Beyond “Yes” to “Use”: TransUnion vs. Micronotes on Profitable Lending Growth

By Devon Kinkead

Rising acquisition costs and dormant credit lines are pushing lenders to rethink prescreen marketing. TransUnion’s newest brief urges institutions to pursue credit users — customers who will actively revolve and re-engage — instead of mere credit-worthy takers. Micronotes agrees that usage is king, yet argues that always-on Automated Prescreen, powered by Experian, combined with 360-degree post-campaign analytics is what turns every outreach into a continually smarter, dollar-specific firm offer. Both aim for profitable engagement, but their paths — and their feedback loops — differ in crucial ways.

The Problem: Acquisition Cost Inflation

| Pain Point | TransUnion | Micronotes + Experian |

|---|---|---|

| Acquisition cost trend | +45 % since 2020; > 50 % of new card lines sit inactive | Even a 10 bp lift in conversion rate can flip a campaign from cost center to profit engine when each offer is financially personalized |

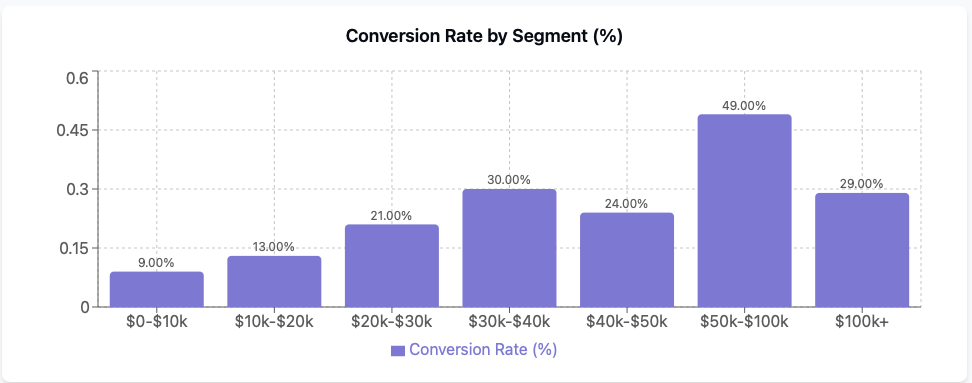

| Targeting gap | Only 9 – 31 % of traditional prescreen names resemble an issuer’s “power users” | Real-time bureau math picks prospects who prove value (e.g., refinance savings) inside the offer itself |

Why Utilization (Not Just Origination) Matters

- TransUnion reminds us that inactive lines destroy ROI; usage drives lifetime value.

- Micronotes pinpoints where usage density is highest — e.g., younger HELOC-for-debt-consolidation borrowers whose typical profile is 761 FICO, $140k income, 91 % card-utilization. Swapping low-utilization “takers” for these high-utilization segments can raise average portfolio utilization — and interest income — without opening more lines.

Segmentation Philosophy

| Selection | TransUnion | Micronotes + Experian |

|---|---|---|

| Core filter | Geo-demo & behavioral look-alikes to existing “power users” | Real-time credit-bureau math that calculates exact dollar benefit of refinancing/consolidation |

| High-utilization flag | Historical revolve behavior across issuers | Equity ≥ 20 % and card-utilization ≥ 80 % (younger HELOC consolidators) |

| Success metric | More active accounts | Acceptance and built-in usage via visible savings |

Offer Construction & Delivery

- TransUnion: Keep existing mail-house prescreen, but “propensity-swap” marginal prospects for slightly lower-score look-alikes with stronger usage likelihood, boosting originations by 26 %.

- Micronotes: Dynamic copy such as “Refinance your $37,900 at 8.7 % and save $265/mo” shows concrete cash-flow, then re-presents that savings across email, online banking and SMS until the borrower acts.

