By Devon Kinkead

In an era where deposits walk at the first sign of a better rate and fintechs promise instant gratification, financial institutions face a critical question: How do you keep deposits not just for today, but for decades? The answer increasingly lies in reimagining one of banking’s oldest products—the certificate of deposit—as both a retention tool and a relationship deepener.

Two complementary approaches are reshaping how community banks and credit unions think about CDs and deposit retention: First Alliance Credit Union’s mission-driven Impact CD and Micronotes’ technology-enabled exceptional deposit strategy. Together, they reveal a powerful truth: the most effective deposit retention combines emotional connection with intelligent intervention at life’s pivotal moments.

The Deposit Retention Challenge: Why Traditional CDs Fall Short

For decades, certificates of deposit served a straightforward purpose: lock in funds at a fixed rate for a set term. But this transactional approach misses the deeper dynamics of deposit retention in today’s market.

Research shows that up to 50% of large deposits exit within 90 days without proactive intervention—a sobering reality for community institutions competing against both rate-chasing depositors and digital-first competitors. Traditional CDs, while offering rate incentives, often fail to address the underlying reasons customers move money: they don’t feel understood, they’re navigating major life events alone, or they simply don’t see their deposits making an impact beyond personal gain.

The institutions winning at deposit retention understand that every significant deposit tells a story—whether it’s an inheritance, a home sale, a business success, or a bonus. These “exceptional deposits” signal life events that require thoughtful guidance, not just product pitches. And increasingly, the most successful institutions are using CDs not merely as rate vehicles, but as relationship-building instruments that address both practical needs and deeper values.

First Alliance’s Impact CD: Turning Deposits into Community Capital

First Alliance Credit Union’s Impact CD represents a bold reimagining of what a certificate of deposit can be. Rather than letting deposits “rest quietly in an account that compounds in silence,” this innovative product transforms member funds into visible community impact.

The Mission-Driven Difference

The Impact CD operates like a conventional certificate—offered in five-, seven-, or ten-year maturities—but with features that turn it into something more meaningful:

Transparency Through Impact Reporting: Members receive an Annual Financial and Community Impact Report tracing their deposit from vault to community outcome—whether that’s a family’s front door, a startup’s first storefront, or someone’s financial fresh start. This transparency creates an emotional connection far deeper than basis points alone.

Flexibility That Builds Relationships: Unlike traditional CDs that penalize any change, Impact CD holders can add to their principal at any time during the term without resetting the clock. This flexibility recognizes that life events—the very moments that create exceptional deposits—happen throughout a CD’s term.

Mission Alignment: Members can direct interest earnings to the First Alliance Credit Union Foundation, amplifying their impact while maintaining the safety of their principal investment.

Extended Protection: For larger balances, supplemental share protection extends deposit insurance beyond standard NCUA limits, addressing a common concern for high-balance depositors.

Results That Matter

In just twelve months, First Alliance’s deposit strategy—anchored by the Impact CD—fueled remarkable outcomes: credit-building programs for 550+ people, affordable homes for 31 families, nearly $5 million to 55 entrepreneurs, and fair financing for 175 immigrant neighbors through ITIN loans.

President/CEO Brent Rempe describes the Impact CD as “a way to turn private prosperity into shared possibility”—a positioning that transforms deposit retention from a defensive financial strategy into an offensive relationship-building opportunity.

Micronotes’ Exceptional Deposits: Technology That Recognizes Life’s Pivotal Moments

