The Evolution of Bank Marketing: From Billboards to Big Data

By Xav Harrigin-Ramoutar

In the world of community banking, where personal touch and deep community roots count for everything, effective marketing strategies are not just beneficial—they’re essential for growth and success. Marketing in the banking sector has traditionally relied on methods that cast a wide net; think billboards dotting highways, newspaper spreads, and radio spots. These approaches have been the backbone of bank marketing for decades, founded on the principle that visibility across a broad audience equates to drawing in customers.

This tradition of marketing has stood the test of time, a testament to community banks’ enduring commitment to embedding themselves within the fabric of the communities they serve. The imagery of a local bank sponsoring a little league team or a billboard that greets you on your morning commute has become synonymous with the community bank’s role as a pillar of local support. Yet, as the digital age accelerates and the banking landscape evolves, these time-honored methods are being reevaluated. The question now is not just about reaching a wide audience but reaching the right audience—and doing so efficiently and effectively.

The Limitations of Traditional Marketing

The Inefficiencies of Broad-Brush Strategies

Traditional marketing methods, including billboards, print ads, and broadcast media, have been cornerstones of the banking industry’s outreach efforts for generations. These strategies are characterized by their broad, general approach to messaging, designed to reach as many eyes and ears as possible. One of the most significant challenges with these broad-brush strategies is the difficulty in measuring their effectiveness and return on investment (ROI). This ambiguity makes it challenging to allocate marketing budgets effectively, as there’s little data to inform decisions on where to invest for the best returns.

Missing the Mark with Your Audience

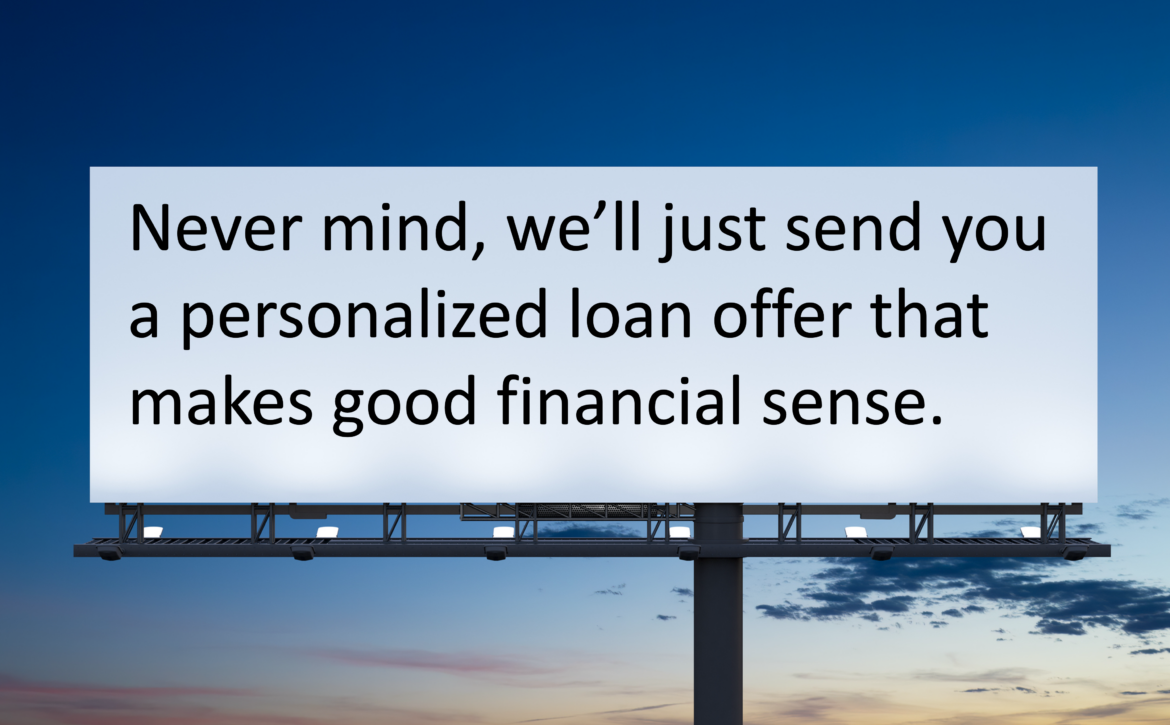

The general nature of traditional marketing also means these methods often fail to engage specific target audiences effectively. For example, a billboard promoting home loans is visible to everyone passing by, regardless of their interest in buying a home, their eligibility for a loan, or even their current customer status with the bank. This scattergun approach can lead to significant missed opportunities, as the message fails to resonate deeply with any specific group.

