Cutting Through the Noise: How Personalized Engagement Transforms Deposit Retention in an Era of Information Overload

By Devon Kinkead

A Micronotes Perspective on Building Trust Through Meaningful Conversations

In today’s banking environment, community financial institutions face a perfect storm of challenges. Customers are bombarded with financial offers from every direction—traditional banks, fintechs, investment platforms, and high-yield online savings accounts all competing for attention. Meanwhile, economic volatility and rising rates have made depositors more skeptical and selective than ever before. The question isn’t just how to retain deposits; it’s how to break through the overwhelming noise to create genuine connections that matter.

The Information Overload Crisis in Banking

Recent insights from MIT Sloan Management Review highlight a critical challenge facing all brands today: audiences have adopted a skeptical mindset, viewing most advertising as confusing, irrelevant noise to be tolerated or avoided. For community banks and credit unions, this reality hits particularly hard. When every financial institution is shouting about their “competitive rates” and “exceptional service,” how do you make your voice heard—and more importantly, trusted?

The traditional playbook of rate wars and broad marketing campaigns no longer cuts it. As we’ve learned from working with hundreds of community financial institutions, winning isn’t about the “my brand is better than your brand” argument—it’s about framing the discussion around relevance. And nowhere is relevance more critical than in deposit retention.

Reframing the Conversation: From Transactions to Life Events

At Micronotes, we’ve discovered a fundamental truth: every large deposit is a life event. Whether it’s an inheritance, a home sale, a business windfall, or retirement savings, significant deposits represent pivotal moments in customers’ lives. These aren’t just transactions—they’re opportunities for meaningful engagement that transcends the typical banking relationship.

Our Exceptional Deposits™ technology, part of Micronotes Cross-Sell, identifies these moments in real-time, but here’s what makes it different from traditional approaches: we don’t lead with product pitches. Instead, we initiate conversations that acknowledge the human behind the deposit. When someone receives a large sum, they’re often overwhelmed with financial decisions. By proactively reaching out with helpful guidance rather than sales messages, we help financial institutions become trusted advisors during critical life moments.

The Power of Compelling, Personalized Content

The MIT research emphasizes that strategic brand builders can create lasting positive impressions by developing compelling content and engaging with rather than talking at customers. This principle is at the heart of our approach. Our microinterview technology doesn’t broadcast generic messages—it creates two-way dialogues that uncover individual needs and preferences.

Consider this: 54% of customers who make atypically large deposits typically withdraw their funds within 90 days if not contacted. But when engaged with personalized, relevant conversations through our platform, these same customers often discover solutions they didn’t know they needed—from retirement planning to wealth management services tailored to their specific situation and from their primary bank.

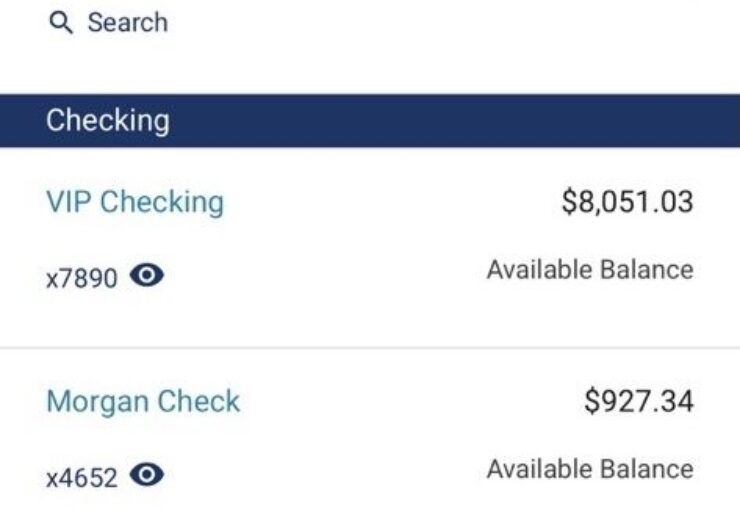

The key is timing and context. Our data-driven platform delivers these engagements at optimal moments—not as interruptions, but as natural extensions of the customer’s digital banking experience. A brief, 12-second interaction on the account summary page can reveal more about a customer’s needs than months of traditional marketing efforts.

