Elevating Credit Union Aspirations: Integrating Prescreen Marketing into Benchmarking Strategies

By Devon Kinkead

As credit union executives navigate the complexities of 2025’s financial landscape, resources like Callahan & Associates’ recent presentation on “Credit Union Performance Benchmarking Trends: Building Aspirational Peer Groups” offer invaluable guidance. Delivered on October 2, 2025, this session, led by Andrew Lepczyk and Josh McAfee, shifts the focus from traditional representational benchmarking—mirroring the status quo—to aspirational peer groups that envision desired futures. Representing nearly 70% of industry assets and supporting over 700 credit unions, Callahan emphasizes setting quantitative goals to model scenarios, assess business models, and drive strategic growth. Key examples include tweaking loan portfolios for credit card expansion, growing non-interest income without fee hikes, and balancing capital amid asset growth. But how can credit unions turn these aspirations into reality? From the lens of prescreen marketing, as explored in Micronotes’ extensive resources, AI-powered tools provide the precision, speed, and compliance needed to bridge the gap between benchmarking ideals and operational success.

At its core, Callahan’s framework encourages credit unions to define aspirational peers based on specific outcomes, such as ideal asset mixes, earnings alternatives, or enhanced member engagement. This resonates deeply with prescreen marketing’s emphasis on data-driven personalization. Micronotes.ai highlights how processing over 230 million credit records weekly enables automated campaigns that target super-prime members for refinancing or cross-selling, while offering subprime segments secured loans or financial coaching. In our November 2025 post, “The Credit Barbell Effect“, we describe a market bifurcation where super-prime originations grew 9.4% and subprime 21.1%, with prime segments shrinking. Prescreen platforms capture both ends by delivering hyper-personalized firm offers, aligning perfectly with Callahan’s call for “growth engineering” through aspirational peers. For instance, a credit union aiming to boost credit card penetration could use prescreen analytics to identify members with high FICO scores (680-850) and no delinquencies, as demonstrated in Wright-Patt Credit Union’s case study, where 172,328 qualified mortgage candidates were pinpointed within branch proximity, unlocking $35.8 billion in potential volume.

One of Callahan’s key insights is the use of Peer Suite for performance projections, creating best-, worst-, and most-likely scenarios to evaluate tradeoffs. Prescreen marketing amplifies this by embedding continuous optimization and post-campaign analytics. As noted in Micronotes’ “The Precision Paradox“, community financial institutions excel in agility and trust, leveraging AI to refine targeting and achieve 3.2x revenue from primary relationships. Traditional batch-and-blast methods give way to iterative loops that measure response rates, cost per acquisition (CPA), and net present value (NPV), ensuring campaigns evolve toward aspirational goals. For credit unions modeling NIM-centric success—focusing on net interest margins—prescreen tools can prioritize high-DTI segments for debt consolidation, responding to market signals. This not only drives loan originations but also mitigates risks, with delinquency rates rising to 0.94% in Q3 2025 per Callahan’s Trendwatch takeaways, providing opportunities for proactive member support.