In contrast, data-driven marketing allows for the creation of personalized messages that can engage individuals based on their interests, behaviors, and banking needs. This tailored approach is far more likely to capture their attention and prompt action, demonstrating how traditional methods can fall short in today’s personalized marketing landscape.

The Rise of Data-Driven Marketing

Tailoring the Message with Precision

In stark contrast to the wide-net strategies of the past, data-driven marketing emerges as a beacon of innovation, emphasizing the use of customer data to craft highly tailored marketing efforts. This approach leverages detailed customer information—such as demographics, transaction histories, and online behavior—to create personalized messages that resonate deeply with individual customers or specific segments. The power of data-driven marketing lies in its precision targeting, allowing banks to send the right message, to the right person, at the right time.

The benefits of such precision are manifold. For one, engagement rates see a significant uptick as customers receive content that is relevant to their needs and interests. This relevance fosters a deeper connection between the bank and its customers, enhancing loyalty and trust. Furthermore, precision targeting allows for a more efficient allocation of marketing resources. Instead of spending broadly on campaigns with uncertain returns, banks can now invest in targeted efforts that are more likely to convert, optimizing their marketing spend and improving the overall return on investment.

Efficiency Through Technology

The advent of advanced technology has been the linchpin in the rise of data-driven marketing. Tools ranging from customer relationship management (CRM) systems to sophisticated analytics platforms and AI-driven algorithms enable banks to sift through vast amounts of data, identifying patterns, preferences, and potential opportunities for engagement. These technologies provide the foundation for making informed decisions, crafting personalized messages, and predicting future customer behavior with a reasonable degree of accuracy.

Introducing Micronotes’ Growth Opportunity Analysis: A Solution Tailored for Community Banking

Why Micronotes’ Growth Opportunity Analysis?

In the evolving landscape of community bank marketing, Micronotes’ Growth Opportunity Analysis presents itself as a thoughtful response to the specific needs of these institutions. Developed with an understanding of the unique challenges faced by community banks, Micronotes leverages advanced analytics to analyze customer data, enabling a deeper understanding of individual customer needs and behaviors. This technology doesn’t just push for more marketing; it aims to make marketing more meaningful by enhancing its relevance and personalization.

The Benefits of Transitioning

Transitioning to Micronotes could provide community banks with several key advantages, each rooted in the technology’s capacity to offer insights and enable precision in marketing efforts. The first is an improvement in customer satisfaction. When customers receive messages and offers that closely align with their interests and needs, it naturally enhances their perception of the bank. This personal touch can make a significant difference in how customers view their bank’s understanding of their needs.

Furthermore, the precision offered by Micronotes leads to higher engagement and conversion rates. Messages are more likely to hit the mark when they’re backed by data-driven insights, resulting in marketing efforts that are more effective and efficient. Finally, the strategic allocation of marketing resources based on Micronotes’ analysis can lead to an improved return on investment. By focusing efforts where they are most likely to yield results, banks can optimize their marketing spend, achieving better outcomes without necessarily increasing their budget.

Beyond Billboards: The Future of Targeted Banking Strategies

In the transition from traditional to data-driven marketing, community banks stand at the cusp of a transformative journey. By embracing the nuanced capabilities of the Micronotes’ Growth Opportunity Analysis and prescreen marketing services, these institutions can navigate the digital age with greater precision, efficiency, and relevance in their marketing efforts. This shift not only enhances customer satisfaction and engagement but also redefines the allocation of marketing resources, ensuring every dollar spent is an investment towards a more connected, understood, and satisfied customer base. As community banks look to the future, the adoption of big data represents a pivotal step in evolving their marketing strategies to meet the dynamic needs of today’s digital landscape.

Get your own growth opportunity analysis HERE, at no cost.