Revolutionary Results: How Micronotes Microinterviews Delivered 23x Better Performance Than Banner Ads Over 10 Years

By Devon Kinkead

A decade-long study at a $10 billion financial institution reveals game-changing engagement rates that challenge everything we thought we knew about digital banking marketing.

Executive Summary

In an era where “banner blindness” is consuming precious digital real-estate unproductively, one financial technology stands out as a beacon of hope. Over the past decade (2015-2025), Micronotes Microinterviews have consistently delivered click-through rates averaging 2.3% – a remarkable 23 times better than traditional banner ads used in mobile and online banking applications.

This comprehensive analysis of 10 years of data from a $10 billion financial institution reveals not just superior performance, but a fundamental shift in how financial institutions can effectively engage their customers in the digital age.

The Banner Ad Problem

Previous pre-2015 Doubleclick data shows an average CTR of just 0.05% for all display formats, with current industry research showing banner ad click through rates have fallen to less than 0.1% and continue declining.

The historical context is sobering. Banner clickthrough rates were around 78% in 1994 and have fallen to 0.1% now. Research from MediaMind, which analyzed 21 billion impressions globally, found that online banners had an average of 0.10% click-through rates.

Even more concerning, as many as 60% of clicks on banner ads are accidental. Banner ad blindness is so severe that 92% of users don’t even notice banner ads when surfing the web.

For financial services specifically, the situation remains challenging. The North American average of 0.14% was slightly below the global average for standard banner ads according to Sizmek’s analysis of hundreds of billions of impressions.

