Looking at Loan Closing Times to Optimize Prescreen Marketing Strategies

By Devon Kinkead

In the competitive financial services landscape, understanding the average days to close a loan is critical for shaping effective prescreen loan marketing strategies. By tailoring marketing efforts based on the closing times of different loan types, financial institutions can significantly increase the number of pre-qualified loan applications and loans. Let’s explore how the data on average days to close a loan can influence marketing strategies.

Understanding the Data

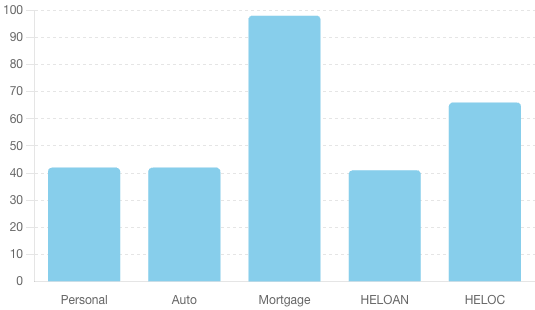

The data on average days to close a loan at one of our clients, following Micronotes-powered prescreen marketing campaigns, is as follows:

Figure 1 – Average days to close a loan following prescreen offer made across 630 loans

It’s puzzling that HELOANs closed faster than HELOCs but, this may be due to a small number of HELOANs that were applied for and processed almost immediately following the issuance of a firm offer of credit.

Impact of Loan Processing Times on Marketing Strategies

Personal and Auto Loans: Quick Turnaround Advantage

With an average closing time of 42 days, personal and auto loans offer a quick turnaround, which is a strong selling point in marketing campaigns. Highlighting the speed and efficiency of these loans can attract prospective qualified borrowers who are seeking rapid access to funds or to lower their borrowing costs. Marketing messages emphasizing fast approval and closing times can drive higher engagement and conversion rates.

Mortgage Loans: Setting Realistic Expectations

Mortgage loans have the longest average closing time at 98 days. Prescreen marketing for mortgages should focus on setting realistic expectations for qualified potential borrowers. Emphasizing the thoroughness of the process, the benefits of taking the time for careful underwriting, and the security of long-term investment can help manage customer expectations. Offering detailed information on the steps involved and providing regular updates can keep applicants engaged throughout the process.

HELOANs: Streamlined Processing

Home Equity Loans, with an average closing time of 41 days, can be marketed as a quick and efficient way to access equity. Similar to personal and auto loans, emphasizing the ease and speed of the application and approval process can attract more applicants. Highlighting the potential uses for HELOAN funds, such as home improvements or debt consolidation, can also enhance the appeal.

HELOCs: Balance of Speed and Flexibility

With an average closing time of 66 days, HELOCs require a balanced marketing approach. Emphasizing the flexibility and ongoing access to funds that a HELOC provides can be a key selling point. Marketing messages should highlight the benefits of having a line of credit available for future needs while also communicating the relatively quick processing time compared to mortgages.

Enhancing Prescreen Loan Marketing Strategies

Targeted Messaging

Tailoring marketing messages based on the average days to close each loan type can significantly impact the effectiveness of prescreen campaigns. For quick-to-close loans like personal, auto, and HELOANs, focus on speed and convenience. For mortgages and HELOCs, emphasize the benefits of the thorough process and the long-term value.

Data-Driven Campaigns

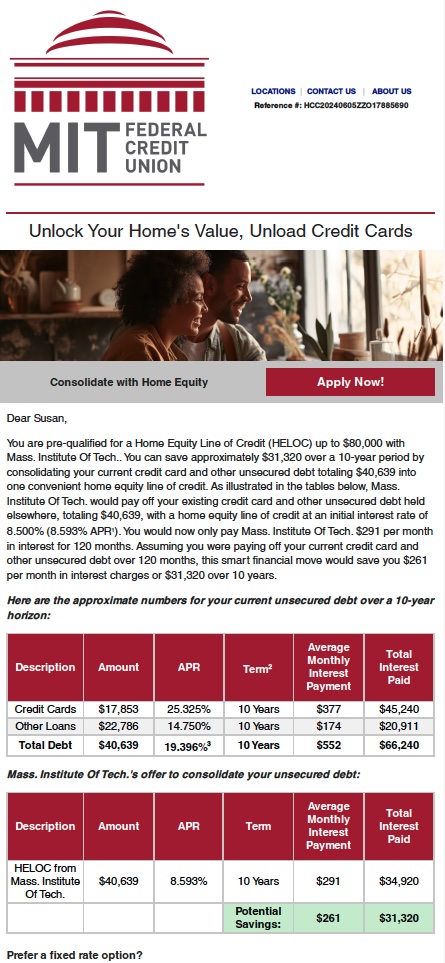

Micronotes processes 230MM credit records per week and delivers completely financially personalized FCRA compliant firm offers of credit to each prescreened customer, member, or prospect as shown below.

Educational Content

Providing educational content about the loan process can build trust and transparency. Detailed guides, FAQs, and step-by-step explanations can demystify the loan process, making potential borrowers more comfortable and confident in their decision to apply.

Multi-Channel Approach

Implementing a multi-channel marketing approach can reach a wider audience. Combining digital marketing, direct mail, and in-branch promotions ensures that the message about the loan’s processing time and benefits reaches potential borrowers through their preferred channels.

Conclusion

The average days to close a loan plays a crucial role in shaping effective prescreen loan marketing strategies. By leveraging this data, financial institutions can craft targeted, financially personalized prescreen marketing campaigns that highlight the strengths of each loan type, ultimately increasing the number of pre-qualified loan applications. In a competitive market, understanding and utilizing loan processing times can be a significant advantage, driving higher engagement and conversion rates while enhancing customer satisfaction.