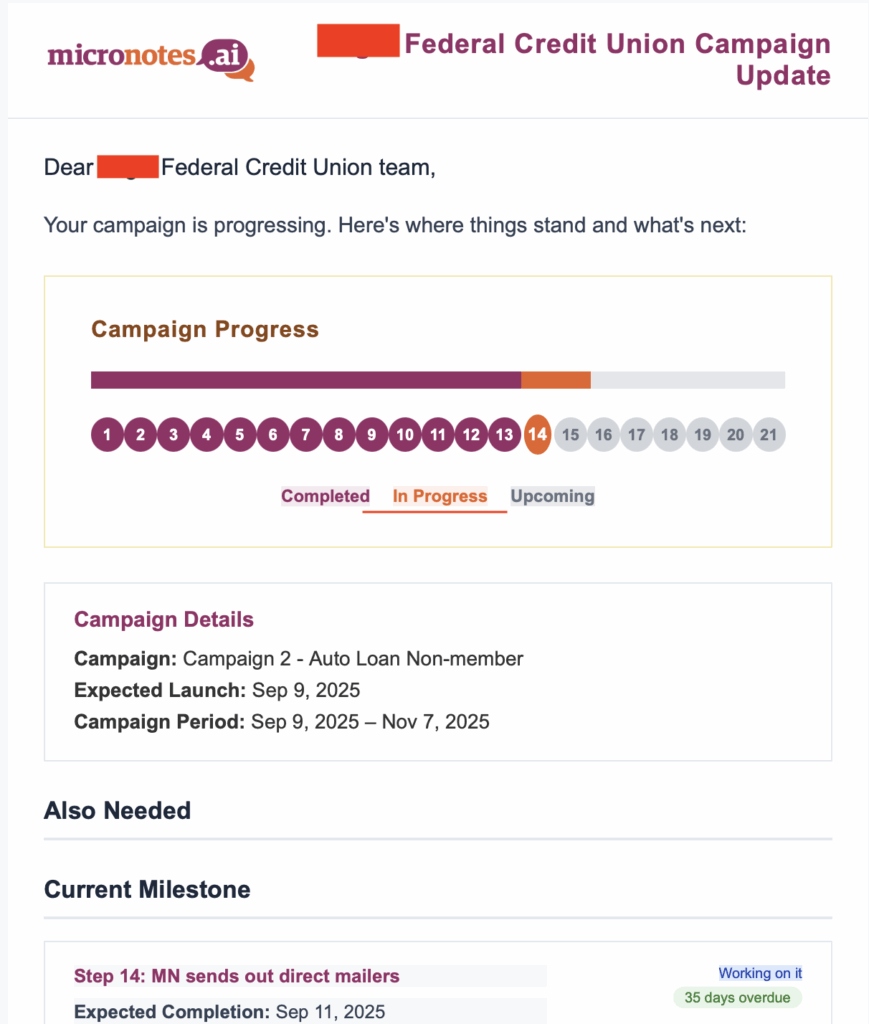

While First Alliance shows how purpose can retain deposits, Micronotes demonstrates how technology can identify and respond to the critical moments when deposits are most at risk—or when relationships can be most profoundly deepened.

