Dynamic Work Design for Deposit Retention: Turning “Exceptional Deposits” into Lasting Relationships

By Devon Kinkead

Large, unusual deposits are almost always life events. If your tech is already flagging them and booking banker meetings, you’re halfway there. The other half is how you design the work—so the right people do the right things, at the right time, in the right way. That’s where Dynamic Work Design (DWD)—from There’s Got to Be a Better Way—is helpful. DWD is built on five practical principles that calm the chaos and systematically improve results: Solve the Right Problem, Structure for Discovery, Connect the Human Chain, Regulate for Flow, and Visualize the Work.

Below is a bank/CU-ready operating model that fuses those principles with Micronotes’ deposit-retention approach—detect the life event, start a personalized microinterview, and book a banker conversation fast—because up to ~50% of life-event deposits walk within 90 days if no one reaches out.

1) Solve the Right Problem: It’s intent, not just rate

Don’t frame the problem as “keep balances by paying more.” Frame it as:

“Within 7 days of a flagged deposit, engage the customer to understand intent and offer the best-fit solution; target ≥70% retention at 90 days.”

DWD stresses crisp, solution-free problem statements to overcome habit-driven responses and find simpler, faster fixes. Micronotes’ playbooks then operationalize that intent focus with guided questions (e.g., inheritance, home sale, business proceeds) that route to the right product path, not a generic rate match.

What to implement

- A standard “Exceptional Deposit” problem statement & target.

- A short, digital microinterview that captures purpose, timeline, constraints.

2) Structure for Discovery: Make learning inevitable

DWD designs the cadence so learning happens by design: a 15-minute daily huddle to review new flags, yesterday’s outreach, today’s meetings, blockers, and outcomes. That’s exactly how DWD teams surfaced and solved issues quickly—clear targets, continuous feedback.

What to implement

- Daily “Life Events Huddle” (cross-channel): deposit ops, contact center, digital, wealth, retail leaders.

- Vital signs on a shared board: time-to-contact, scheduled-within-48h, show rate, retention at 30/90 days, and next best action coverage. (Lean tip: visual controls accelerate PDCA.)

- Rapid fixes right in the huddle (permissions, calendar availability).

3) Connect the Human Chain: Perfect the hand-offs

In DWD, outputs of one role must equal the inputs of the next; most failures are mismatched hand-offs, not “bad people” or “bad IT.” Design the journey from flag → microinterview → banker meeting → proposal so every step delivers precisely what the next step needs (intent, amount, horizon, risk profile, documents), eliminating rework and speed loss.

