Direct Deposits Made Elsewhere

In the previous deposits-focused article, we discussed how to detect and immediately act on anomaly deposits to keep those deposits from exiting the financial institution’s balance sheet. In this article, we’ll discuss asking existing customers/members for deposits held elsewhere, programmatically, because that’s always the first order of business.

The most obvious sources of deposits held elsewhere by existing customers/members are the direct deposits being made by your customers/members to other institutions. The financial institutions we serve have typically established a direct deposit relationship with fewer than 25% of their total customer/member base, leaving a lot of room for growth. The lack of a direct deposit relationship with so many customers/members reduces the deposit base and increases attrition. For example, past attrition studies we have published demonstrate that holding all other variables constant, a customer with direct deposit has 0.42 times the odds of leaving the financial institution versus a customer/member without direct deposit*. For example, if the odds of attrition of a customer without direct deposit averages 10%, the odds of attrition of a customer with direct deposit average 4.2%. This metric won’t surprise anyone in retail banking, the direct deposit relationship is king**!

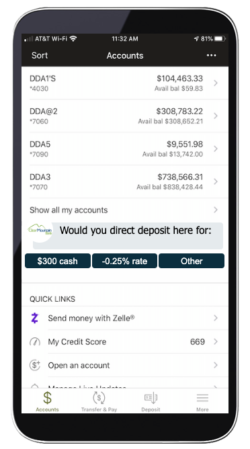

So, a simple way to improve both deposits and retention is to programmatically ask your customers/members without direct deposit to establish direct deposit with you like this (this particular example is for loan customers):

Figure 1

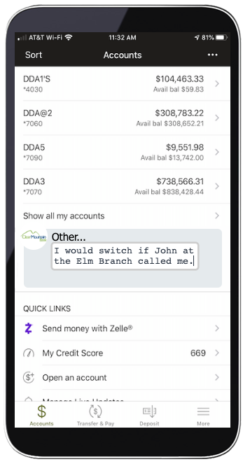

The “other” button enables the user to describe exactly what it would take, sometimes surprisingly!

Figure 2

Summarily, use technology to ask your customers what it would take to move their direct deposit relationship, then get the direct deposit relationship to increase deposits and cut attrition risk. You’ll probably be the only financial institution that ever asked.

In our next installment, we’ll talk about how to:

- Attract customers who can make large deposits.

*Study of 779 customers lost over 2 months out of a total of 67,424 customers total), 283 of which were deemed “profitable.” by the bank.

** “Holding all other variables constant, each additional e-service (e.g. bill-pay, debit card, e-statements) a customer takes multiplies the odds of churn by 0.73.”