The Exceptional Deposits Approach

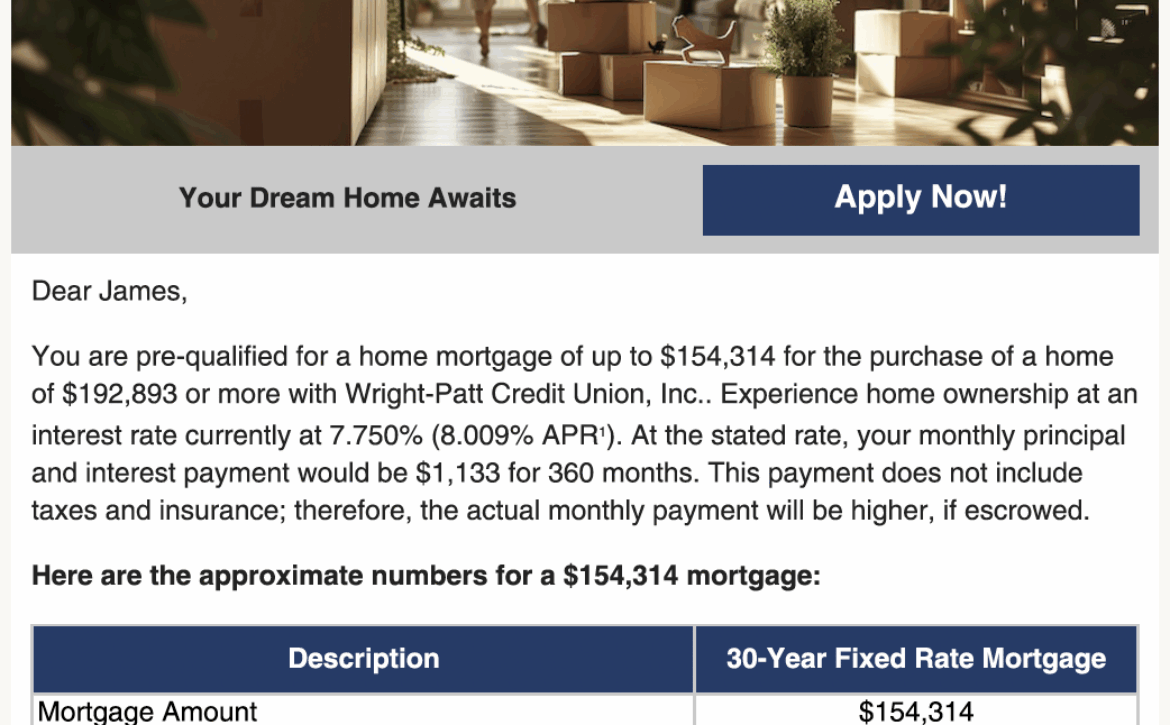

Micronotes’ platform uses predictive analytics to identify “exceptional deposits”—statistically anomalous deposits that typically signal major life events. The moment these deposits occur, the system initiates personalized microinterviews through digital banking channels, creating conversations rather than broadcasting sales messages.

The technology addresses a fundamental insight: every large deposit represents a life event, and the window to respond is narrow. Without intervention, these deposits often leave quickly as customers navigate major transitions—home purchases, inheritances, business launches, retirement planning—often feeling overwhelmed and underserved.

How It Works in Practice

The Micronotes approach transforms the CD from a passive product into an active retention tool:

- Immediate Detection: The system flags unusual deposit activity in real-time, identifying customers likely experiencing major life transitions.

- Personalized Engagement: Rather than generic marketing, the platform initiates relevant conversations: “I see you’ve made a significant deposit. Are you planning for retirement, considering a home purchase, or navigating another major financial decision?”

- Intelligent Product Matching: Based on customer responses, the system connects them with appropriate solutions—including CDs—that match their life stage and goals.

- Seamless Handoff: When customers express interest in speaking with advisors or learning more about products like CDs, the platform delivers qualified leads to relationship managers in real-time.

Measurable Impact

Financial institutions using Micronotes’ Exceptional Deposits solution have seen dramatic results:

- Engagement with customers who would typically withdraw large deposits within 90 days

- Substantial new CD purchases from previously at-risk funds

- Successful retention of significant deposits, more than half of which would otherwise have been withdrawn

- Preempting fund transfers to competitors by proactively offering competitive CD and investment products

One community bank customer shared: “I was planning on investing into a money market with Wells Fargo at 5.4%.” With Micronotes-enabled intervention, the bank offered competitive CD products that retained the relationship.

The Synthesis: CDs as Strategic Retention Instruments

When we combine First Alliance’s mission-driven approach with Micronotes’ technology-enabled intervention, a comprehensive CD retention strategy emerges:

1. Use Technology to Identify the Moment

Exceptional deposits are retention opportunities in disguise. Whether someone receives an inheritance, sells a home, or gets a major bonus, they’re navigating a life transition that requires financial guidance. Technology like Micronotes identifies these moments instantly, creating the opportunity for timely intervention.

2. Lead with Understanding, Not Rates

The most effective retention conversations begin with empathy, not product pitches. Micronotes’ microinterview approach asks questions and listens before recommending solutions. This mirrors First Alliance’s understanding that members want to be co-authors of impact stories, not just rate shoppers.

3. Offer CDs That Match Values and Goals

Traditional CDs compete solely on rate and term. But modern depositors—especially those navigating significant life events—seek more. They want:

- Safety and growth: Traditional CD benefits remain important

- Flexibility: The ability to add funds during life transitions (like First Alliance’s Impact CD)

- Purpose: Connection to community impact and mission alignment

- Guidance: Expert advice during major financial decisions

4. Create Ongoing Engagement, Not Just Maturities

First Alliance’s annual impact reports and Micronotes’ continuous microinterview technology both recognize that deposit retention isn’t a one-time sale—it’s an ongoing conversation. CDs with longer terms (five, seven, or ten years) become relationship anchors when institutions stay engaged throughout the term.

5. Build Household Relationships Through Life Stages

Micronotes research emphasizes that financial decisions don’t happen in isolation—they occur within household contexts. A large deposit for a home down payment might involve parents helping children; an inheritance affects multiple generations. CDs positioned within these household relationships become stickier because they’re woven into family financial planning.

