Close Quarters, CFO Insights: Strategic Loan Growth Through Local Engagement

By Devon Kinkead

Introduction

In an increasingly competitive banking landscape, Chief Financial Officers (CFOs) are constantly seeking efficient strategies to enhance the return on investment (ROI) from acquiring new loan customers. A targeted approach, focusing on potential customers within a 5-mile radius of bank branches, represents a strategic opportunity to leverage proximity for improved customer acquisition rates and financial returns.

Strategic Overview

Recent analyses, including a comprehensive ROI study, underscore the importance of a focused customer acquisition strategy. By honing in on prospects living close to bank branches, banks can optimize marketing efforts, personalize loan offerings, significantly reduce acquisition costs, and improve long-term prospects for deep customer relationships with greater lifetime customer values.

Key Metrics for Success

Conversion Rates: High conversion rates from loan offers to funded loans attest to the effectiveness of targeted marketing strategies.

Average Loan Size: Understanding the average loan size helps in assessing the profitability of new loan customers.

Loan Portfolio Diversity: A mix of auto loans, personal loans, mortgages, and HELOC/HELOAN products contributes to a diversified and healthy loan portfolio, mitigating risks and enhancing revenue streams.

Operational Efficiency: Keeping operational and origination costs in check is crucial for maximizing net income from new loans. Automated, targeted, and personalized acquisition strategies reduce processing times and costs.

Maximizing ROI

- Tailored Marketing Approach: Utilize credit data and automation to create personalized loan offers that resonate with the financial needs of potential customers within the 5-mile radius of a branch.

- Cost Management: By focusing on potential creditworthy customers living near branches, banks leverage existing brand awareness to reduce acquisition costs and increase the probability of long-term relationship growth.

- Strategic Partnerships: Collaborate with martechs/fintechs to enhance targeting, personalization, and campaign execution to improve the accuracy and effectiveness of targeted loan offers to optimize marketing spend.

Leveraging the Micronotes ROI Calculator Using Real Data

The Micronotes ROI calculator leverages geotargeted, near-branch, consumer credit records to find and offer to refinance every dollar of mispriced debt in the branch footprint, or offer attractive lending offers like auto lease to buy offers within 6 months of a lease end.

Here’s an example of the ROI output summary across all loan types for one $10B financial institution:

