“Checking Out” of Deposit Motels

By Devon Kinkead

As Ron Shevlin of Cornerstone Advisors likes to say, checking accounts have become “paycheck motels” – that is, temporary places for people’s money to stay before it moves on to bigger and better places.

Given the all-out war for deposits right now by competing financial institutions, we see this temporary cash housing problem as a serious but preventable threat to the financial well-being of our client financial institutions and their respective customers and members.

Nothing New to Micronotes

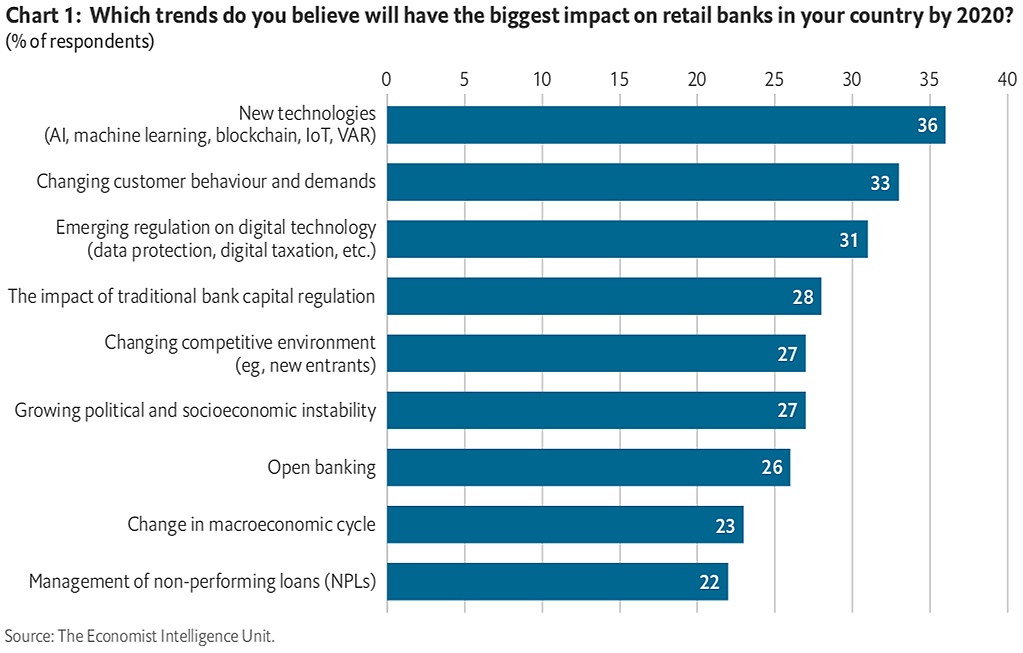

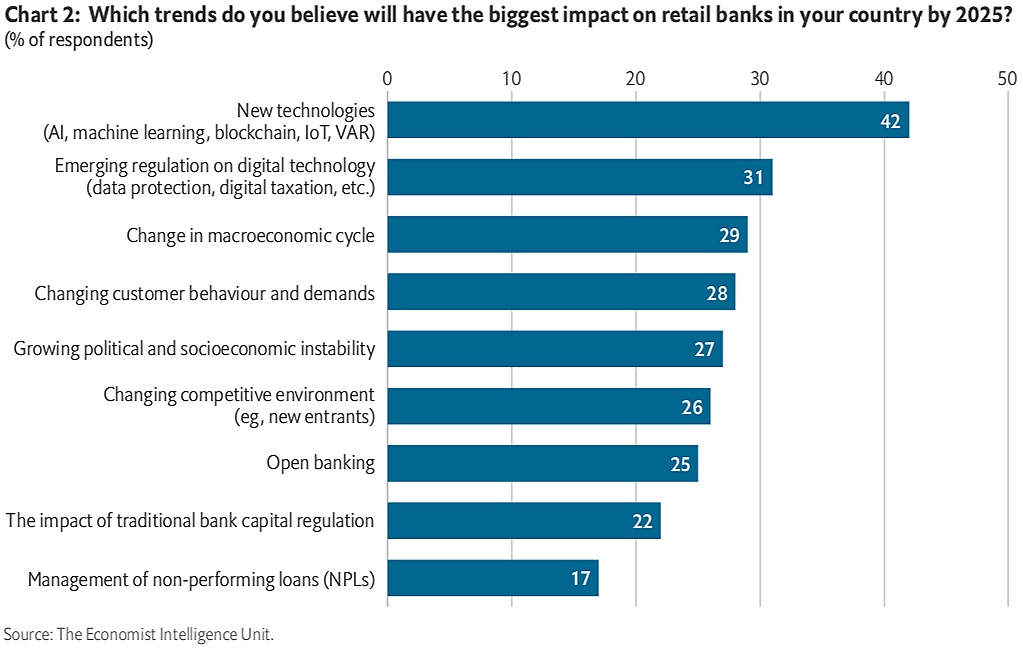

We’ve been helping financial institutions increase deposits for years using our proprietary microinterview engagement technology targeted by machine learning.

Quoting Tom Novak, VP and Chief Digital Officer of Visions Federal Credit Union in a 2021 Q2 case study, “…Micronotes is a conversational AI tool, digital marketing tool, where we use machine learning on the backend to more effectively target and curate offers and messages to our digital banking members. One of the best outcomes we experienced a couple years ago, before COVID hit, was when we were in a little bit of a liquidity crunch. We needed to tell our members that we had great deposit rates, and that they could bring those deposits to us and we’d reward them with nationally leading interest rates – or dividend rates, as we call them on the credit union side. We developed that through Q2’s SDK (software development kit), which is part of the Innovation Studio. It let us curate those messages and integrate them into the digital experience. In a few short months, we brought in over $8 million in deposits, retaining those deposits on our books.”

