How AI and Advanced Analytics Are Transforming Prescreen Campaign Performance in a Highly Regulated Industry

By Devon Kinkead

In today’s highly competitive financial landscape, where every lending decision counts and every customer interaction matters, the effectiveness of prescreen marketing campaigns can determine whether a bank or credit union captures or loses market share. Increasingly, financial institutions are turning to AI-driven campaign intelligence to outperform traditional methods and unlock higher response rates, funded volume, and long-term account value.

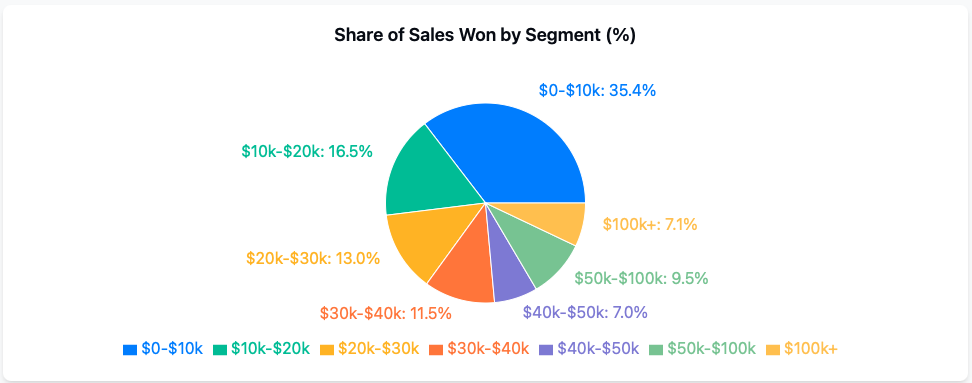

Recent results from a personal loan campaign run by a Micronotes client, targeting debt consolidation prospects in Greater Los Angeles, reveal just how critical analytics and AI have become. Despite distributing 15,161 offers across 42 cities, the campaign only captured 13% of the total available market—well below the 23% benchmark. Competitors, meanwhile, originated over $3 million in loans. AI-powered post-campaign analysis not only diagnosed the gaps but delivered four actionable recommendations—each of which has been cleared for regulatory compliance.