What to implement

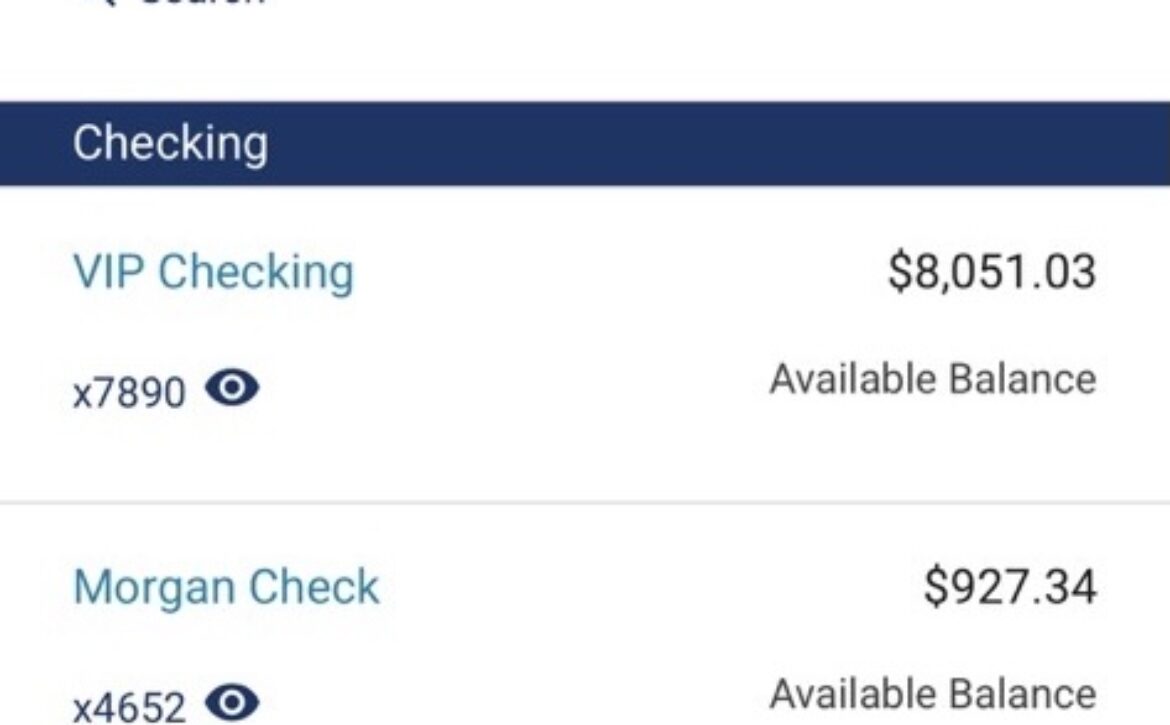

- Micronotes Cross-Sell Exceptional Deposits that automatically spots unusually large deposits and starts an interview in mobile/online banking.

- Handoff contracts: for each step, define the deliverable the next role needs to move forward without email ping-pong.

- Escalation criteria so leadership only touches atypical/risky cases; everything else flows.

- Micronotes to calendar: include all inputs in the meeting hold (purpose, options pre-qualified), so bankers spend time advising, not gathering basics. Micronotes

4) Regulate for Flow: Control WIP to go faster

Overloaded systems stall. DWD’s “regulate for flow” limits work-in-process so everything keeps moving; too many items means everything is late. Use capacity-aware rules for how many new deposit cases enter banker queues per day and how quickly to triage or re-route.

What to implement

- WIP limits by banker (e.g., max 8 open life-event cases); overflow goes to a pooled team or wealth desk.

- Service levels: contact after Micronotes lead email received ≤4 business hours, meeting ≤48 hours; expedite only by rule, not exception.

- Portfolio discipline: pause lower-value outreach if the board “goes pink” (overload), then finish high-value items first.

5) Visualize the Work

Knowledge work is invisible; DWD makes it visible with a digital/physical board that shows each flagged deposit’s status end-to-end—a virtual shop floor. Fannie Mae used string and clips to cut close time by ~80%; your CRM can do the same for deposit journeys.

What to implement

- A single lane for each stage: Flagged → Contacted → Scheduled → Met → Proposed → Accepted → 30/90-day Retained.

- Color rules for SLA breaches; blockers get solved in the daily huddle.

The Operating Loop (tech + team)

Trigger & triage

- Micronotes detects statistical anomalies (exceptional deposits), launches a brief guided conversation to capture intent, then books a banker meeting.

Discovery & advice

- Banker uses the micro-interview outputs to tailor advice: growth CDs with partial-withdrawal flexibility, wealth consult, 529s, business treasury, mortgage, or trust planning.

Follow-through & measurement

- Auto-tasks for paperwork and onboarding; automated 7/30/90-day check-ins keyed to the life event. Measure retention and cross-sell, not just calls and meetings. (Align metrics to ROE/EVA so the program funds itself and scales.)

What to track (and why it matters to Finance)

- TTC (Time-to-Contact), Scheduled-Within-48h, Show Rate, Offer Acceptance, 30/90-Day Retention, Products per HH, NPS after meeting.

- Tie outcomes to ROE/EVA/NOPAT so executives see cash-flow and productivity impact, not just activity.

30-60-90 to launch

Days 1-30 (Design for flow & visibility)

- Stand up the Life Events Board and daily huddle; set WIP limits and SLAs.

- Turn on Micronotes Exceptional Deposits, integrate calendar booking, and deploy the microinterview.

Days 31-60 (Wire the human chain)

- Finalize hand-off contracts (flag → outreach → banker → wealth/treasury).

- Add escalation rules; leadership reviews only exceptions.

Days 61-90 (Scale what works)

- Use huddle learning to refine scripts, SLAs, and product bundles (e.g., growth CDs + wealth checkup).

- Publish an exec dashboard linking retention lift to ROE/EVA; fund headcount/technology from gains.

Why this wins now

- Proactive > reactive: engage before money moves—Micronotes detects and reaches out immediately, then your DWD-designed process converts intent into relationship value.

- High tech + high touch: the platform books the meeting; your team delivers advice fast, with clean hand-offs and no overload. That combination is exactly what DWD is built to enable.

- Measurable impact: institutions report NPS gains and concrete deposit wins when they combine detection with guided banker outreach.

If you’ve already got the flags and auto-booking, you’re close. Use the five DWD principles above to design the work around those moments, and you’ll retain more “exceptional deposits,” cross-sell more meaningfully, and build household-level loyalty that outlasts rate cycles.