Automated Credit Marketing Solutions for Leaner Marketing Teams

By Xav Harrigin-Ramoutar and Devon Kinkead

Over the past two years, many financial institutions have faced significant cuts in their marketing departments. These reductions have left them struggling to execute effective prescreen marketing campaigns. However, Micronotes offers a solution: a fully automated prescreen marketing service that can fill the gap and expand marketing capacity.

Effective Credit Marketing Strategies: Lessons from Successful Lending Campaigns

For today’s financial institutions, credit marketing is indispensable for expanding their accountholder base and enhancing loyalty via wallet share expansion. It drives revenue growth, strengthens customer relationships, and boosts satisfaction. Advanced technologies and the increasing availability of customer data enable financial institutions to deliver personalized and timely credit offers, meeting specific customer needs and preferences.

Data-Driven Personalization in Credit Marketing

Personalized Loan Offers Through Advanced Data Integration

Community financial institutions partner with Micronotes to enhance their credit marketing efforts by utilizing comprehensive accountholder data and Experian’s extensive credit database. This collaboration delivers personalized loan offers through always-on credit marketing, ensuring customers receive relevant and timely financial solutions. The campaigns leverage the institution’s existing accountholder data combined with Experian’s credit records, which include approximately 230 million consumer credit profiles updated weekly. This data integration provides a deep understanding of accountholders’ financial situations, enabling highly personalized loan offers.

By implementing an always-on credit marketing strategy, institutions continuously deliver personalized credit offers, ensuring ongoing marketing efforts that increased new and existing accountholder engagement and conversion. These campaigns significantly boost loan and deposit business as customers responded positively to the financially personalized offers, leading to higher engagement rates and improved customer satisfaction. Consequently, institutions expand wallet share by providing relevant and timely credit solutions tailored to individual needs.

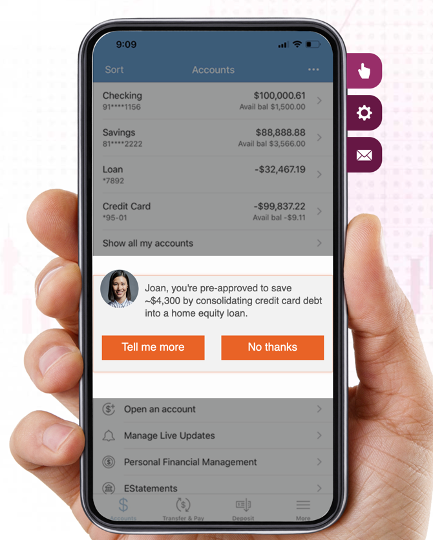

Enhancing Cross-Selling with Microinterview Technology

In other successful campaigns, financial institutions utilize Micronotes’ microinterview technology to enhance the cross-selling efforts. This approach involves brief, targeted interactions within digital banking channels to engage customers and present relevant product offers and reminders of offers made, conversationally. The microinterview technology enables short, focused interactions with accountholders, quickly capturing their interests and needs, and allowing the institution to effectively present personalized product offers. By analyzing customer data, the institution identified the most relevant products for each customer, significantly increasing the likelihood of successful cross-selling.

Microinterviews typically outperform ads of equivalent size by a factor of 26 so, the significant increase in engagement further drives cross-selling opportunities and improved customer retention. Customers appreciate the personalized approach, leading to stronger relationships and increased loyalty.

Geotargeted Acquisition Campaigns for Market Expansion

Financial institutions also implement geotargeted acquisition campaigns in partnership with Micronotes, leveraging consumer credit records and precise geotargeting to attract new customers in their branch footprint. These campaigns utilize a vast database of consumer credit records to identify creditworthy prospects within targeted geographic regions. By focusing on specific areas, the institutions tailor marketing to areas where brand recognition is highest in the communities they serve. This approach combines automated marketing techniques with comprehensive data analysis to deliver financially personalized and geo-targeted email and direct mail firm offers of credit.

Geotargeted acquisition campaigns achieve high response rates, successfully expanding the institution’s market share in targeted regions. The use of automated prescreen marketing and precise targeting reduces overall marketing costs, making the campaigns more cost-effective and yielding a net negative customer acquisition cost. Financial institutions can assess the near branch loan opportunity by ordering a growth analysis here at no cost.

Conclusion

Prescreen marketing is one of the most effective tools to grow wallet share and expand market share for financial institutions and that effectiveness is proven 400MM times per month in prescreen mail volume. However, prescreen marketing has historically been complex, lacking financial personalization, and labor intensive. That labor is no longer available in the marketing departments of many financial institutions that have been cut over the past 2 years. The introduction of Prescreen-as-a-Service (PaaS) to automate this complex process enables marketers and lenders to hit their numbers with their lean staff.