Banking Beyond the Crisis

By Devon Kinkead, Founder and CEO, Micronotes

I attended the MIT Sloan School of Management conference titled “Finance Beyond The Crisis” in New York City today and heard from some of the brightest, most accomplished minds in finance, including 1997 Nobel Laureate in Economics Bob Merton. Perhaps you’ve heard of the Black–Scholes–Merton model of pricing derivatives? Yeah, he’s that Merton. Here’s what I took from the conference about the future of banking:

Lesson 1: Keep it simple!

Merton discussed an incredibly powerful—but simple—model to help regular people save for retirement. It’s a government bond (zero-risk) innovation that works, for the consumer, very simply. The basic tenets are:

-

People want to retire with the same standard of living they enjoyed in the latter part of their working life.

-

Most people can’t do complex financial computations to determine how much to save and how to invest those savings to meet their goal.

-

People love pensions—but fewer have them.

Merton’s idea is called SeLFIES(Standard-of-Living indexed, Forward-starting, Income-only Securities). The point I want to illustrate is the simplicity of this retirement solution for the retiree. Here’s how it works:

-

The aspiring retiree is, for example, 25 years old.

-

The person decides when s/he want to retire, say at age 65.

-

It’s 2019.

-

Each 2059 (2019 + 40 years to retirement) SeLFIE delivers $10 in retirement income per year.

-

The retiree decides s/he wants to retire with $50,000 in annual income.

-

The retiree needs to purchase 5,000 ($50,000/$10/SeLFIE) 2059 SeLFIES during her working life to ensure $50,000 per year in retirement income.

-

So, her retirement plan is to purchase 5,000 2059 SeLFIES over the course of her working life.

That’s it! Once she reaches 2,500 SeLFIEs, she knows she’s half way there. Simple! What goes on in the background is more complex, but retirement planning now becomes something that anyone with a 10thgrade education can do. Brilliant!

What’s the lesson? Let’s design and explain retail banking products in ways that are simple, actionable and trackable. If we can do that, we can really help our customers and members live better lives.

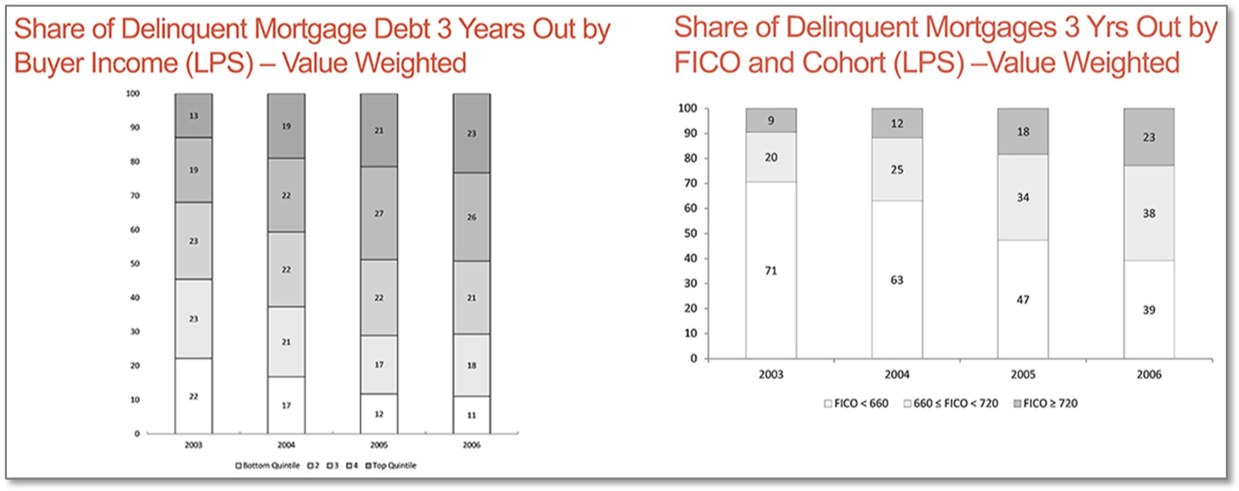

Lesson 2: Dig into the data before making policy

Antoinette Shoar, a visiting professor at MIT Sloan, then spoke about her analysis of the mortgage/housing crisis of 2008. First, she dispelled the myth that the financial crisis was caused by an irrational zeal to lend a lot of money to subprime borrowers. Look at the plot below and note the subprime share of 3-year delinquent mortgages.

Source: https://mitsloan.mit.edu/ideas-made-to-matter/rethinking-how-housing-crisis-happened

If you look at the plots above, it’s impossible to conclude that subprime (FICO <660) or relatively poor buyers were the primary root cause of mortgage delinquency. So, any bank that adjusted its mortgage lending policies to safeguard against loan losses from subprime borrowers—the narrative—missed the point.

Surprisingly, she also found that 50 percent of the contact information that banks had on borrowers in 2008 was incorrect, which makes it difficult to reach customers for loan repayment discussions. Now I understand why Micronotes’ clients are so interested in our current information capture feature.

To sum it up, let’s keep it simple and keep our eyes on the facts—our customers and members will thank us with extraordinary loyalty. And that’s the best thing a business selling commoditized products can hope for.