How Automated Prescreen Makes Hyper-Personalized HELOC Debt Consolidation a Reality

By Devon Kinkead

Financial institutions are constantly searching for more effective ways to identify high-value opportunities and connect with qualified borrowers and people need their help. The HELOC debt consolidation opportunity represents one of the most promising avenues for growth given both record credit card debt and home equity, but executing these campaigns efficiently has traditionally required significant resources and expertise.

The Evolution of Prescreen Marketing

The concept of finding mispriced debt is compelling, but the execution has historically been challenging. Financial institutions needed to manually coordinate between credit bureaus, marketing teams, and compliance departments to create effective prescreen campaigns. This cumbersome process often resulted in generic offers that failed to capture consumer attention.

Enter automated prescreen technology – a game-changing approach that transforms how financial institutions target both existing customers and prospects with personalized HELOC consolidation offers.

How Automation Powers Hyper-Personalization

Modern automated prescreen solutions leverage advanced algorithms and real-time data access to create truly personalized HELOC offers. Here’s how the technology makes hyper-personalization possible:

1. Comprehensive Data Integration

Micronotes Automated Prescreen combines multiple data sources:

- Credit bureau data on 230+ million consumers (updated weekly)

- Property values and equity positions

- Current loan terms and interest rates

- Financial institution’s core data

- Underwriting criteria and rate sheets

This integration allows for precise identification of consumers with mispriced debt who could benefit from HELOC consolidation.