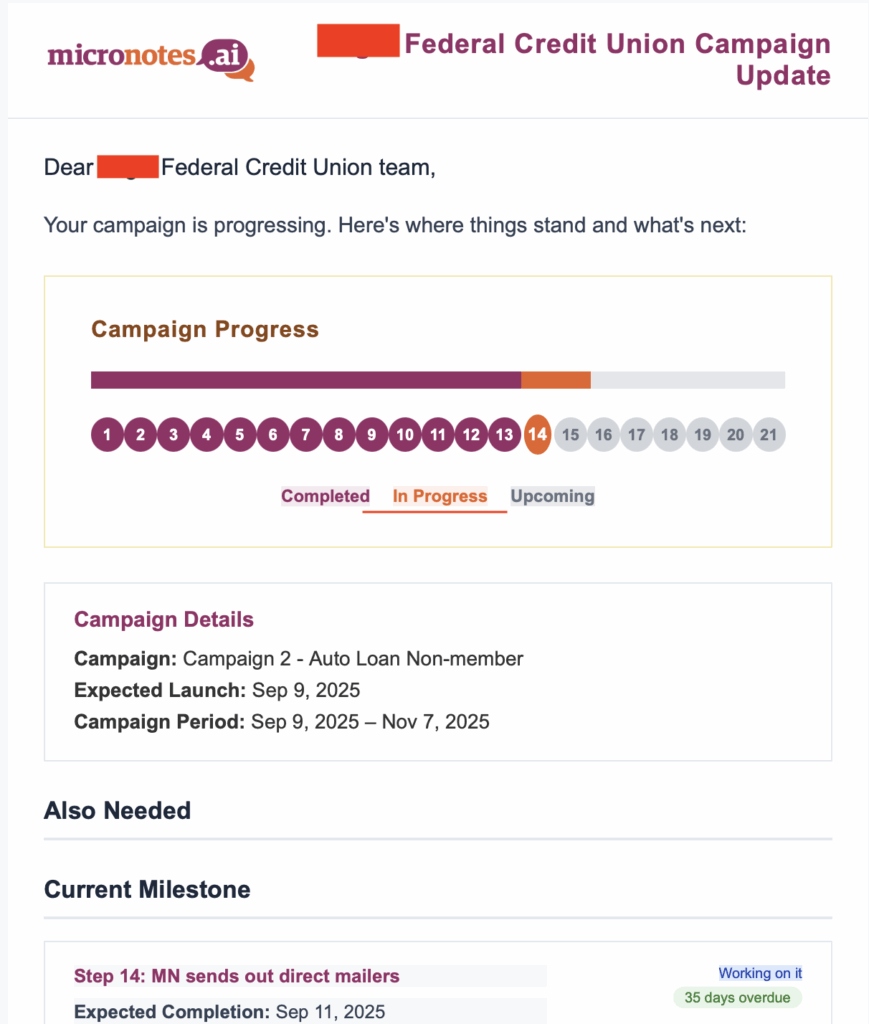

Compliance emerges as a non-negotiable in both frameworks. Callahan warns of limitations in peer groups, stressing that outcomes don’t always match intent and require deeper consultations. Micronotes addresses this head-on in “The Compliance Imperative”, integrating AI for compliance conformance under FCRA, ECOA, and Fair Housing Act, with pre-launch checks and disparate impact audits. This ensures prescreen campaigns avoid regulatory pitfalls while optimizing for performance, turning potential obstacles into strengths. For example, in navigating rising delinquencies—credit card rates exceeding 2% for the first time in 2025—prescreen marketing frames offers as empowerment tools, aligning with evolving debt perceptions tied to moral values, as discussed in “Navigating Credit Union Lending Strategies in 2026“. By automating workflows, credit unions reduce cycle times from months to 42 days, echoing lessons from Standard Chartered’s efficiency gains in “What Standard Chartered Taught Us About Speed“, where ranked backlogs and weekly huddles unlock revenue.

Member-centricity ties these elements together. Callahan’s aspirational groups target enhanced share-of-wallet and product penetration, while prescreen marketing fosters deeper relationships by addressing individual needs. With member growth ticking up to 2.2% in Q3 2025, per Trendwatch, and loan balances rising amid rate cuts (real estate up 24.2% year-over-year), hybrid models blending digital prescreening with branch proximity prove essential. Micronotes’ “Why Branches Still Matter“ reveals HELOC conversions drop beyond 15 miles, underscoring geo-weighted targeting to boost trust for high-stakes products. This approach not only achieves net negative acquisition costs, as seen in Q3 2025 trends where shares grew 4.6% but loans lagged at 3.4% (“Turning Credit Union Performance Trends Into Growth Opportunities),” but also supports community missions like homeownership and financial wellness.

In reflecting on Callahan’s benchmarking trends, prescreen marketing emerges as the operational engine for aspirational goals. By leveraging AI for precision, automation for speed, and analytics for optimization, credit unions can transform data into actionable strategies. As net interest margins hit 3.38% outpacing operating expenses (3.11%), per Q3 insights, there’s flexibility to invest in these tools without compromising ROA (0.81%). Yet, success demands a shift from reactive to proactive: starting small with pilot campaigns, as advised in Micronotes’ resources, and scaling through virtuous feedback loops.

Ultimately, this integration positions credit unions not just to survive economic uncertainties—like inflation, tariffs, and rate compressions—but to thrive as catalysts of prosperity. Executives should explore Micronotes’ prescreen solutions alongside Callahan’s Peer Suite to craft bespoke paths forward. In 2026 and beyond, those who blend aspirational vision with precise execution will lead the industry, delivering hope and value to members while securing sustainable growth.