Breaking Through Skepticism with Authentic Engagement

In an environment where audiences view advertising as annoying interruptions from profit-driven sources, authenticity becomes your greatest differentiator. This is why our technology focuses on creating genuine value in every interaction:

1. Proactive Problem-Solving

Rather than waiting for customers to seek help, we identify potential needs before they become problems. Our predictive analytics can flag at-risk deposits and trigger supportive outreach that addresses concerns before customers consider leaving.

2. Transparent Communication

When economic uncertainty rises, customers need reassurance. Our platform enables banking providers to proactively communicate about FDIC/NCUA insurance coverage and institutional stability—not as marketing messages, but as genuine service communications that build trust.

3. Personalization at Scale

Unlike traditional relationship banking limited by geography and human resources, our digital engagement platform scales personalized service across entire customer bases. Each interaction feels individual because it is—tailored to specific behaviors, balances, and life circumstances.

The Results Speak Louder Than Marketing Messages

The effectiveness of cutting through information overload with relevant, personalized engagement is measurable. In one recent campaign, a community bank using our Exceptional Deposits solution saw dramatic results:

- Engaged customers who would typically withdraw large deposits within 90 days

- Generated substantial new CD purchases from previously at-risk funds along with wealth management leads

- Successfully retained significant funds, more than half of which would otherwise have been withdrawn

These aren’t just statistics—they represent real relationships strengthened at crucial moments. When customers feel understood and supported during major life events, they don’t just keep their deposits; they deepen their entire banking relationship.

Building Tomorrow’s Retention Strategy Today

As we look toward the future of deposit retention, several key strategies emerge from our experience and research:

Lead with Empathy, Not Products

Every retention strategy should begin with understanding the customer’s situation. Are they dealing with a windfall they don’t know how to manage? Planning for retirement? Starting a business? The conversation should address their concerns first, products second.

Leverage Behavioral Intelligence

Move beyond demographic targeting to behavioral economics. Our microinterviews are optimized using behavioral economics best practices and are triggered by real life events.

Create Seamless Digital Experiences

Information overload often stems from friction. By embedding engagement opportunities naturally within digital banking workflows, we eliminate the need for customers to seek out information or navigate complex processes.

Measure What Matters

Success isn’t just about retention rates—it’s about relationship depth. Track not only whether deposits stay, but whether customers expand their product usage, increase engagement, and become advocates or promoters for your institution.

The Competitive Advantage of Connection

In a world where marketers face challenges in attracting consumers’ attention and generating interest, the institutions that win won’t be those with the loudest voices or the highest deposit yields. They’ll be those that master the art of meaningful connection—cutting through the noise with conversations that matter.

Our technology enables this transformation, but technology alone isn’t the answer. It’s about embracing a philosophy that sees every deposit as an opportunity to help, every interaction as a chance to build trust, and every customer as a person navigating important financial decisions.

Your Path Forward

The landscape of deposit retention has fundamentally changed. Information overload and customer skepticism aren’t going away—if anything, they’re intensifying. But within this challenge lies opportunity. Financial institutions that can break through the noise with genuine, personalized engagement will not only retain deposits; they’ll build the kind of loyal relationships that transcend rate competition.

At Micronotes, we’re not just providing tools; we’re partnering with community financial institutions to reimagine what deposit retention can be. Because in an era of information overload, the answer isn’t more noise—it’s better conversations.

Ready to transform your deposit retention strategy? Let’s start a conversation about how personalized engagement can help you cut through the noise and build lasting relationships with your depositors. Learn more here.