The Micronotes Advantage: 10 Years of Consistent Excellence

Overall Performance Metrics

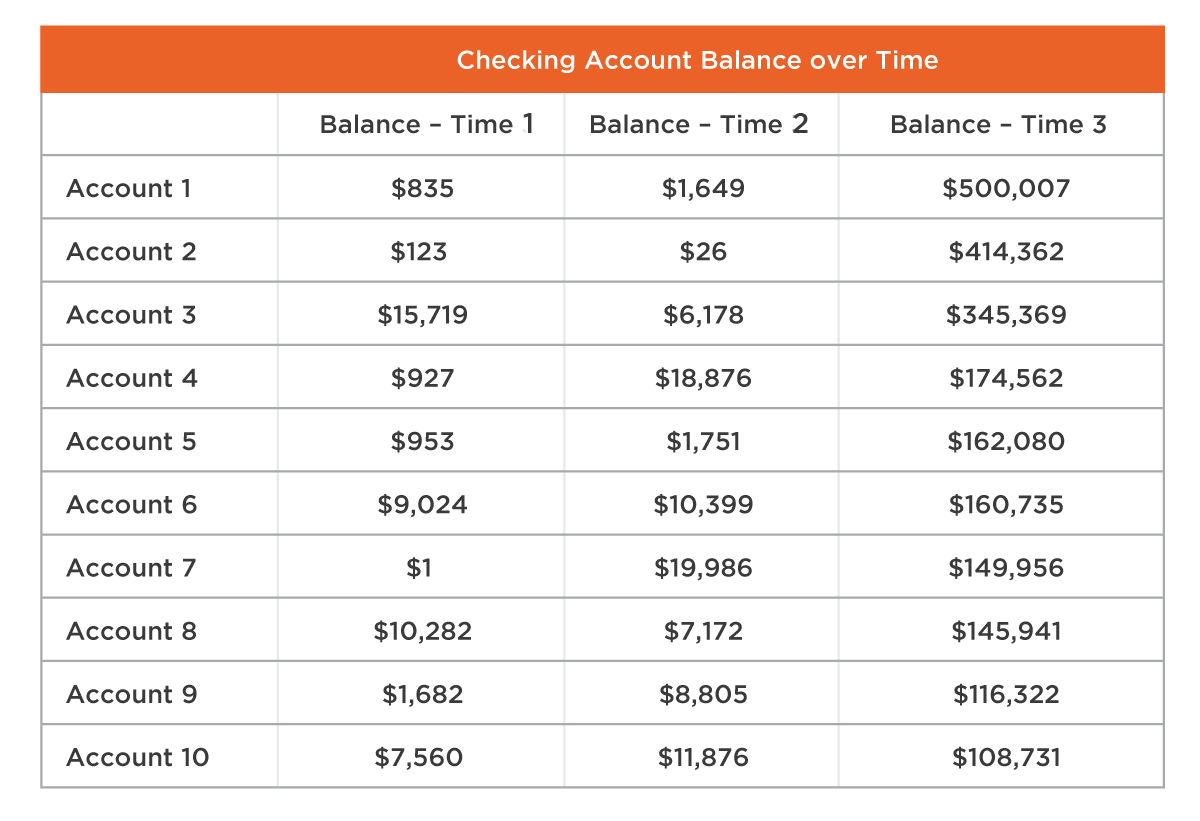

Our analysis of 123 months of data from June 2015 to June 2025 reveals remarkable consistency and performance:

- Total Unique Views: 8,459,570

- Total Unique Clicks: 1,578,265

- Overall Click-Through Rate: 2.3%

- Average Engagement Rate: 18.7% (Unique clicks/Total Unique Views)

These numbers represent more than just statistics – they represent a fundamental reimagining of customer engagement in financial services.

Year-by-Year Performance Analysis

The data reveals fascinating trends over the decade:

Peak Performance Era (2015-2016)

- 2015: 4.67% CTR with 401,331 unique visitors

- 2016: 3.76% CTR with 799,399 unique visitors

Maturation Period (2017-2020)

- Gradual normalization as user base expanded

- CTR range: 2.03% – 2.57%

- Visitor growth: 834,930 to 904,272

Digital Acceleration (2021-2022)

- 2021 maintained 2.06% CTR

- Over 1 million visitors annually achieved

- Sustained performance above 2% CTR

Modern Efficiency (2023-2025)

- CTR range: 1.16% – 2.12%

- Visitor base exceeding 1.2 million in 2023

- Maintained 23x advantage over banner ads

The Science Behind Superior Performance

Why Microinterviews Work Where Banner Ads Fail

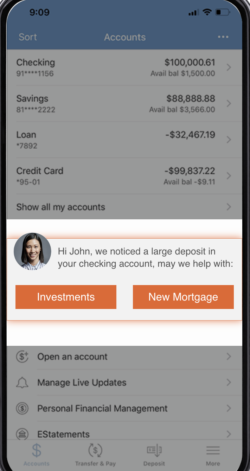

1. Contextual Relevance Micronotes Microinterviews integrate seamlessly into the banking journey, appearing at moments when customers are most receptive to relevant financial guidance, for example when they make a large deposit.

2. Personalization at Scale Each Microinterview is tailored to the individual customer’s financial behavior, transaction patterns, and lifecycle stage – creating a sense of personal attention that generic banner ads simply cannot match.

3. Value-First Approach Rather than pushing products, Microinterviews lead with educational content and personalized insights, building trust before introducing relevant solutions.

4. Optimal Timing By leveraging real-time or near real-time banking data, Microinterviews appear when customers are actively engaged with their finances, significantly increasing the likelihood of meaningful interaction.

Industry Context: The Broader Digital Advertising Landscape

The financial services industry faces unique digital marketing challenges in an environment where traditional display advertising continues to deteriorate. For standard banner ads, a CTR of 0.05% is considered average, while static banners typically achieve CTRs around the 0.1% mark.

The decline in banner effectiveness isn’t just about numbers – it’s about fundamental changes in user behavior. We are served more than 1,700 banner ads per month, leading to widespread banner blindness where users actively ignore display advertising.

Regional data reinforces these challenges. Standard banner CTRs were highest for the apparel (0.24%), telecom (0.21%) and retail (0.2%) verticals and lowest for the sports (0.07%), corporate (0.08%) and careers (0.1%) sectors, demonstrating that even in the best-performing industries, banner ads struggle to achieve meaningful engagement.

The Trust Factor: Building Relationships in Financial Services

Financial services marketing faces a fundamental trust challenge. Customers are increasingly skeptical of traditional advertising, with 25% of users employing ad blockers, up 34% from the previous year.

Micronotes addresses this challenge head-on by:

- Leading with education rather than sales pitches

- Providing genuine value through personalized financial insights

- Respecting customer intelligence with sophisticated, relevant content

- Building relationships rather than chasing transactions

Looking Forward: The Future of Financial Institution Marketing

The implications of this 10-year study extend far beyond a single product’s success story. They point toward a fundamental shift in how financial institutions must approach customer engagement:

From Interruption to Integration

The days of interrupting customers with irrelevant banner ads are numbered. The future belongs to platforms that integrate seamlessly into the customer journey.