| Micronotes Prescreen Acquire – Consolidated ROI Calculator | |

| Offer Type Selection | |

| Auto Loan | Yes |

| HELOC and/or HELOAN (Consolidation) | Yes |

| HELOC and/or HELOAN (Traditional) | Yes |

| Personal Loan | Yes |

| Mortgage | Yes |

| Campaign Output | |

| Total Loan Offers Sent ($) | $76,169,902,887 |

| Total Loan Offers Sent (#) | 497,732 |

| Number of Loans Funded | 1,534 |

| Loans Funded ($) | $134,349,146 |

| Average Loan Size | $87,581 |

| Weighted Average Life of a Loan (Months) | 134 |

| Consolidated Conversion Rate | 0.31% |

| Revenue | |

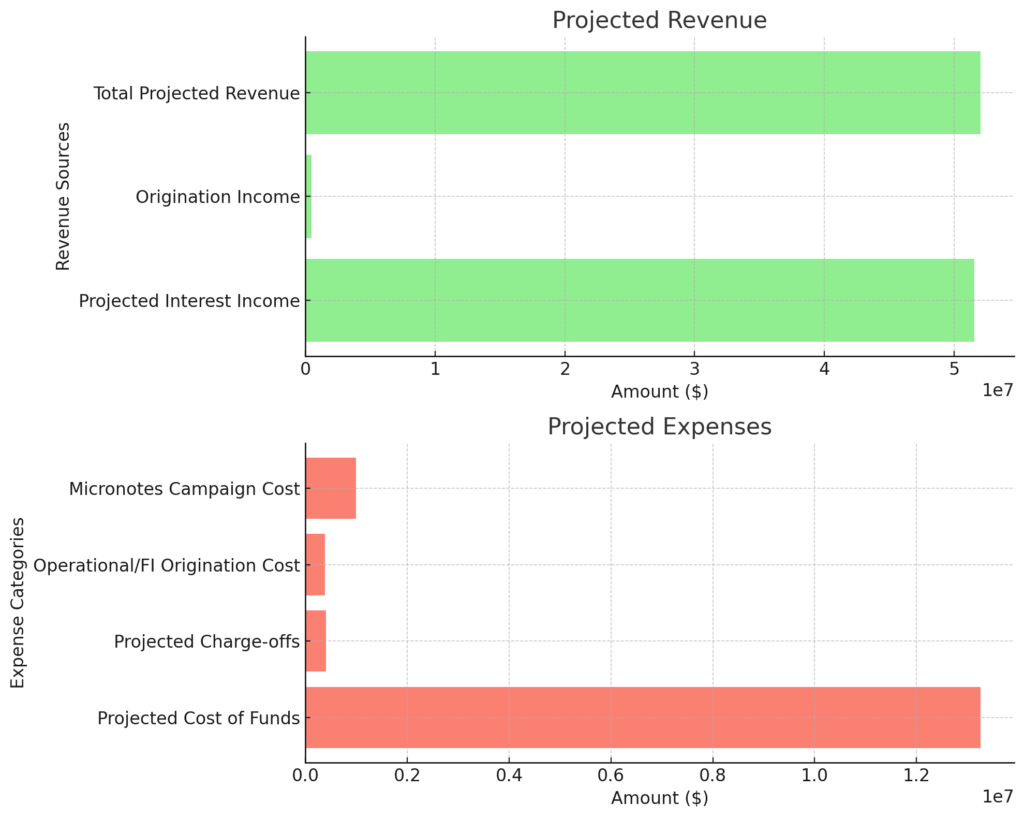

| Projected Interest Income | $51,565,525 |

| Origination Income | $461,350 |

| Total Projected Revenue | $52,026,875 |

| Expenses | |

| Projected Cost of Funds | ($13,254,702) |

| Projected Charge-offs | ($403,047) |

| Operational/FI Origination Cost | ($387,950) |

| Micronotes Campaign Cost | ($995,464) |

| Micronotes Direct Mail Pass-Thru Cost | ($497,732) |

| Total Projected Expenses | ($15,538,895) |

| Net Income | $36,487,979 |

| Return on Investment (ROI) | 235% |

| Key Metrics | |

| Average Net Income per Loan | $23,786 |

| Net Interest Income per Loan | $24,974 |

| Campaign Cost Payback in Months | 5.2 |

| Campaign Payback Based on Funded Loans | 59.8 |

Not surprisingly, nearly all the projected revenue comes from net interest margin and the vast majority of the cost of new loan customer acquisition is driven by cost of funds as shown in tables 2 and 3.

Tables 2 (top) and 3 (bottom)

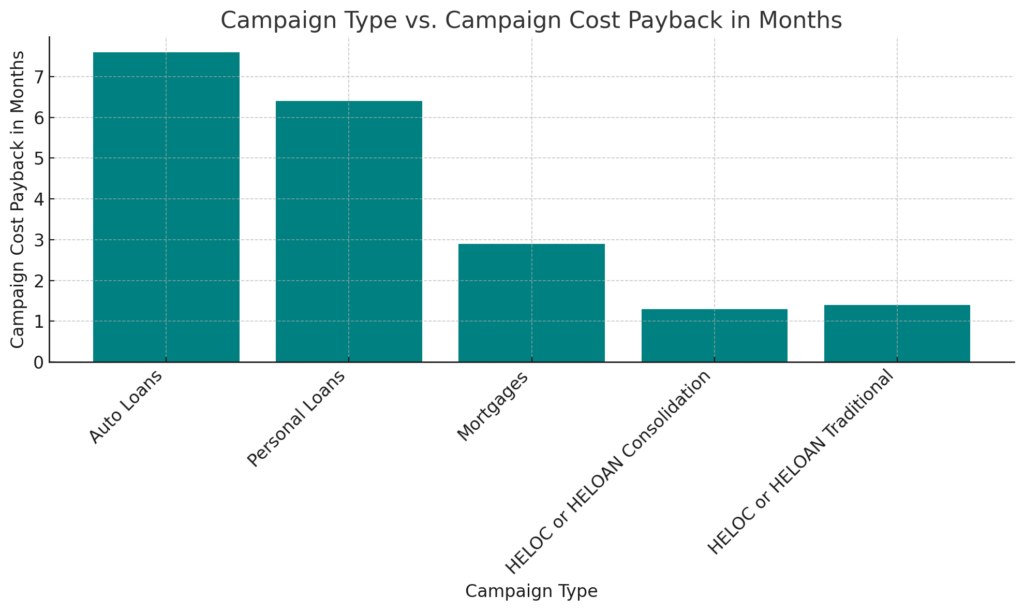

Assuming HELOCs fund to similar levels as HELOANS, which is admittedly optimistic, all else being equal — the mortgage and equity products show the fastest returns.

This payback period analysis is key to understanding the financial efficiency and sustainability of marketing efforts, helping to inform future budget allocations and strategy adjustments. Payback values are updated based on the results of each campaign and can be used for cash flow forecasting to sustain new near-branch customer acquisition campaigns.

Conclusion

The strategic acquisition of new loan customers near bank branches is not just about expanding the customer base—it’s about doing so in a way that maximizes both near-term returns and long-term customer value through deeper relationships. Through big data-driven strategies, efficient operational practices, and targeted marketing efforts, CFOs can lead their banks to achieve superior financial performance while meeting the needs of their communities.