Post-Campaign Analytics: Micronotes’ 360-Degree Feedback Loop

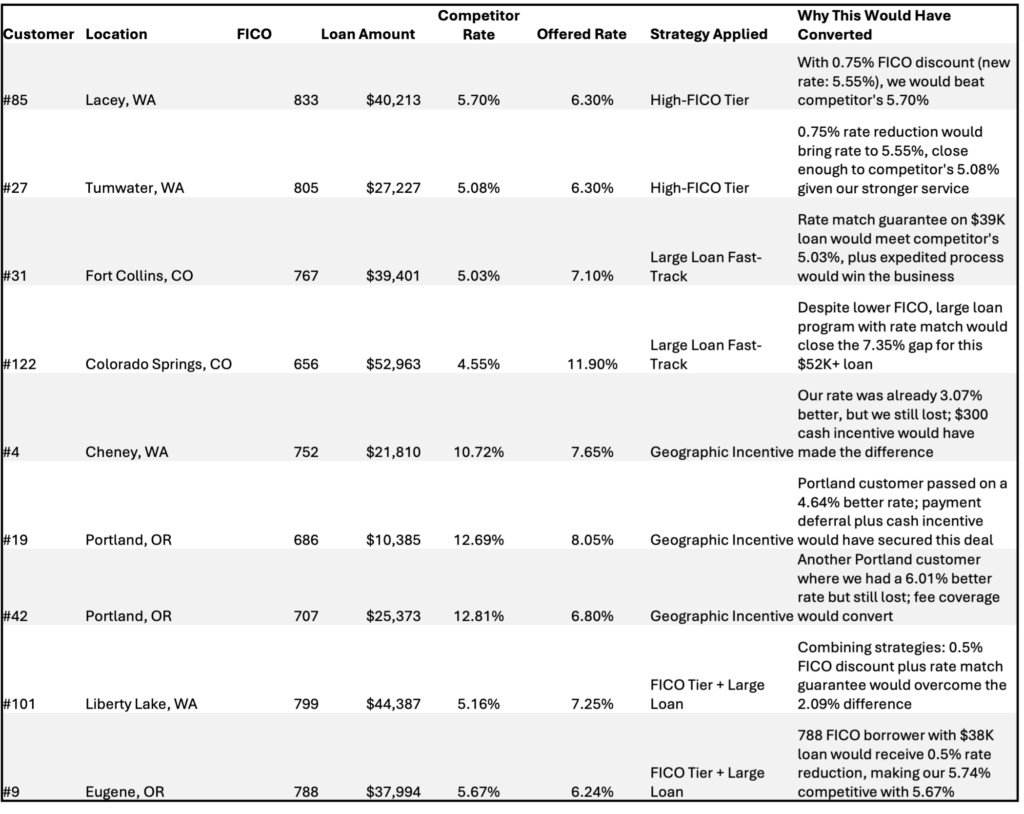

Micronotes doesn’t stop at the funded loan. After each drop, the platform ingests multi-dimensional outcome data — loan amount, FICO, income, DTI, rate won/lost, CPA, etc. — and applies three programmatic levers:

- Progressive Optimization Model – Treats every campaign as a controlled experiment; results feed the next predictive model to tighten targeting precision.