The most sophisticated institutions use technology to identify when a member’s child is approaching college age, when families might be planning for eldercare, or when multiple generations could benefit from coordinated CD laddering strategies.

Practical Applications: What This Means for Your Institution

How can community banks and credit unions apply these insights to transform CDs from commodity products into retention powerhouses?

For Institutions Without Advanced Technology

Start with mission and positioning:

- Reframe your CD offerings: Move beyond rate sheets to tell stories about what deposits accomplish. First Alliance’s Impact CD proves that transparency about fund deployment creates emotional connection.

- Train staff on life event recognition: Even without automated exceptional deposit detection, relationship managers can identify life transitions through conversations and use these moments to position CDs as solutions.

- Create flexibility where possible: Consider allowing additions to CD principals during the term, recognizing that life events continue after the initial opening.

- Develop impact reporting: Even traditional CDs can connect to community impact through aggregate reporting on how deposits fund local mortgages, small business loans, and community development.

For Institutions Ready to Invest in Technology

Deploy intelligent intervention:

- Implement exceptional deposit monitoring: Use platforms like Micronotes to automatically identify at-risk deposits and life event signals in real-time.

- Create CD-specific microinterview sequences: Design conversation flows that help customers understand when CDs make sense for their goals versus other products.

- Build CD laddering guidance into digital experiences: Use technology to show customers how multiple CDs with staggered maturities can provide both liquidity and higher rates.

- Integrate household view analytics: Identify opportunities to serve multiple generations with coordinated CD strategies tied to life stage planning.

For All Institutions

Focus on these universal principles:

- Respond quickly to exceptional deposits: The 90-day window is real. Whether through technology or process, create systems that engage significant depositors immediately.

- Lead with consultation, not sales: Ask about life events, goals, and concerns before recommending CD terms and rates.

- Differentiate on more than rate: While competitive rates matter, purpose, flexibility, and relationship depth create stickier deposits.

- Measure retention, not just origination: Track how many exceptional deposits convert to long-term CD relationships versus leaving the institution within 90 days.

- View every CD as a relationship anchor: Use CD terms as opportunities for regular engagement—annual reviews, maturity planning conversations, and life stage check-ins.

The Future of CD-Based Retention: Where Purpose Meets Precision

The convergence of mission-driven products like First Alliance’s Impact CD and technology-enabled intervention like Micronotes’ Exceptional Deposits platform points toward the future of deposit retention.

Successful institutions will:

- Use predictive analytics to identify life events before customers tell them

- Offer values-aligned products that connect deposits to community impact

- Create flexible CD structures that recognize life’s unpredictability

- Maintain ongoing engagement throughout long CD terms

- Build household relationships that span generations

- Compete on purpose and service, not just rates

In this future, CDs evolve from simple rate vehicles into sophisticated relationship tools that:

- Signal commitment to community impact

- Provide stability during life transitions

- Create engagement opportunities throughout their term

- Connect individual financial goals to broader household planning

- Demonstrate institutional understanding of what matters to depositors

Conclusion: Reinventing the Humble Certificate of Deposit

The certificate of deposit—one of banking’s oldest and most straightforward products—is being reinvented for the modern deposit retention challenge. Financial institutions that view CDs merely as rate-driven commodities will continue losing deposits to whoever offers 25 basis points more this month.

But institutions that follow First Alliance’s lead in creating mission-aligned CD products, combined with Micronotes’ approach to technology-enabled life event identification, will transform CDs into relationship-building instruments that retain deposits not through penalties or rate games, but through genuine understanding and shared values.

The path forward requires both heart and technology: the emotional intelligence to understand that every exceptional deposit represents a human story, and the technological capability to identify and respond to these stories at scale. When purpose meets precision, CDs become more than financial instruments—they become the foundation of multi-generational banking relationships built on trust, transparency, and shared community commitment.

The question for your institution isn’t whether to offer CDs—it’s whether your CDs are retention tools or just another rate on the board. First Alliance and Micronotes show that when you reimagine these foundational products through the lens of life events, community impact, and intelligent engagement, they become among your most powerful deposit retention strategies.

Because in the end, deposits don’t leave institutions—people do. And people stay when they feel understood, valued, and connected to something larger than basis points. That’s the true power of strategically positioned certificates of deposit in the modern deposit retention playbook.

Learn more