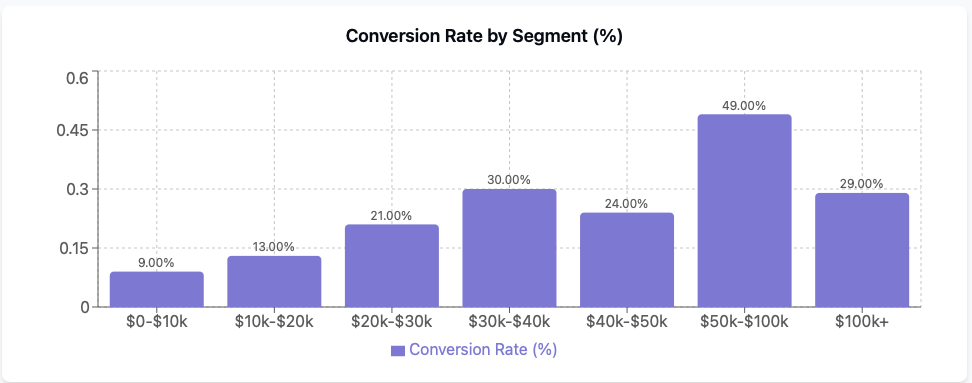

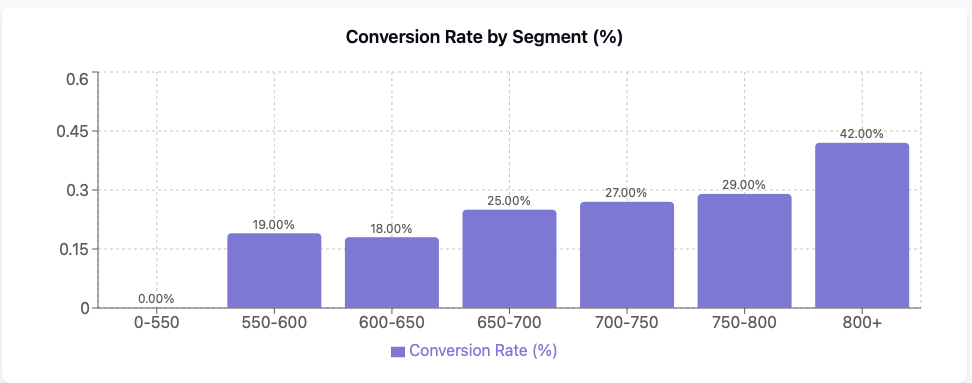

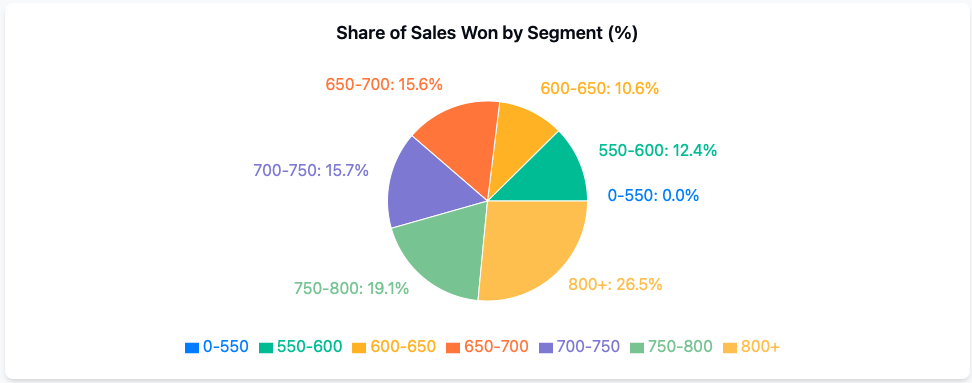

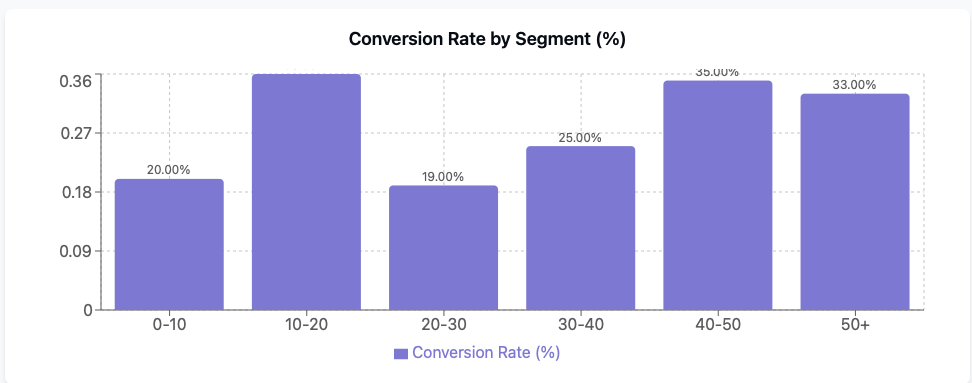

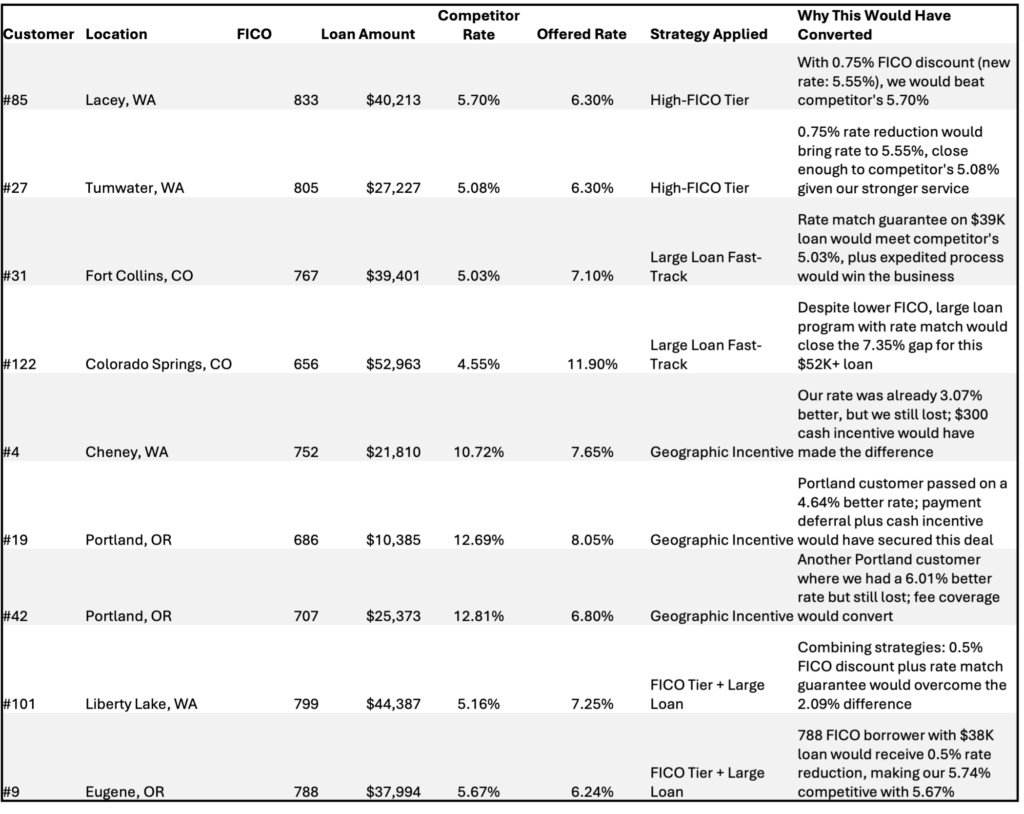

1. Smarter Pricing: Optimize Loan Rates by FICO Segment

Issue Identified: Average funded rate was 13.535%, while loans lost to competitors averaged 13.42%. In many segments, competitors offered significantly better terms.

Recommendation: Deploy risk-based tiered pricing strategies that adjust APRs by FICO bands, offering more competitive rates to prime segments without increasing portfolio risk.

Compliance Cleared: This approach complies with:

- 15 U.S.C. § 1681b (permissible purpose under FCRA),

- 12 CFR 1022.54 and 16 CFR 642 (prescreen disclosures and firm offer criteria),

- And assumes firm offers are based on consistent underwriting criteria.

Projected Impact: 5–8% improvement in loan acquisition rate.