From Generic to Personal

Mass marketing messages are increasingly ineffective. Customers expect and respond to personalized, relevant communications that acknowledge their unique financial situation.

From Product-Push to Value-First

Leading with value and education builds trust and engagement in ways that product-focused advertising simply cannot match.

Key Takeaways for Financial Institution Leaders

- The Banner Ad Era is Ending: With CTRs below 0.1% and declining, traditional banner advertising in financial services is no longer a viable customer engagement strategy.

- Personalization is Non-Negotiable: The 23x performance difference demonstrates the power of relevant, personalized customer communications.

- Timing Matters: Engaging customers when they’re actively thinking about their finances dramatically improves response rates.

- Trust Through Value: Educational, value-first approaches build the trust necessary for effective financial services marketing.

- Integration Over Interruption: The most effective digital engagement happens within, not alongside, the customer’s banking experience.

Conclusion: A New Paradigm for Financial Services Marketing

The 10-year Micronotes study represents more than impressive statistics – it represents proof of concept for an entirely new approach to financial services marketing. In an industry where customer trust is paramount and attention is increasingly scarce, the ability to deliver 2.3% click-through rates consistently over a decade isn’t just impressive; it’s revolutionary.

As financial institutions continue to navigate an increasingly complex digital landscape, the lesson is clear: the future belongs to those who can deliver genuine value through personalized, timely, and relevant customer engagement. The era of spray-and-pray banner advertising is over. The age of intelligent, customer-centric marketing has begun.

For financial institutions still relying on traditional banner advertising with its 0.1% performance rates, the question isn’t whether to evolve – it’s how quickly they can embrace the proven power of personalized, value-driven customer engagement.

The data speaks for itself: 23 times better performance isn’t just an improvement – it’s a complete transformation of what’s possible in financial services marketing. Learn more.

References for Banner Ad Click-Through Rates

SocialSellinator (2024)

“Decoding Display Ad CTR”

“Static Banners: These are the traditional display ads you see on websites. Their CTR is usually around the 0.1% mark”

URL: https://www.socialsellinator.com/social-selling-blog/average-click-through-rate-display-ads

Smart Insights (2025)

“2024 average ad click through rates (CTRs) for paid search, display and social media”

Previous pre-2015 Doubleclick data shows an average CTR of just 0.05% for all display formats

URL: https://www.smartinsights.com/internet-advertising/internet-advertising-analytics/display-advertising-clickthrough-rates/

Marketing Insider Group (2023)

“Banner Ads Have 99 Problems And A Click Ain’t One”

Banner ad click through rates have fallen to less than 0.1%

URL: https://marketinginsidergroup.com/content-marketing/banners-99-problems/

AdPushup

“9 Ways to Improve the Clickthrough Rates of Banner Ads”

There has been a continued decline in banner clickthrough rates, which where around 78% in 1994 and have fallen to 0.1% now

URL: https://www.adpushup.com/blog/9-ways-to-increase-the-clickthrough-rates-of-your-banner-ads/

MediaPost/Marketing Charts (2016)

“Research Brief: North America Banner Click Through Rate Up To 0.14%”

Based on Sizmek study analyzing hundreds of billions of impressions: “The North American average of 0.14% was slightly below the global average”

URL: https://www.mediapost.com/publications/article/290285/north-america-banner-click-through-rate-up-to-014.html

Quora – MediaMind Research Citation

“What are average click-through rates for mobile banner ads?”

MediaMind studied 21 billion telecom impressions that were delivered globally from Q2 2010 to Q1 2011: “Mobile Advertising CTRs averaging 0.64% while online banners had an average of 0.10%”

URL: https://www.quora.com/What-are-average-click-through-rates-for-mobile-banner-ads

Neurons

“How to Increase Display Ad CTR + Examples [Based on Neuroscience]”

“For standard banner ads, a CTR of 0.05% is considered average” and “A 2% click-through rate (CTR) for display ads can be considered good, as it is higher than the average CTR of 0.1%”

URL: https://www.neuronsinc.com/insights/increase-display-ad-ctr-examples-neuroscience