68%: Hidden Returns of Automated Prescreen Marketing

By Devon Kinkead

Vertically-integrated automated prescreen marketing systems are finding their way into community banking with obvious, and not so obvious returns. A review of 20 campaigns Micronotes’ customers ran reveals that 68% of the loan volume is in indirect sales; that is — an existing or prospective accountholder was offered one loan, like a HELOC, but originated a different loan, like a mortgage. Given the sheer volume of indirect loans, they represent an important but overlooked component of the return on investment analysis.

Direct Versus Indirect Sales

Direct Sales: These are the sales directly attributed to the prescreen marketing campaign. For example, a prescreen offer for a HELOC consolidation loan was made to a prospect on February 1st, 2024 and a HELOC loan was originated on February 24, 2024.

Indirect Sales: These are the sales indirectly attributed to the prescreen marketing campaign. For example, a prescreen offer for a HELOC consolidation loan was made to a prospect on February 1st, 2024 and a mortgage was originated on April 24, 2024.

Key Data Insights

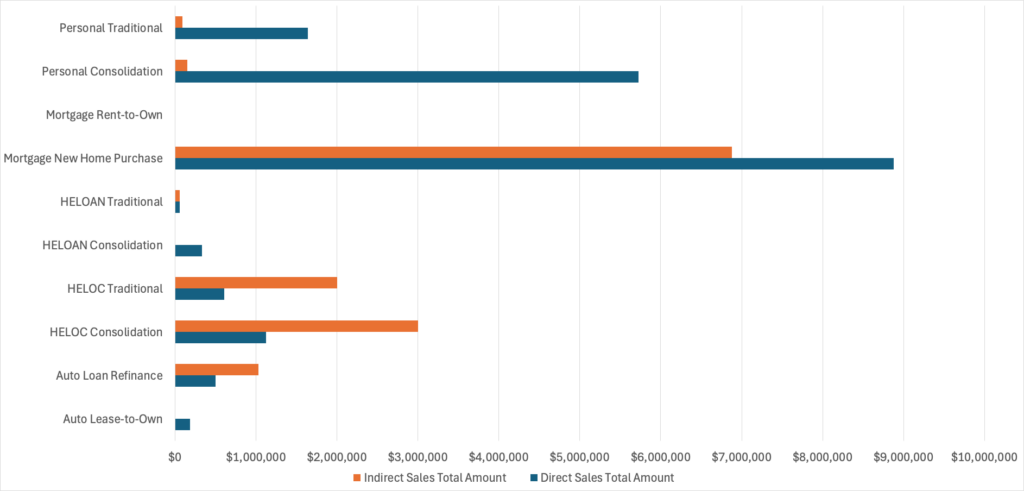

Figure 1 – Direct vs. Indirect closed loan volume across different offer types. Note: no data for rent-to-own because this was a small scale test campaign.

Indirect sales vary by offer type, with indirect sales materially exceeding direct sales in HELOCs and auto loan refinancing and entirely absent in auto lease-to-own and HELOAN consolidation. Personal loan offers show relatively few indirect sales while mortgages show a significant fraction of indirect sales.

Summarily, return on investment computations must included indirect sales to accurately reflect the real net interest income generated by a prescreen loan campaign, particularly with HELOCs, auto loan refinance, and mortgages.

Conclusion

Understanding the real benefit of automated prescreen marketing requires a comprehensive dataset, excellent analytics, and a good working knowledge of probabilities. Micronotes has developed a vertically-integrated automated prescreen marketing tool that enables community financial institutions to launch campaigns and comprehensively measure the return on campaigns and understand the unique characteristics of each prescreen offer type. Armed with this knowledge, Micronotes’ customers continue to invest wisely to acquire new borrowers and expand wallet share with existing accountholders.