Strategic Framework for Deposit Retention: Decoding Signals in a $105 Trillion Wealth Transfer

By Devon Kinkead

The banking industry faces an unprecedented convergence of forces: a $105 trillion intergenerational wealth transfer, digital disruption from fintechs, and the reality that 50% of large deposits exit within 90 days without intervention. Success in deposit retention requires more than reactive campaigns—it demands a strategic framework for interpreting and responding to competing market signals.

Mapping the Forces: A Strategic View of Deposit Dynamics

Applying an MIT Sloan framework of analyzing time horizon and impact level reveals four distinct categories of deposit retention challenges, each requiring tailored strategic responses:

Continental Drifts: The Generational Wealth Migration

Long-term, High Impact

The $105 trillion wealth transfer represents the most significant structural shift in banking history. This isn’t a quarterly concern—it’s a decade-long transformation that will fundamentally reshape deposit bases. Traditional single-account relationships are giving way to multi-generational household banking, where financial decisions ripple across family networks.

Strategic Response: Build persistent household infrastructure now. This means creating collaborative financial tools that bridge youth accounts to adult banking, implementing life-stage recognition systems, and developing multi-generational engagement strategies. The institutions that establish trusted relationships with entire families today will capture the wealth transfers of tomorrow.

Lightning Strikes: The Life Event Moments

Short-term, High Impact

Every exceptional deposit—whether from a home sale, inheritance, bonus, or business exit—represents a lightning strike moment. Data shows 54% of these deposits vanish within 90 days if unaddressed. These aren’t just transactions; they’re inflection points where customers make decade-long financial decisions.

Strategic Response: Deploy real-time detection and engagement systems. When a customer receives a $200,000 inheritance, you have days—not weeks—to demonstrate value. Implement automated triggers that identify statistical anomalies in deposits, launch immediate personalized outreach through digital channels, and connect life events to relevant solutions (wealth management for inheritances, mortgage services for home sale proceeds).

Smoldering Embers: The Digital Experience Gap

Long-term, Low Impact (individually)

Each subpar digital interaction, delayed response, or friction point in account opening might seem minor. But these accumulating frustrations create vulnerability. When 70% straight-through account opening becomes the baseline and customers expect real-time everything, technical debt becomes deposit flight risk.

Strategic Response: Systematic infrastructure modernization with clear priorities. Focus on eliminating friction in high-value customer journeys first. Measure and monitor digital experience metrics obsessively—every additional click or delay increases attrition probability. Small improvements compound: reducing account opening time from 15 to 5 minutes might only save individual transactions, but across thousands of customers, it preserves millions in deposits.

Surface Ripples: The Rate Chase Distraction

Short-term, Low Impact

Every competitor’s promotional CD rate, every fintech’s cashback offer, every headline about rates creates noise. The temptation to match every offer dilutes strategic focus and erodes margins without building loyalty.

Strategic Response: Establish clear response criteria. Not every competitive move warrants action. Instead of reflexive rate matching, focus on value differentiation. Data shows loyalty programs and personalized engagement can be 3x more effective than rate competition for retention. Let competitors race to the bottom on rates while you build relationships.

From Reactive to Predictive: The Behavioral Intelligence Advantage

Traditional deposit retention waited for withdrawal requests. Modern retention predicts them. The strategic framework reveals three levels of intelligence:

Level 1: Transaction Monitoring

Basic tracking of balance changes and account activity. Necessary but insufficient—by the time you see the withdrawal, it’s too late.

Level 2: Behavioral Pattern Recognition

Identifying customers who exhibit pre-attrition behaviors: declining transaction frequency, channel switching, service inquiries about account closure procedures. This provides a 30-60 day warning window.

Level 3: Life Event Prediction

Using behavioral economics and data analytics to anticipate life transitions before they manifest in transactions. When a customer’s children approach college age, when property values in their area spike, when their peer cohort begins retiring—these signals predict future deposit movements months in advance.