Our strategy for increasing deposits for our clients is:

- Hold on to the deposits you have!

- Ask for deposits held elsewhere, programmatically.

- Attract customers who can make large deposits.

Watching Deposits Check-Out

How often has a customer or member parked a large sum of money in her checking or savings account while deciding what to do with it next? Did the banking institution reach out to discuss investment or new mortgage options for that big deposit? Probably not.

So what happened next? She probably moved the money elsewhere and 3 months later saw a billboard advertising great CD rates from her banking provider; too little, too late, and way too slow.

A better strategy is to detect deviations from an average account balance, deploy Micronotes and start a mobile or online banking conversation with your customer/member about investment opportunities and/or new mortgage/loan options; with a personal approach.

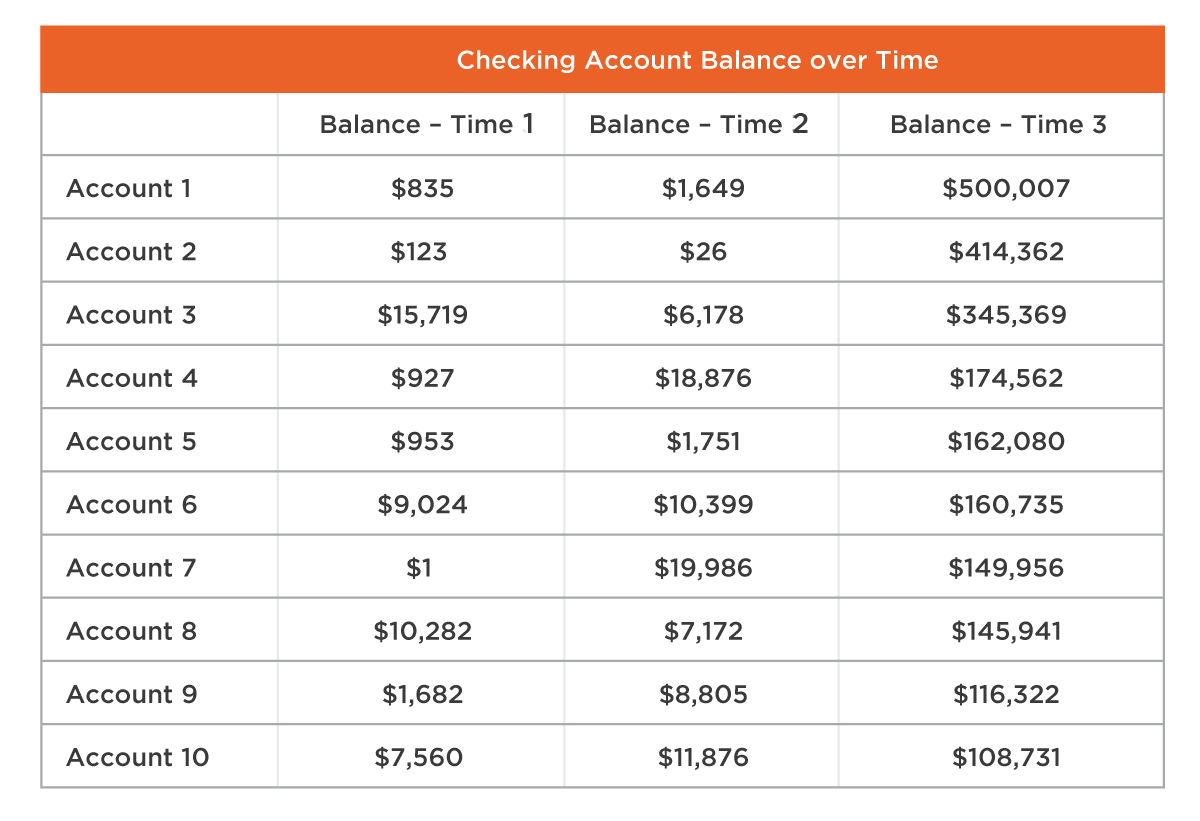

For example, look at these 10 real checking account balances that are 1-2 months apart (table 1):

Table 1

These 10 accounts all show anomalies given the balances at time 3, which are all North of ten times the average balance over the previous two periods. Given the net interest margin advantage of having large deposits sitting in low-yield accounts, the risk of losing the deposit is now the key question.

The risk of losing an anomaly deposit can be computed by looking at anomaly deposits that exited the balance sheet within 30 days of the deposit and is a value from 0-1, 1 being 100% probability that the deposit will exit the financial institution balance sheet in the next 30 days.

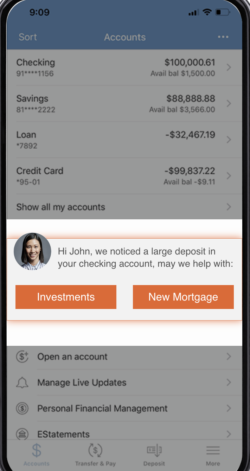

However, this computation is unnecessary because the anomaly deposit represents a low-cost automated opportunity to learn about the large depositor’s life and needs. For example, a personalized microinterview with the mobile banking customer can be automatically triggered to uncover important information as shown below in Figure 1.

Figure 1

From this one question, we use branch and skip logic to pinpoint the depositor’s situation and needs and direct her to the right banker for options to retain the deposit.

The application of this simple method of detecting anomaly deposits, triggering a discovery conversation in mobile/online banking to understand context and intention, and connecting that customer to the right banker in your organization is a simple but powerful way to reduce the probability that your financial institution becomes a large deposit motel where deposits check-out at noon.

In the next installment, we’ll go through how to:

- Ask for deposits held elsewhere programmatically

- Attract customers who can make large deposits.