How to Make Deposit Flight a Thing of the Past

— as you migrate to Fiserv® Create & Configure Digital

By Devon Kinkead

Community Financial Institutions Upgrade Digital

You’re a community-minded bank or credit union that’s just moved, or is moving, to Fiserv’s Create or Configure Digital platform. Your #1 goal: keep the surge of low-cost deposits you worked so hard to win during the rate hikes—and hold onto the relationships behind them.

But Deposit Leakage Remains a Challenge

Deposit attrition is accelerating. Fintechs tempt consumers with slick apps, while mega-banks blanket them with offers; I’m offered $900 to open an account with Chase. A leaky deposit base means higher funding costs and lower lifetime value.

Enter Micronotes® Cross-Sell XD

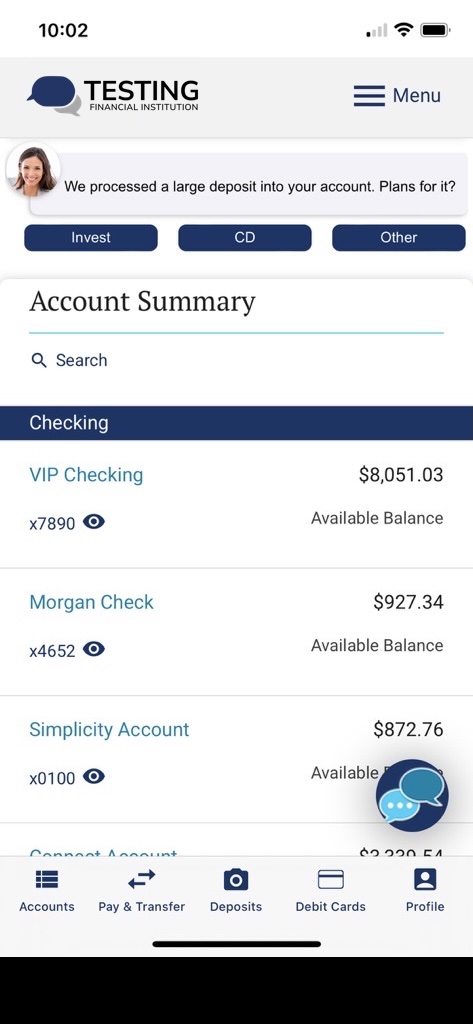

Micronotes Cross-Sell XD is purpose-built for Fiserv Experience Digital (XD) online & mobile banking.

- Under the hood: bank-held data analytics, machine-learned recommendations, and patented MicroInterview® technology.

- What it does: automatically turns Fiserv XD API data into targeted, two or three question “conversations” that feel personal—at scale.

- Why it matters: institutions using Cross-Sell XD start 20+ conversations for every one banner click and cut deposit leakage while boosting e-service adoption and Net Promoter Score®.

4. The Plan (light-lift, big-win)

| Step | What happens | Why it’s easy |

|---|---|---|

| 1. Activate the XD API feed | Cross-Sell XD pulls real-time account data—no nightly batch files. | Zero IT lift; you’re already on XD. |

| 2. Tweak interview language to make it your own | Out-of-the-box deposit campaigns—Checking, Money Market, Courtesy Pay, HSA, “Exceptional Deposits,” and more—are ready to launch in minutes. | Marketing chooses, clicks, deploys. |

| 3. Let the algorithms work | Machine learning selects the right accountholders, timing, and offer; behavioral-economics framing boosts response. | Always-on optimization—no manual segmentation. |

| 4. MicroInterview® engagement | Two to 3 polite questions a inside mobile/online banking tile; answers drive immediate, personalized follow-ups. | Feel more like a conversation than an ad. |

| 5. Measure & refine | Dashboard shows lift in balances, product uptake, and retention. | Continuous ROI visibility for executives. |

The Payoff

Banks and credit unions running Cross-Sell XD on Fiserv XD enjoy:

- Deposit defense: targeted “Exceptional Deposit” and “Emergency Savings” interviews steer funds to insured accounts, not external rivals.

- Relationship depth: cross-selling Money Market or HSA at the exact moment of need grows wallet-share.

- Digital stickiness: campaigns also drive Bill Pay, e-Statements, Mobile Check Deposit, and other sticky services.

- Provable results: 20× CTR vs. static banners and measurable reductions in outflows.

Call to Action

If you’re already on Fiserv Create or Configure Digital, you’re one API toggle away from turning deposit flight into deposit growth. Micronotes does the heavy lifting; your team reaps the kudos.

Ready to keep more dollars—and the people attached to them—right where they belong?

Schedule a 30-minute demo of Cross-Sell XD today.

Because in the story of deposit retention, the best outcome is the one where your accountholders—and their wallets—live happily ever after.