Why Branches Still Matter — Even When Everyone Says They Don’t

By Devon Kinkead

Introduction

Banking futurists keep announcing the death of the branch. Yet, real data tells a more complicated story.

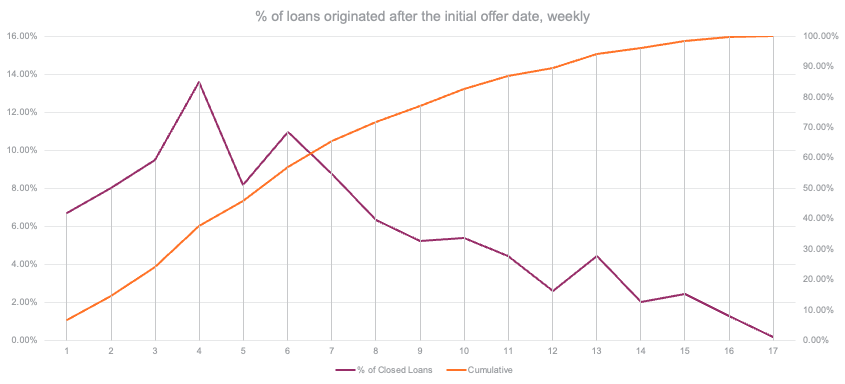

Micronotes’ post-campaign analytics revealed that home equity loan conversions increased sharply the closer members lived to a branch. Members within one mile of a branch converted at five times the rate of those more than five miles away — and beyond 15 miles, conversions nearly vanished.

That finding seems to contradict Brett King’s provocative thesis in Branch Today, Gone Tomorrow, summarized in The Financial Brand, which argues that branches have become functionally irrelevant in the digital age.

So which is true? Are branches still essential, or are they obsolete?

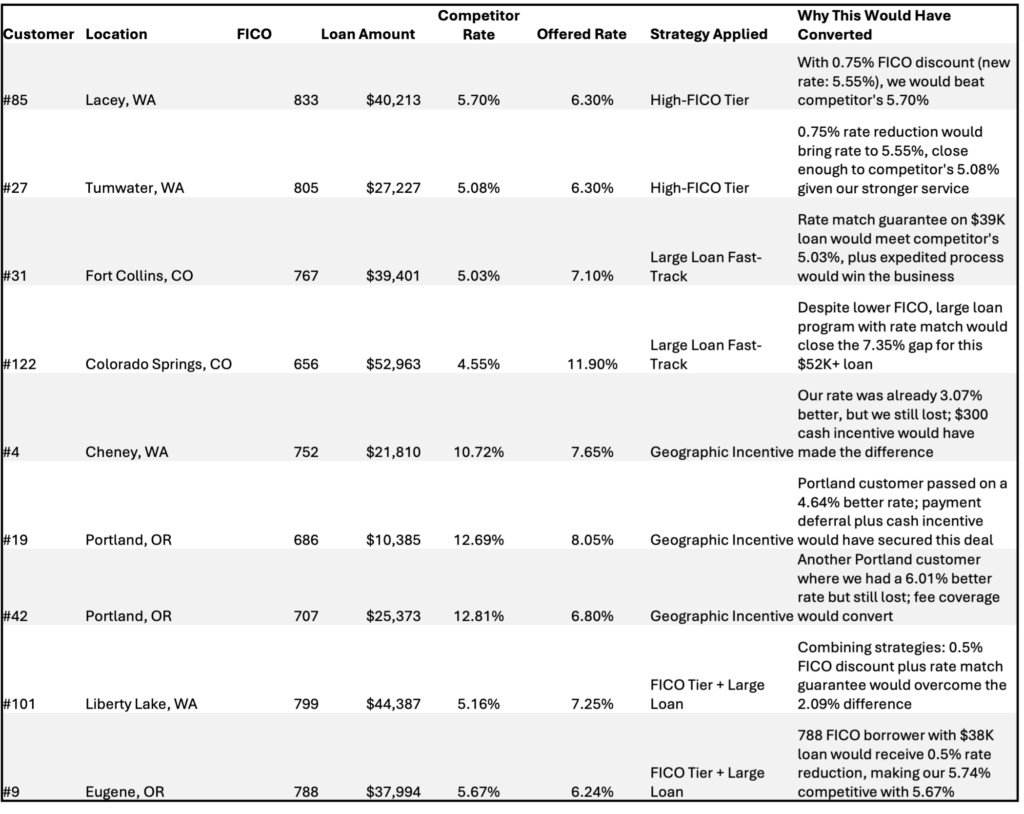

The Data: Distance Still Drives Conversions

| Distance Range (mi) | Conversion Rate |

|---|---|

| 0–1 | 0.5 % |

| 1–5 | 0.1 % |

| 5–10 | 0.1 % |

| 10–15 | 0.2 % |

| 15+ | 0 % |

Micronotes Analysis, Feb 2025 — new customer HELOC Firm Offer of Credit

Why This Happens: It’s Not About Transactions — It’s About Trust

The conversion lift near branches isn’t a relic of paper processes — it’s a psychological signal. Physical proximity reinforces trust, familiarity, and confidence in a brand’s permanence.

When the product is high-stakes — like pledging home equity — prospects want the reassurance that someone nearby can help. A branch’s mere existence reduces perceived risk, even if the borrower never walks through the door.

In short: branches still move people, even if they no longer move paper.

Behavioral Mechanisms Behind the Branch Effect

- Trust & Reassurance

Proximity communicates stability — “If I need help, I know where to go.” - Hybrid Journeys

Digital buyers still toggle between screens and conversations. A nearby branch lowers friction when they need a human step. - Local Brand Exposure

Branch presence amplifies marketing awareness via signage, sponsorships, and community footprint. - Engaged Member Cohorts

Households near branches often have stronger engagement or relationship tenure, which compounds conversion probability.

Reconciling Brett King’s Argument

Brett King is right about one thing: the traditional, transaction-centric branch has reached the end of its useful life.

Routine banking is mobile-native. Consumers want instant, 24/7 access and invisible infrastructure.

But our data show that for high-trust, high-involvement decisions, branches still exert measurable influence.

They no longer define banking — they reinforce belief in the institution behind it.

In that sense, King’s thesis and the Micronotes findings are two sides of the same coin.

Branches aren’t obsolete; they’re evolving from utility to symbol.

The New Model: Branch-Light, Trust-Heavy

- Digital-First, Branch-Smart

Design campaigns digitally — but leverage branch proximity as a conversion multiplier for complex products. - Geo-Weighted Marketing

Use distance from branch as a predictive variable. Increase bids or offer value inside a 15-mile “trust radius.” - Redefine the Branch Footprint

Shrink physical square footage, but expand reach through micro-hubs, co-locations, and advisory centers. - Equalize Digital Trust for Distant Members

Provide virtual consults, video closings, and live-chat concierge services to neutralize the distance penalty.

The Takeaway

The data and the futurists are both right — just about different things.

Yes, digital dominates transactions. But trust — the invisible currency of banking — still benefits from physical proximity – particularly when the stakes are high.

Branches may be fewer and smaller in the future, but they’ll remain powerful conversion amplifiers in markets where emotion, risk, and reassurance intersect.

The smartest banks won’t be branch-heavy or branch-free. They’ll be branch-light — and trust-rich.