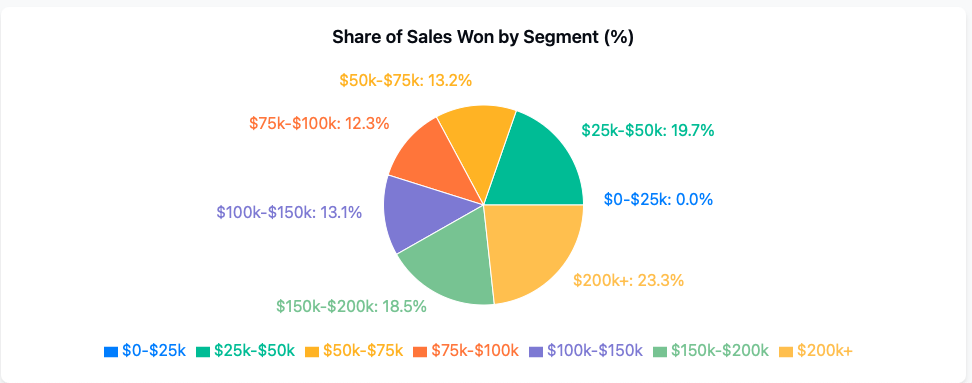

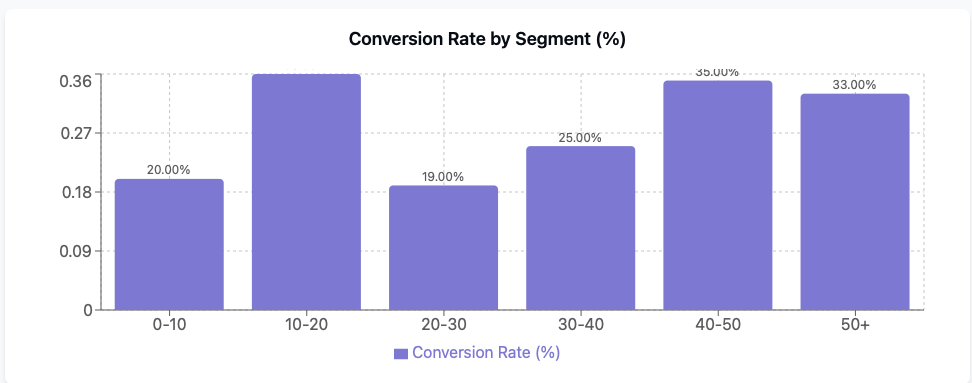

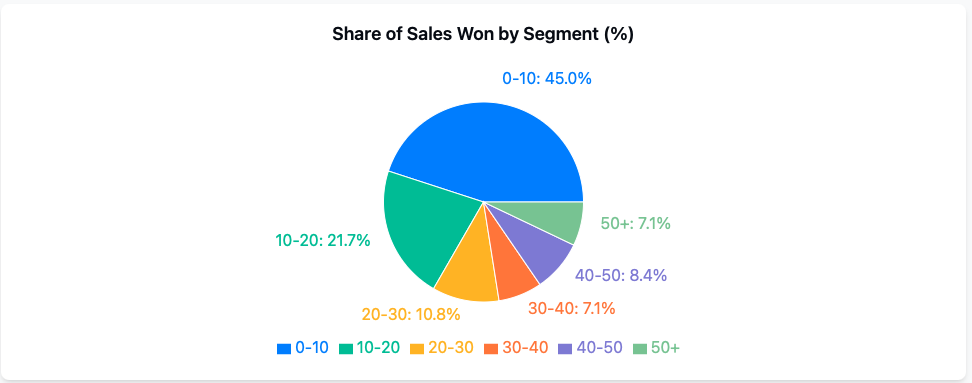

- Competitive Gap Analysis – Surfaces the exact rate spread between wins and losses by segment, guiding pricing and positioning.

- Segment-Level CPA Accounting – Calculates cost-per-acquisition by micro-segment, shifting budget to the most efficient pockets automatically.

The outcome: prescreen marketing evolves from quarterly “batch-and-blast” into a continuously optimized system that improves conversion and win-rate every cycle.

Operational Snapshot

| Approach | TransUnion | Micronotes + Experian |

|---|---|---|

| Speed-to-market | Overlay new models on existing flows | Campaigns launch quickly; bureau refresh weekly |

| Compliance | Fits inside current FCRA rules | Disclosure, opt-out & audit trail embedded |

| Measurement loop | End-of-campaign origination/balance metrics | Real-time dashboards + 360-degree analytics close the loop and auto-refine next drop |

Where They Converge — and Diverge

| Lever | TransUnion Focus | Micronotes Focus | Why It Matters |

|---|---|---|---|

| Primary KPI | Active accounts & balance growth | Net interest income minus CPA and win-rate | Profit and improving competitiveness vs. volume |

| Average Utilization | Gradual lift via propensity swaps | Immediate spike via high utilization HELOC consolidators | Faster revenue realization |

| Tech Dependence | Moderate | High (full-stack SaaS + AI analytics) | Culture & budget fit |

A Unified Playbook

- Score for Engagement – Use propensity models to rank users over takers.

- Layer Financial Personalization – Add Micronotes’ dollar-savings math to every firm offer.

- Prioritize High-Utilization Segments – Younger, equity-rich debt-consolidators deliver outsized utilization immediately.

- Automate & Iterate – Feed Micronotes’ 360-degree analytics back into both the propensity model and the offer math so each drop gets sharper.

- Measure Holistically – Track funded balance, win-rates, post-booking utilization and CPA by micro-segment — the real driver of lending ROI.

Final Word

TransUnion teaches why focusing on credit users is essential; Micronotes shows how to locate the richest pockets of those users, convert them with personalized math, and then use 360-degree post-campaign analytics to make the next campaign even better. Blend the two approaches and you move the conversation from “Will you take the credit?” to “Here’s how to optimize the credit you already use.” That’s a win for borrowers and the bottom line.