Leveraging 360-Degree Analytics to Programmatically Improve Competitiveness in Prescreen Marketing

By Devon Kinkead

A recent auto loan refinance campaign focused on new customer acquisition provides valuable analytical insights that can directly enhance conversion rates and win rates. By adopting a comprehensive, 360-degree view of the data, lenders can identify specific opportunities to improve competitive positioning in the market.

The Power of Multi-Dimensional Analytics

The campaign results demonstrate how analyzing data across multiple dimensions simultaneously reveals optimization opportunities that single-variable analysis would miss:

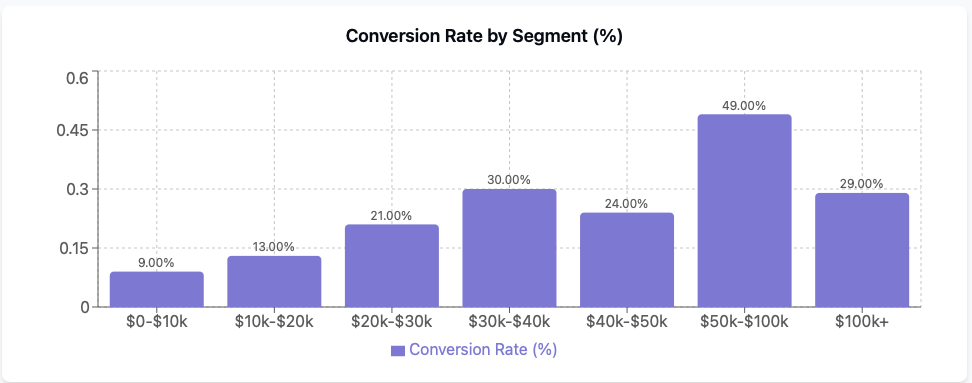

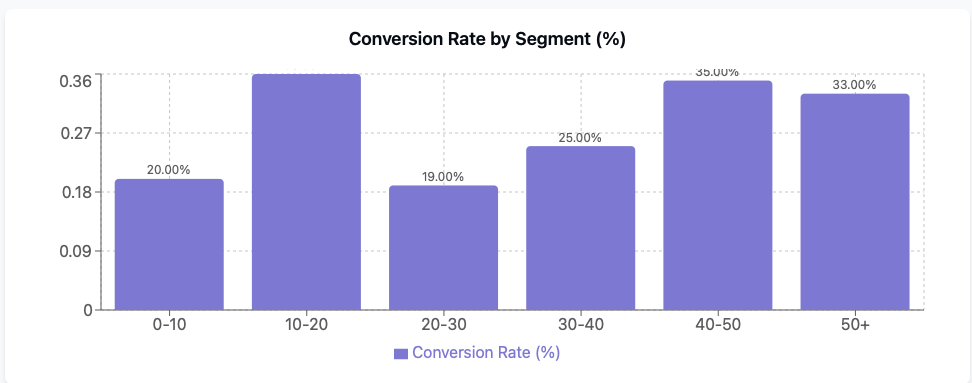

Figure 1 – Conversion rate by loan origination amount

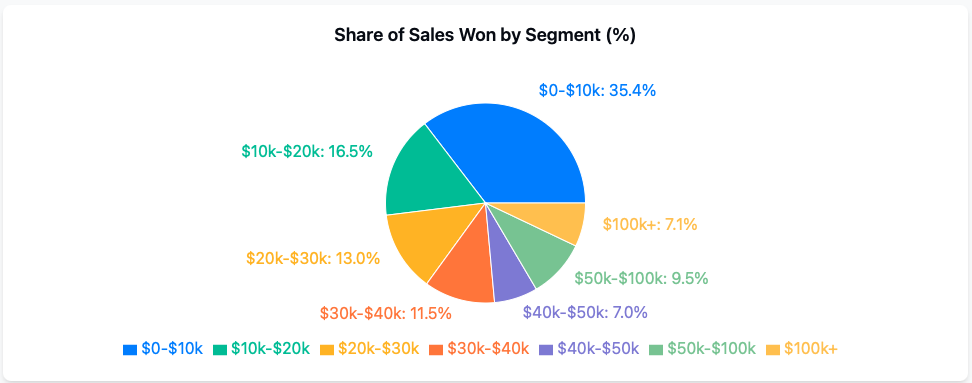

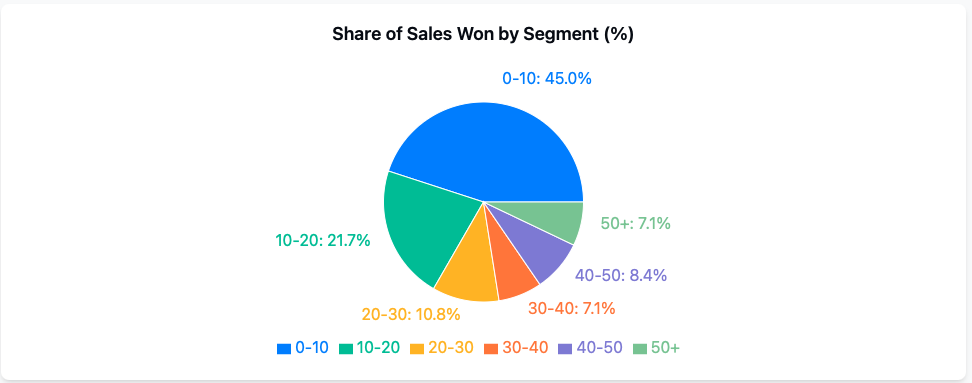

Figure 2 – Share of total loans originated by prescreened prospects by loan origination amount