2. Financial Personalization That Drives Results

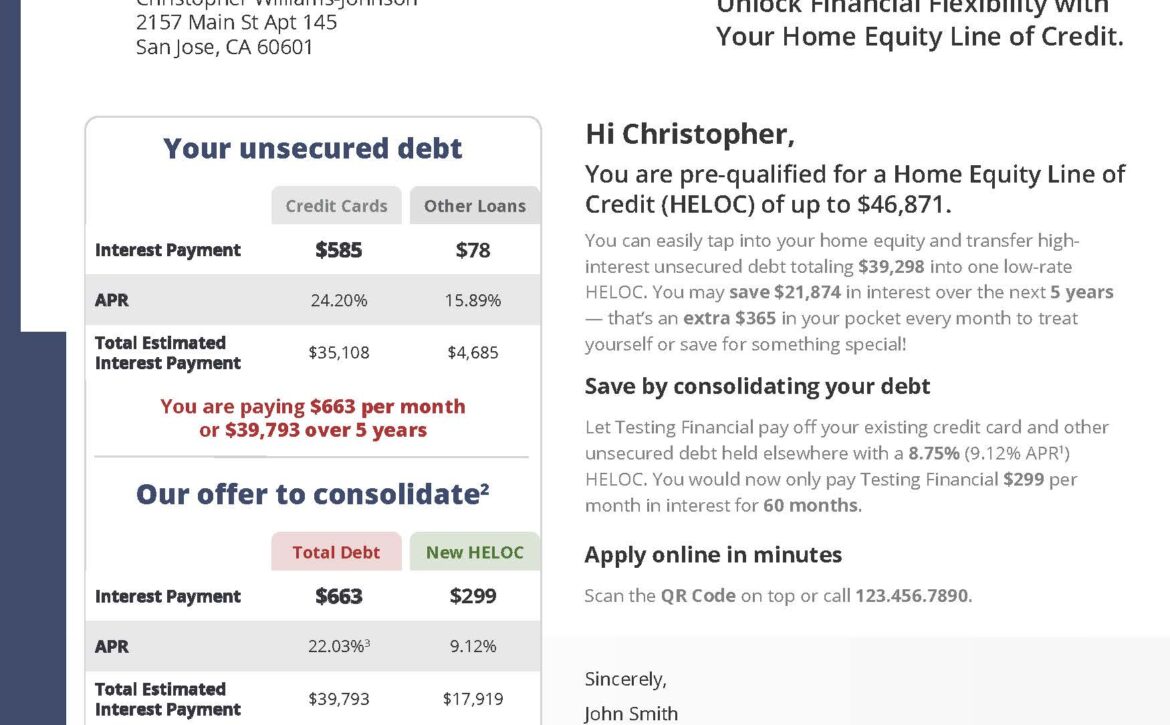

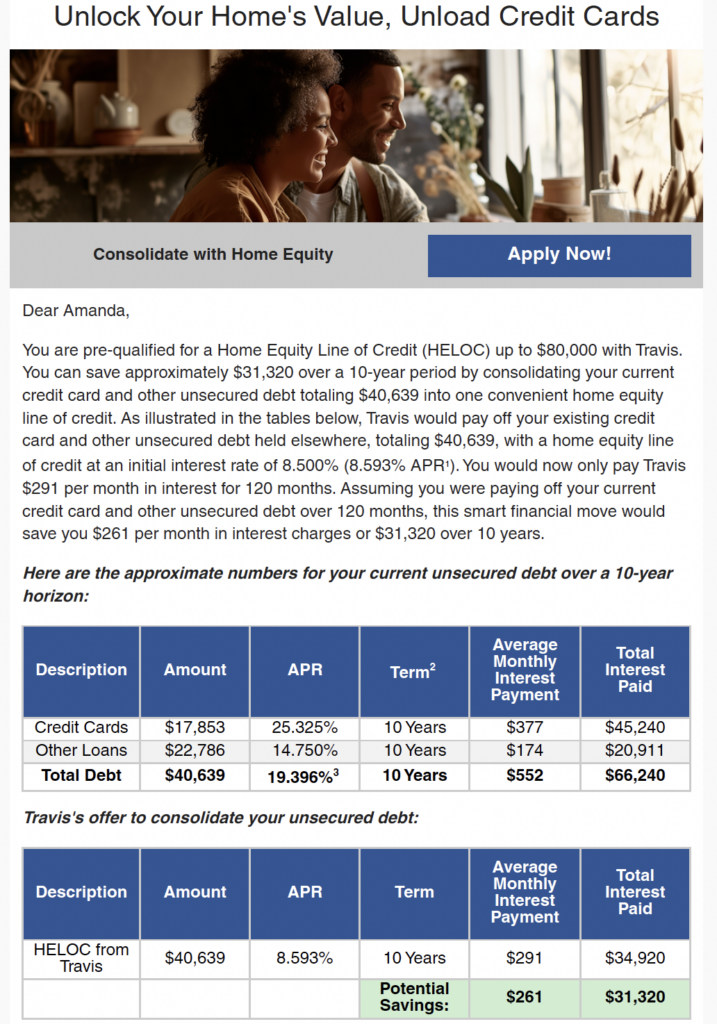

Rather than generic “You’re pre-approved” messaging, automated prescreen enables specific offers like:

“John, you can refinance your $40,639 debt from 19.890% to 8.642% and stop overpaying $280 per month in interest.”

This financially personalized approach leverages behavioral economics principles to demonstrate concrete value, resulting in higher conversion rates and win rates for loans.

3. Geotargeting Built Into the Process

The system automatically applies geographic filters to ensure targeting remains focused on prospects within the financial institution’s footprint. This ensures branch proximity for people who prefer in-person interactions while maximizing operational efficiency and brand recognition.

4. Multi-Channel Delivery for Maximum Impact

Once identified and personalized, offers can be delivered through multiple channels with friction-reducing calls to action:

- Custom branded email

- Direct mail with personalized tables and charts

- Digital banking re-presentment

- QR codes for easy response

5. Compliance Built Into the Workflow

Perhaps most importantly, Automated Prescreen handles the complex regulatory requirements for firm offers of credit, ensuring all communications include required disclosures and follow FCRA and UDAAP rules.

The Business Case for Automated Prescreen

For financial institutions considering HELOC debt consolidation campaigns, automated prescreen technology delivers compelling benefits:

- Reduced Manual Effort: Automation handles the complex data analysis and offer generation that would otherwise require significant staff resources.

- Negative Acquisition Costs: The net interest income from successful HELOC consolidations typically exceeds campaign costs, creating a self-funding growth engine.

- Expanded Market Share: Target qualified prospects who don’t currently have a relationship with your institution.

- Increased Wallet Share: Identify existing accountholders who hold high-interest debt with competitors, bringing those relationships to your institution.

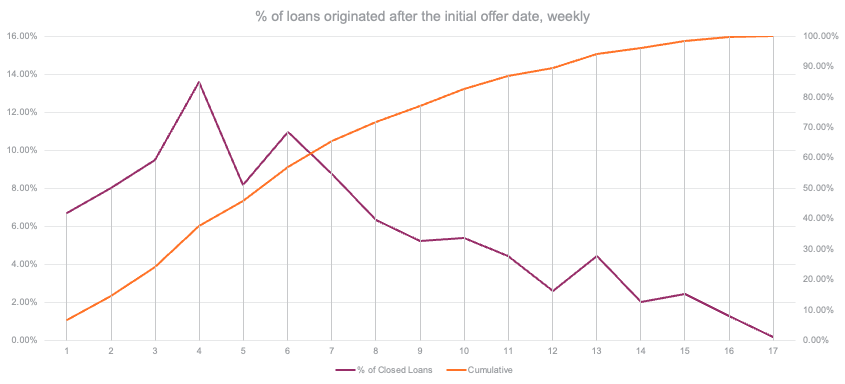

- Continuous Optimization: Performance tracking shows which offers resonate best, allowing for ongoing refinement rather than one-off campaigns.

Moving Forward: From Concept to Campaign

Implementing a successful HELOC debt consolidation campaign using Automated Prescreen doesn’t require massive internal resources or years of data science expertise. Micronotes’ cloud-based solution provide the technology infrastructure while financial institutions maintain control over targeting criteria, offer parameters, and brand presentation.

The campaigns can support multiple loan types simultaneously, including:

- HELOC/HELOAN consolidation

- Traditional HELOC/HELOAN

- Auto loan refinance

- Personal loan consolidation

- Mortgage new home purchase

Take the Next Step

If you’re interested in capturing the huge HELOC debt consolidation opportunity within your footprint, it’s time to explore how Automated Prescreen can transform your marketing approach and deliver the numbers, this year.

Order your own growth analysis today or book a demo to learn how you can start acquiring and retaining more profitable relationships through Micronotes. In a market where every advantage matters, Automated Prescreen may be the differentiator your institution needs.