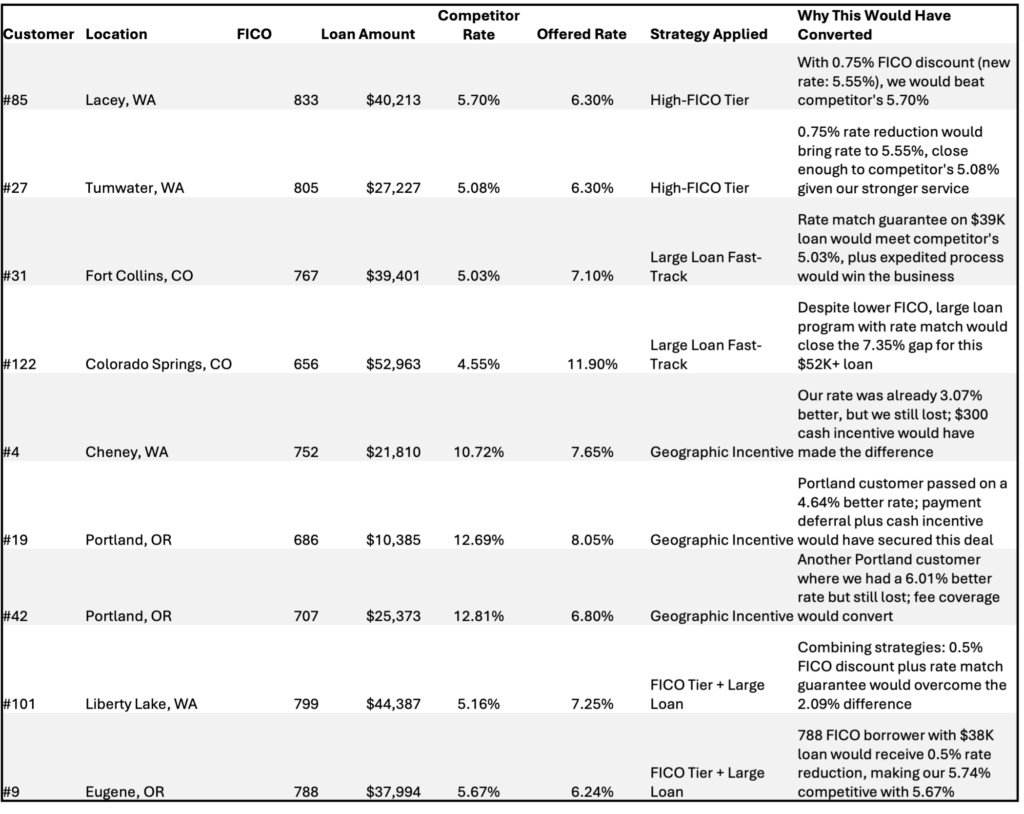

Advanced segmentation algorithms can categorize customers based on credit profiles and borrowing costs, delivering insights that traditional demographic analysis simply cannot match. This granular understanding enables banks to deploy risk-based tiered pricing strategies, align loan offers with borrower demand, and microtarget high-yield geographic zones—all based on existing data sources enhanced by machine learning.

The results speak for themselves: institutions implementing these approaches report 5-15% increases in campaign revenue, 26 times higher click-through rates compared to banner advertising, and 15-20% operational cost reductions within two years.

Real-Time Intelligence Beats Perfect Data

The banking industry’s traditional approach to data infrastructure resembles building a perfect library—organizing every piece of information before attempting to learn from it. But in today’s fast-moving financial landscape, institutions need real-time intelligence that can operate more like a skilled detective, finding meaningful patterns within available evidence and acting on them immediately.

Modern AI-driven platforms demonstrate this principle by continuously learning from customer interactions and market conditions. Every conversation, every campaign response, and every customer decision feeds back into predictive models that become more accurate over time. This creates a virtuous cycle where data quality improves through use rather than through upfront investment.

Regulatory Compliance as an Enabler, Not a Barrier

One of the most significant advantages of modern AI-driven banking solutions is their built-in compliance framework. Rather than treating regulatory requirements as obstacles to data utilization, intelligent systems can ensure that every insight, recommendation, and customer interaction meets strict regulatory standards.

For example, AI-powered prescreen campaign optimization automatically ensures compliance with FCRA permissible purpose requirements, Equal Credit Opportunity Act provisions, and truth-in-lending standards. This means banks can move faster and with greater confidence, knowing that their data-driven strategies are both effective and compliant.

The Path Forward: Embracing Intelligent Action

The financial institutions that will thrive in the coming years are not those waiting for perfect data infrastructure, but those implementing intelligent systems that can extract maximum value from current resources while continuously improving their capabilities.

This approach requires a fundamental shift in mindset—from data perfectionism to intelligent action. Instead of asking “Is our data clean enough?” the question becomes “What insights can we extract from available data, and how quickly can we act on them?”

The evidence is clear: institutions that embrace AI-driven analytics and engagement platforms are not flying in the dark—they’re illuminating new paths to customer understanding, operational efficiency, and competitive advantage. They’re proving that in the modern banking landscape, intelligence matters more than perfection, and action delivers better results than preparation.

While data governance and infrastructure improvements remain important long-term investments, banks cannot afford to wait for perfect conditions before leveraging the transformative power of AI and advanced analytics. The institutions moving ahead today are those that recognize that the best time to start extracting value from data is right now, with the tools and data they have available.

The future belongs to financial institutions that combine human insight with artificial intelligence, creating systems that can think, learn, and adapt in real-time. These organizations aren’t flying in the dark—they’re using advanced navigation systems that help them see further and move faster than ever before. Learn more