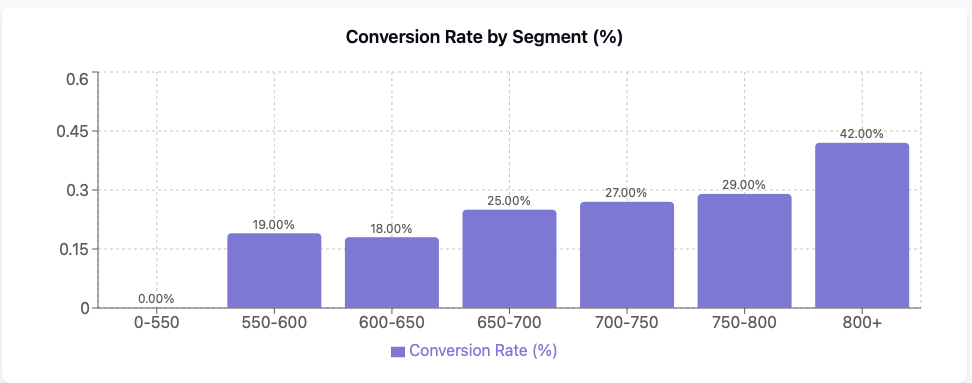

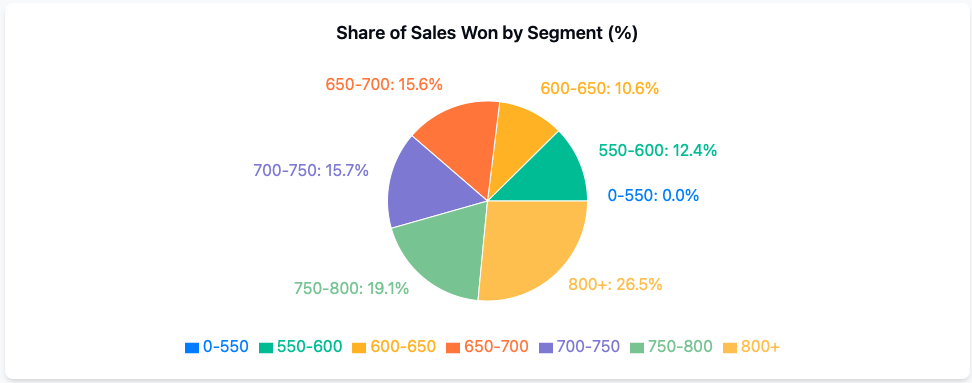

Figure 3 – Conversion rate by FICO score band

Figure 4 – Share of total loans originated by prescreened prospects by FICO band

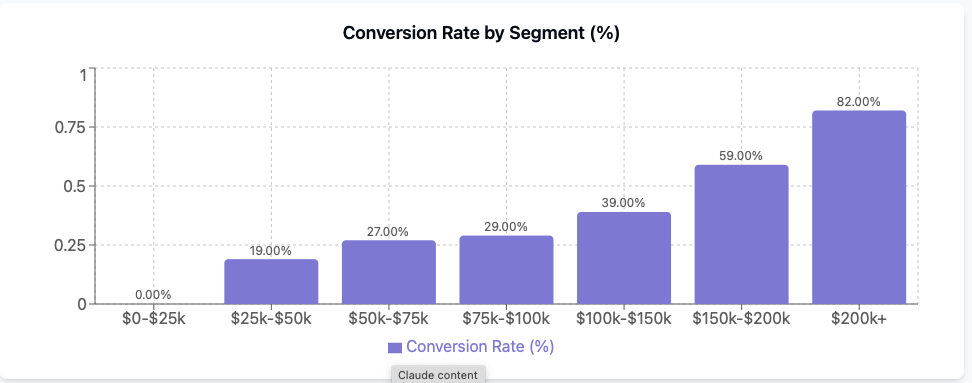

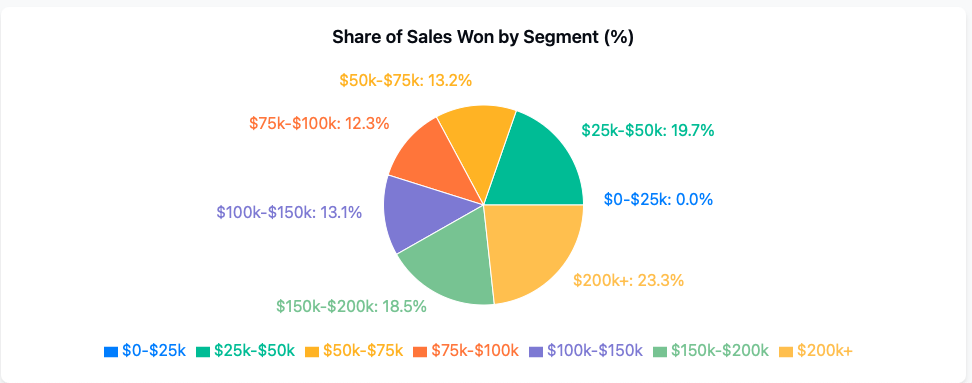

Figure 5 – Conversion rate by prospects’ income

Figure 6 – Share of total loans originated by prescreened prospects’ income

Figure 7 – Conversion rate by prospects’ Debt to Income Ratio (DTI) x 100

Figure 8 – Share of total loans originated by prescreened prospects’ DTI x 100

Key Insights

- Higher income segments ($150k+) show dramatically better conversion rates (0.59%-0.82%)

- Premium FICO scores (800+) demonstrate 50% better conversion than average

- Larger loan amounts ($50k-$100k) convert at 0.49% – nearly double the campaign average

- Multi-dimensional targeting (combining high FICO, income and loan amount) can yield 3x better results

- DTI optimization shows best performance in the 40-50 range at 0.35% conversion

Building Systematic Improvement Through Analytics

A comprehensive analytics approach enables continual refinement through these strategies:

- Progressive Optimization Model: Each campaign iteration can be treated as a controlled experiment, with results feeding directly into predictive models that continuously improve targeting precision.

- Competitive Gap Analysis: Rate differential data between won and lost applications (6.60% vs. 7.80%) provides clear competitive positioning insights. Understanding this spread across segments highlights specific competitive advantages.

- Cost-Per-Acquisition Efficiency: Multi-dimensional analytics allows precise calculation of acquisition costs by segment, enabling resource allocation to the most efficient channels and borrower profiles.

Implementation Framework for Competitive Advantage

Financial institutions implementing 360-degree analytics approach can achieve systematic improvement by:

- Creating segment-specific value propositions based on comprehensive performance data

- Implementing dynamic and compliant pricing strategies calibrated to competitive position by segment

- Establishing near real-time performance monitoring across all variables

- Leveraging artificial intelligence to improve next campaign specification based on what is now known and design experiments to discover what is not known with statistical certainty.

By applying these data-driven insights consistently across campaigns, lenders can expect measurable improvements in conversion rates, win rates, and portfolio quality. The analytics clearly demonstrate that understanding the interplay between multiple factors – rather than optimizing for individual variables in isolation – provides a significant competitive advantage.

This approach transforms new customer acquisition through lending from an occasional campaign activity into a continuously optimized process, driven by comprehensive data intelligence.

Get a demo of Micronotes’ smarter prescreen capabilities.