Bankers See AI Casting a Long Shadow

By Kevin Flanagan, Marketing Director, Micronotes

To paraphrase Paul Revere, “AI is coming! AI is coming!!” And that includes machine learning, too.

That was one of the key findings in a new research report published by The Economist Intelligence Unit.

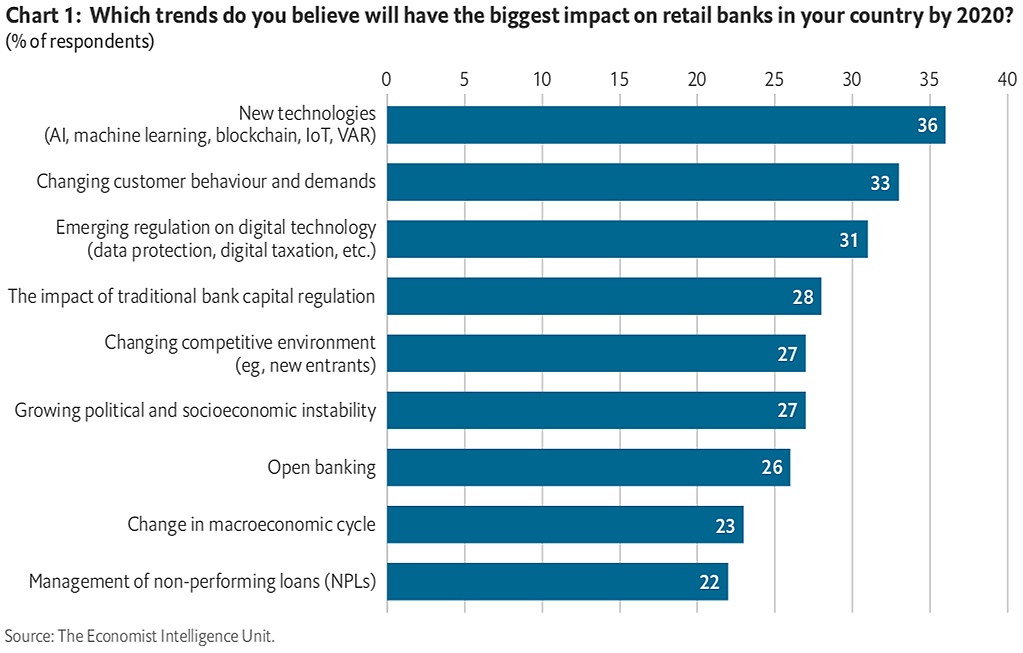

The researchers asked more than 400 retail banking executives worldwide to estimate the impact a variety of technologies, new competitors, and other factors are likely to have on the banking industry over the next several years.

Now, regular readers of this blog know that artificial intelligence (AI) is already having a significant effect on the banking industry, as an increasing number of institutions leverage AI machine learning to connect with their digital users, who rarely visit branches these days.

But it’s always interesting to read the opinions of bankers about which factors will make the most significant impact on the industry moving forward. That’s what this report provides.

The survey first asked bankers to rank the trends that will have the biggest impact on retail banks next year.

AI machine learning and other cutting-edge technologies outpaced even the changing requirements of customers, which often have the most significant impact on the future direction of any industry.

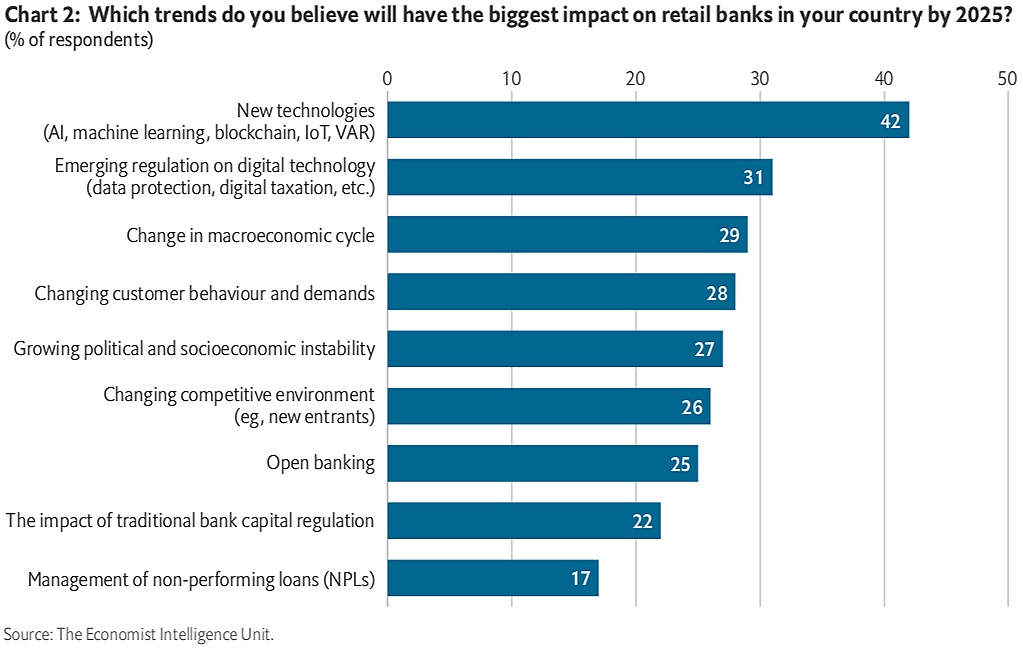

The survey then posed the same question, but asked respondents to look out an additional five years.

Bankers anticipate that AI machine learning will have an even greater impact on their business by 2025.

The takeaway from surveys like this is pretty simple: The pace of change brought about by technology will continue to increase.

With all the pressures on retail banks—competition from national institutions, efforts by non-bank fintechs to capture lucrative swaths of banking business, and the often fickle preferences of consumers—the time to adopt technologies such as AI machine learning that can help bankers connect with their digital customers isn’t five or six years in the future.

It’s today.