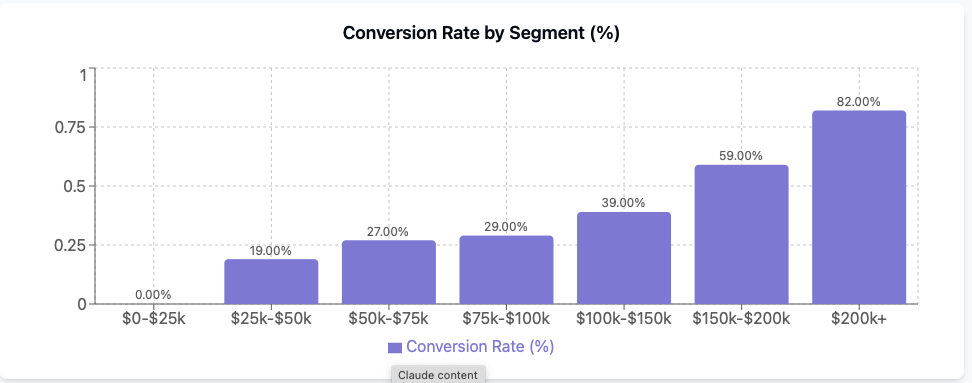

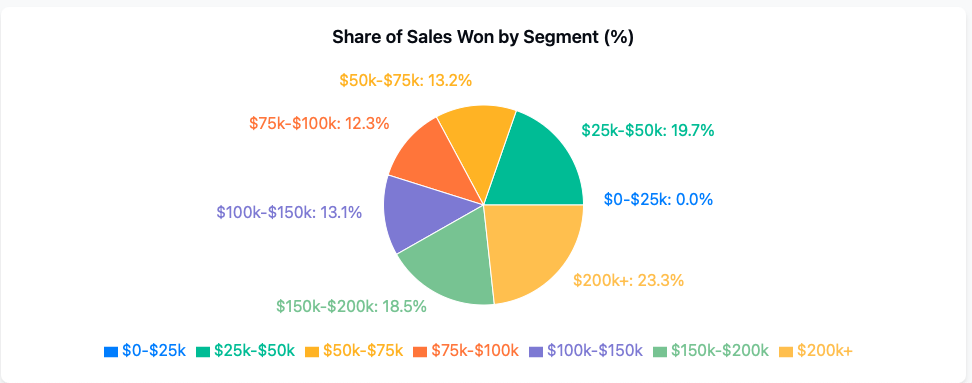

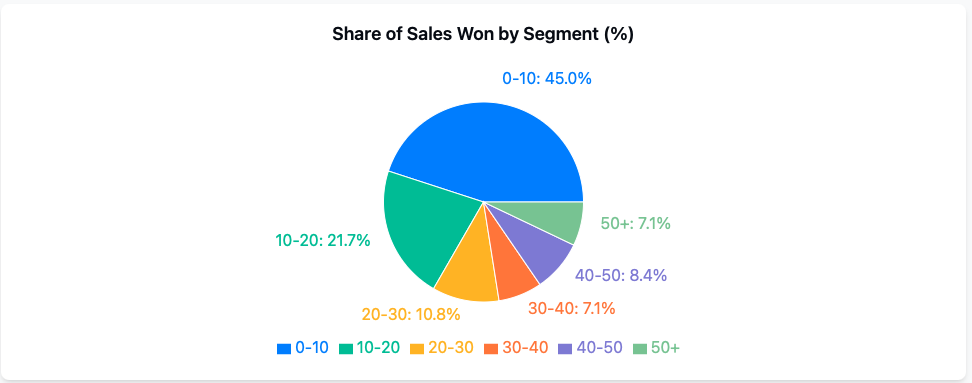

2. Align Loan Offers with Borrower Demand

Issue Identified: Funded loans averaged $15,493, while the average size of lost loans was $19,420.

Recommendation: Expand loan amounts in high-credit-capacity ZIP codes to better align with borrower expectations and creditworthiness.

Compliance Cleared: Compliant with:

- Equal Credit Opportunity Act (15 U.S.C. § 1691), provided that all applicants within a segment are offered the same terms,

- FCRA 15 U.S.C. § 1681m for adverse action and firm offer provisions.

Projected Impact: Potential to increase funded volume by $150,000 or more.

3. Microtarget High-Yield Zones

Issue Identified: Reseda alone saw 14 lost loans totaling $292,778—no funded volume.

Recommendation: Use ZIP-based credit trigger data and behavioral analytics to microtarget areas with high loan loss rates and low campaign penetration.

Compliance Cleared: Fully permissible under:

- 15 U.S.C. § 1681b(c)(1)(B) for prescreened offers,

- 12 CFR 1022.54 and 16 CFR 642 (including opt-out and firm offer requirements).

Projected Impact: 10–15% lift in funded volume in underserved geographies.

4. Tailor Messaging to Borrower Needs

Issue Identified: Messaging was uniform across all credit segments, regardless of borrower intent or risk profile.

Recommendation: Customize creatives to align with segment-specific motivations—such as refinancing for high-FICO or payment relief for mid-FICO consumers.

Compliance Cleared: Meets advertising fairness and truth-in-lending standards under:

- 15 U.S.C. § 45(a) (FTC Act’s prohibition on unfair/deceptive acts),

- 12 U.S.C. § 5531 (UDAAP standards for financial services marketing).

Projected Impact: 3–5% lift in application conversion rates.

Strategic Summary

These analytics-powered strategies—each cleared through a compliance lens—are not just marketing enhancements, they’re strategic levers for outperforming the competition while meeting regulatory requirements.

Combined Impact Potential:

- Up to 40% lift in overall funded volume

- Improved competitive positioning in key markets

- Greater marketing ROI and regulatory risk mitigation

Financial institutions that integrate advances analytics and AI with campaign planning, segmentation, pricing, and creative optimization are positioned not just to react—but to lead. Learn more.