Conversion Rates Are Great… Unless You’re Playing Blindfolded

By Devon Kinkead

Introduction

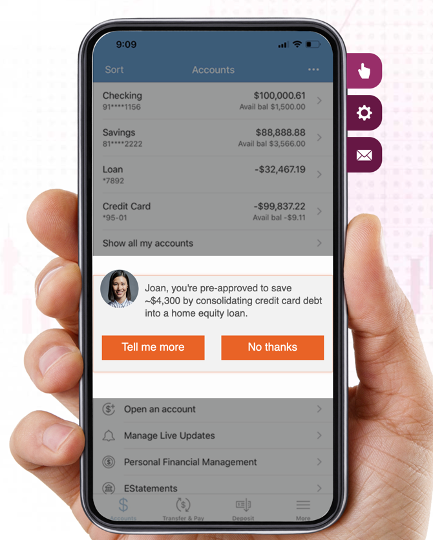

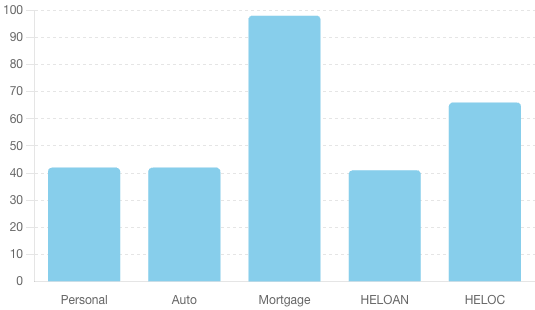

In the world of prescreen marketing, success is often measured by conversion rates. However, focusing solely on conversion rates can provide a misleading picture of a campaign’s effectiveness. The true measure of success is not how many leads a campaign converts but how well it performs against competitors in capturing market share. A recent personal loan campaign serves as a prime example of why the win-rate against competitors is the most critical performance indicator.

The Reality Behind Conversion Rates

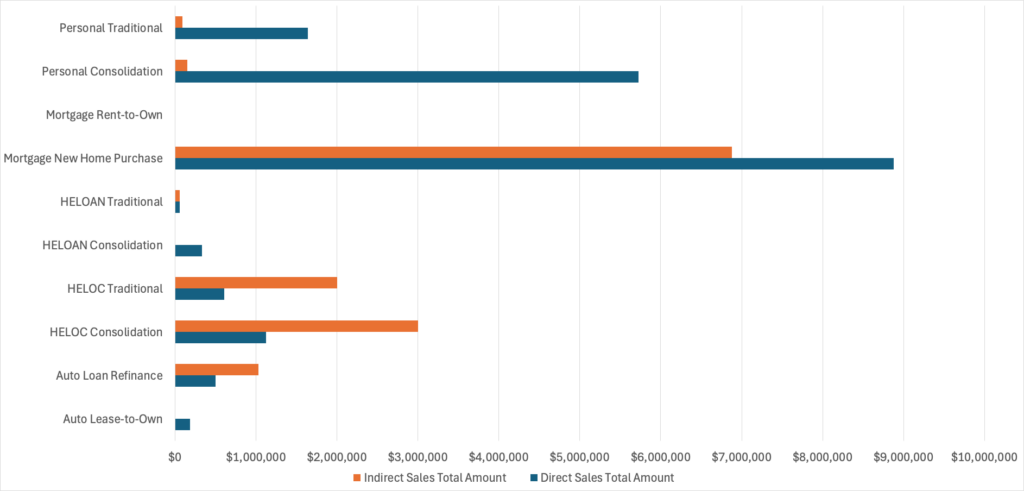

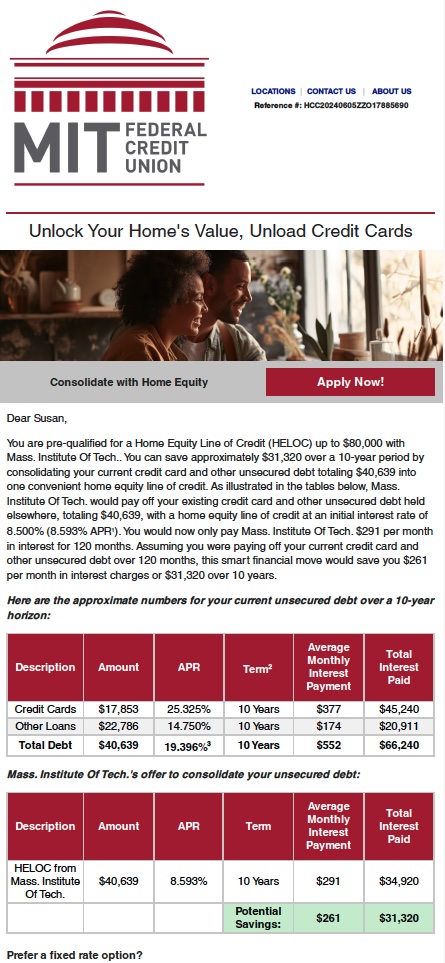

A Micronotes’ client’s recent new accountholder personal loan acquisition campaign distributed 15,000 firm offers of credit, resulting in 24 funded loans totaling $372,000. This equates to a conversion rate of just 0.16%. While this number might seem low, the true challenge lies in the fact that competitors secured 155 loans from the exact same audience, totaling $3MM. These figures highlight the need to shift the focus from conversion rate to the campaign’s competitive performance.

Understanding Win Rate: A Competitive Perspective

Win rate measures the share of the market captured relative to the competition. In the case of the referenced campaign, the 24 acquired loans represent only 13% of total funded loans from firm offer recipients, significantly below the benchmark set by our highest performing clients of 23%. This gap underscores the importance of enhancing strategic efforts to outperform competitors.

Key Insights from the Campaign

- Competitive Loan Rates Matter:

- The average offered rate for acquired loans was 13.5%, while lost loans averaged 13.4%. Although the difference appears minor, further analysis revealed that competitors offered significantly lower rates to higher FICO score borrowers, resulting in lost opportunities in micro credit cells.

- Loan Amounts Influence Decisions:

- The average funded loan size was $15,493, compared to the average lost loan size of $19,420. This suggests that competitors are successfully capturing demand for higher loan amounts, an area we can optimize.

- Geographic Performance Highlights Opportunities:

- One city showed strong performance with 4 funded loans, whereas another city had 14 lost loans totaling $292,778 with zero acquisitions. This reveals important geographic differences in competitiveness.

Boosting Win Rate

- Refining Rate Tiers:

- Introduce more competitive pricing for high-FICO segments to capture prime borrowers who are currently choosing lower-rate competitors.

- Expanding Loan Size Offerings:

- Align loan offerings with market demand by increasing loan limits to match competitor offerings and borrower expectations.

- Targeted Marketing Strategies:

- Concentrate efforts on high-potential suburban areas and high-loss urban centers with incentives.

- Incentive Programs:

- Introduce cashback or rate discount incentives to attract borrowers who are price-sensitive and value additional perks.

Conclusion

The campaign data highlights a crucial lesson: success is not just about conversions, it’s about outperforming the competition. By focusing on improving win rates through competitive pricing, tailored loan offerings, and strategic marketing efforts, financial institutions can capture a larger share of the market and achieve sustainable growth. In today’s competitive landscape, the ultimate goal should always be to win more business than the competition, not just convert an comparatively arbitrary number of firm offers sent into loans. Connect with us today to get your competitive context right!