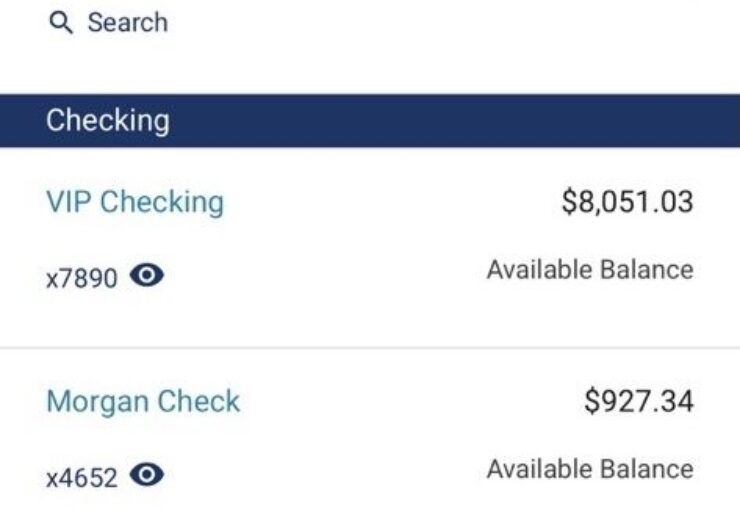

The Household Strategy: Beyond Individual Retention

The most profound strategic shift involves reimagining retention at the household level. Consider these realities:

- Primary households maintain 23% higher balances and stay twice as long

- The top 10% of checking households average $147,000 in combined deposits and loans

- 60% of checking customers represent 98% of relationship value

This concentration demands a portfolio approach to deposit retention:

Fortress Accounts (Top 10%)

These multi-generational households with deep relationships require white-glove service, proactive wealth management, and succession planning support. Losing one means losing decades of deposits across multiple family members.

Growth Accounts (Next 20%)

High-potential relationships that could become fortress accounts with proper nurturing. Focus on expanding services, capturing life events, and building multi-product relationships.

Maintenance Accounts (Middle 50%)

Stable but not strategic. Automate retention efforts, focus on operational excellence, and watch for signals of potential upgrade or downgrade.

Risk Accounts (Bottom 20%)

Monitor for early warning signals but don’t over-invest. Some attrition is natural and attempting to retain everyone dilutes resources from high-value segments.

Technology as Strategic Enabler, Not Solution

The framework reveals a crucial distinction: technology enables strategy but doesn’t replace it. Consider the contrast:

Technology Without Strategy: Implementing chatbots, mobile apps, and AI because competitors have them. Result: Digital features that don’t drive retention.

Strategy Enabled by Technology: Using predictive analytics to identify life events, deploying personalized micro-interviews at scale, automating proactive engagement based on behavioral triggers. Result: 23x better engagement than traditional digital banking ads.

The Execution Imperative: Speed and Scale

Understanding forces means nothing without rapid, scaled execution:

Speed Requirements by Force Type:

- Lightning Strikes: Hours to days (life events require immediate response)

- Surface Ripples: Ignore or respond within weeks (competitive noise)

- Smoldering Embers: Quarterly improvement cycles (infrastructure upgrades)

- Continental Drifts: Annual strategic reviews (generational positioning)

Scale Requirements:

- Personalization at Scale: Engaging thousands of customers with individualized strategies

- Automation with Empathy: Using AI to enable human connection, not replace it

- Compliance-Embedded Innovation: Building regulatory requirements into the technology stack

The Path Forward: Strategic Clarity in Turbulent Times

The deposit retention battlefield of 2025 and beyond won’t be won by those with the highest rates or flashiest apps. Victory belongs to institutions that can:

- Distinguish signal from noise using strategic frameworks

- Respond with force-appropriate strategies rather than one-size-fits-all campaigns

- Build household relationships that transcend individual accounts

- Deploy technology strategically to enable human connection at scale

- Execute with speed and precision when moments matter

The $105 trillion wealth transfer isn’t just changing who holds deposits—it’s redefining what deposit retention means. Institutions that decode these competing signals and respond strategically won’t just retain deposits; they’ll capture generational relationships that define the next era of banking.

The question isn’t whether you’ll face deposit attrition—that’s inevitable. The question is whether you’ll see it coming, understand what it means, and respond strategically before competitors capture the opportunity. In the framework of forces, will you be the lightning that strikes or the institution struck by it?