Rethinking Silos: How Technology Optimization and HELOC Marketing Converge in 2025

By Devon Kinkead

The banking industry stands at a critical inflection point where technology optimization meets unprecedented opportunities in home equity lending. Two recent industry reports—BAI Banking Strategies’ “Unlocking Value Through Technology Optimization” and Experian’s insights on HELOC Marketing Strategies in a Flat Rate Environment—reveal a compelling narrative about how banks can leverage digital transformation to capitalize on the $25.6 trillion in untapped home equity held by U.S. homeowners.

The Perfect Storm: Market Conditions Creating HELOC Opportunity

The current economic environment has created ideal conditions for HELOC growth. With 61% of homeowners locked into mortgage rates of 6% or lower and equally reluctant to sell their homes in the next decade, traditional mortgage refinancing has become less attractive. Meanwhile, median home equity has climbed steadily from 35% in 2020 to over 50% in 2024, creating a massive pool of accessible capital.

This “rate lock” phenomenon aligns perfectly with banks’ need to diversify revenue streams amid economic uncertainty. As the BAI report notes, banks are under pressure to optimize technology investments for competitive differentiation—and HELOCs represent a prime opportunity to do exactly that.

Technology as the Great Equalizer

The intersection of these trends reveals a critical insight: technology optimization isn’t just about operational efficiency—it’s about market access and competitive positioning.

Speed and Digital Experience as Competitive Advantages

Traditional HELOC processes have been notoriously slow, taking 5+ weeks with dozens of documents and over 50% denial rates. Online lenders like Figure, Rocket Mortgage, and Spring EQ are capitalizing on this inefficiency by offering:

- Approval in minutes vs. 21-day industry average

- Closing in one week vs. 36-day industry average

- Fixed rates and predictable payments vs. variable rates

This directly aligns with the BAI report’s emphasis on “instant decisioning” and customer experience optimization. Banks that can leverage AI-powered underwriting, automated valuation models (AVMs), and remote online notarization (RON) can compete effectively with fintech disruptors.

The AI and Analytics Imperative

Both reports emphasize the critical role of data analytics and AI. The BAI study shows that 75% of banks are exploring generative AI potential, while the Experian presentation demonstrates how data-driven segmentation can unlock HELOC opportunities:

Three key segmentation strategies emerge:

- Existing mortgage customers with growing revolving credit balances

- Younger, digital-first demographics seeking debt consolidation

- Homeowners in high-appreciation markets with substantial equity

The typical HELOC borrower profile—761 FICO score, $140K income, 91% credit utilization—represents exactly the kind of customer that benefits from banks’ data analytics capabilities highlighted in the BAI report.

Addressing the HELOC “PR Problem” Through Technology

Experian identifies three critical challenges facing HELOC adoption:

- Misconceptions about equity-based products

- Lack of awareness

- Behavioral preferences (credit cards over HELOCs)

These challenges directly map to technology solutions emphasized in the BAI report:

Digital Education and Customer Experience

Banks need to bridge the gap between digital and personal service—exactly what the BAI report recommends. This means:

- Proactive financial guidance through AI-powered insights

- Educational content delivered through digital channels

- Seamless omnichannel experiences that combine self-service with expert consultation

API-Driven Innovation and Fintech Partnerships

The BAI report’s emphasis on secure API connections and fintech partnerships becomes particularly relevant for HELOC marketing. Banks can leverage embedded finance solutions to:

- Integrate HELOC offers into existing digital banking experiences

- Partner with home improvement platforms for contextual marketing

- Utilize third-party data for better customer targeting

Strategic Recommendations: Leveling Up HELOC Marketing Through Technology

1. Invest in Speed-to-Market Technology

Following the BAI report’s guidance on digital transformation, banks should prioritize:

- AI-powered underwriting for instant approvals

- Automated valuation models to eliminate appraisal delays

- Digital document processing to streamline origination

2. Leverage Data for Precision Marketing

Both reports emphasize data-centricity. Banks should:

- Segment existing customers based on mortgage status and credit utilization

- Use predictive analytics to identify HELOC prospects

- Implement real-time personalization in all channels using automated prescreen technologies

3. Create Educational Digital Experiences

Address the “PR problem” through technology:

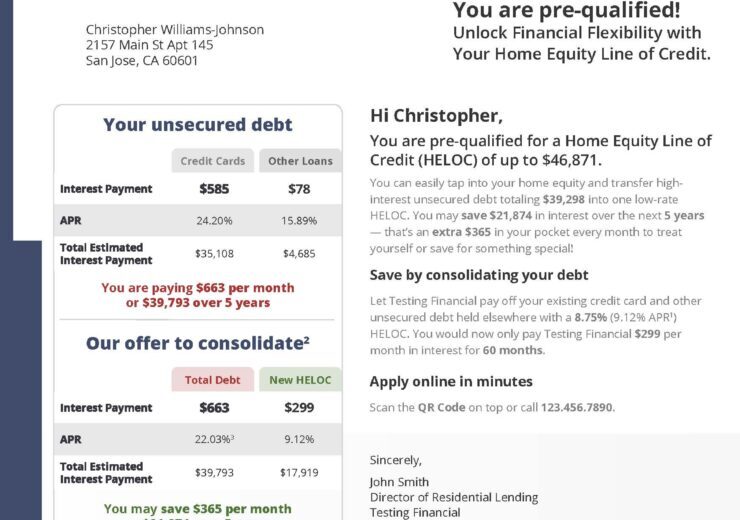

- Interactive calculators showing HELOC vs. credit card comparisons

- Personalized rate previews using existing customer data

- Educational content targeted by life stage and financial goals

4. Modernize the Application Experience

Align with customer expectations for digital-first experiences:

- Mobile-optimized applications with pre-filled data

- Real-time status updates throughout the process

- Digital closing options where legally permissible

The Competitive Imperative

The convergence of high home equity, rate-locked homeowners, and advancing fintech competition creates both opportunity and urgency. Banks that successfully integrate the technology optimization strategies outlined in the BAI report with targeted HELOC marketing will capture market share in one of 2025’s most promising lending segments.

The 29.3% of homeowners who have only a first mortgage and over 20% equity represent 28.7 million potential HELOC customers. With proper technology investments and data-driven marketing strategies, traditional banks can compete effectively against online-only lenders while deepening existing customer relationships.

Conclusion: Technology-Enabled Growth

The intersection of technology optimization and HELOC marketing opportunity represents more than just product promotion—it’s about fundamental business model evolution. Banks that view technology investments through the lens of market opportunity, rather than just operational efficiency, will be best positioned to capitalize on the $25.6 trillion in accessible home equity.

As both reports make clear, the future belongs to institutions that can combine the trust and stability of traditional banking with the speed and convenience of digital-first experiences. In the HELOC market, this combination isn’t just advantageous—it’s essential for competitive survival.

The time to “level up” is now. Banks that act decisively on both technology optimization and HELOC market opportunities will define the competitive landscape for years to come.