The Micronotes Perspective: Turning Credit Union Loan Growth Headwinds into Tailwinds in 2025

By Devon Kinkead

The credit union industry faces a paradox in 2025: record-high home equity meets frozen mortgage markets, rising consumer debt collides with tightening credit standards, and members need financial solutions more than ever while traditional lending channels stagnate. Recent data paints a challenging picture for loan growth, but at Micronotes, we see these headwinds as the perfect conditions for credit unions to deploy smarter, data-driven growth strategies.

The Current Landscape: Five Forces Suppressing Traditional Loan Growth

The latest industry analysis reveals five critical factors constraining loan growth across credit unions:

1. The Student Loan Squeeze

With student loan delinquencies surging to nearly 8% following the end of payment freezes, millions of members face damaged credit scores and reduced borrowing capacity. This ripple effect impacts not just student loan portfolios but constrains overall lending opportunities as members struggle with substantial debt burdens.

2. The Great Mortgage Lock-In

An astounding 81% of homeowners hold mortgages below 6%, with half locked in under 4%. With current rates hovering around 6.7%, homeowners aren’t moving—and they’re not refinancing. This creates a double challenge: minimal mortgage origination opportunities and reduced purchase mortgage activity as inventory remains frozen.

3. The Home Equity Opportunity

Here’s where the story shifts. Americans sit on $25.6 trillion in accessible home equity, with HELOC balances reaching $406 billion. Members who can’t afford to move are instead tapping equity for renovations, debt consolidation, and major purchases. This represents one of the most significant untapped opportunities for credit unions in 2025.

4. The Auto Loan Paradox

Despite a surge in vehicle purchases driven by tariff fears, auto loan balances actually declined for only the second time in 14 years. Why? A credit crunch pushed average credit scores up 8 points, excluding many traditional borrowers. Used car financing dropped from 41.6% to 37.1% as high rates made loans less attractive.

5. The Lingering Debt Burden

Credit card balances remain elevated at $1.18 trillion nationwide, with high-cost states showing the strongest correlation between inflation impacts and debt levels. Members need debt consolidation solutions more than ever, yet traditional marketing approaches fail to connect the right solutions with the right members at the right time.

The Micronotes Solution: Automated Prescreen Marketing as a Growth Catalyst

While these challenges seem daunting, they actually create ideal conditions for credit unions that embrace modern, data-driven marketing approaches. Here’s how automated prescreen marketing transforms each challenge into an opportunity:

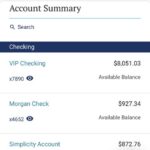

Precision Targeting in a Constrained Market

Traditional spray-and-pray marketing doesn’t work when loan demand is selective. Our automated prescreen technology processes 230 million credit records weekly, identifying exactly which members and prospects are:

- Credit-qualified for specific products

- Paying higher rates elsewhere

- Ready to consolidate debt

- Located within your service area

This precision means every marketing dollar works harder, achieving what we call “net negative acquisition costs”—where loan income exceeds campaign costs.

The HELOC Advantage: Meeting Members Where They Are

With mortgage refinancing off the table for most homeowners, HELOCs emerge as the hero product of 2025. Our data shows that 29.3% of homeowners with only a first mortgage and over 20% equity represent 28.7 million potential HELOC customers nationally.

Credit unions using Micronotes’ automated prescreen for HELOC marketing report:

- Higher conversion rates than traditional prescreen marketing

- Lower borrowing costs for members

- Manageable loan origination volume spread over 17 weeks (not all at once)

- Deeper wallet share with existing members

- Strong new member acquisition performance

Speed and Efficiency: Competing with Fintechs

While online lenders promise instant approval and one-week closings, credit unions can compete by combining their trust advantage with modern marketing efficiency. Automated prescreen:

- Delivers pre-approved offers in real-time

- Adapts to rate changes automatically

- Runs continuously without manual intervention

- Frees staff to focus on member relationships

The ROI Reality Check

Here’s the math that matters: Credit unions need just a 0.03% improvement in conversion rates to cover the cost of automation. Our clients typically see 0.10% improvements or higher—that’s a 3x return on investment. For a credit union sending 100,000 prescreen offers annually, that means just 33 additional funded loans pay for the entire system.

Three Strategic Imperatives for 2025

1. Embrace Continuous Marketing

The days of quarterly campaigns are over. Members’ financial needs don’t follow your marketing calendar. Automated prescreen runs continuously, catching members at their moment of need—when they’re actually ready to consolidate debt or tap home equity.

2. Focus on Financial Wellness, Not Just Loan Volume

Credit unions that position themselves as financial wellness partners, not just lenders, will win in 2025. This means:

- Proactively identifying members paying high rates elsewhere

- Offering debt consolidation before members ask

- Educating about home equity advantages over credit cards

- Providing personalized savings calculations in every offer

3. Leverage Data for Competitive Intelligence

Understanding why campaigns succeed or fail is crucial. Our AI-powered post-campaign analytics reveal:

- Which competitors are winning in your markets

- What rates and terms drive conversions

- Where untapped opportunities exist

- How to optimize future campaigns

The Mission Alignment Advantage

Unlike banks focused solely on profitability, credit unions have a unique advantage: prescreen marketing directly furthers your mission. By continuously identifying members who could save money through refinancing or debt consolidation, you’re not just growing loans—you’re improving financial lives.

Consider this: A member paying 24% on credit cards who consolidates to a 12% HELOC saves thousands annually. That’s money staying in your community, reducing financial stress, and building long-term member loyalty. It’s profitable growth with purpose.

Looking Ahead: The Window of Opportunity

The convergence of high home equity, elevated consumer debt, and rate-locked mortgages won’t last forever. Credit unions that act now to implement automated prescreen marketing will:

- Capture market share while competitors hesitate

- Build deeper relationships with existing members

- Attract profitable new members from larger institutions

- Position themselves for sustained growth beyond 2025

The credit unions succeeding in 2025 won’t be those waiting for conditions to improve—they’ll be those using smart technology to thrive in current conditions. With automated prescreen marketing, the question isn’t whether you can afford to modernize your approach; it’s whether you can afford not to.

Take Action Today

The data is clear, the opportunity is massive, and the technology is proven. While the industry faces legitimate headwinds, credit unions equipped with automated prescreen marketing are turning these challenges into competitive advantages.

Ready to transform your loan growth strategy? Contact Micronotes today for a personalized growth analysis of your market opportunity. Let’s turn 2025’s lending challenges into your credit union’s growth story.

About Micronotes: We deliver cloud-based big data, analytics, and digital engagement solutions to financial institutions that want to expand wallet share, market share, and retention. Our automated prescreen marketing platform processes 230 million credit records weekly, delivering financially personalized, FCRA-compliant offers that drive measurable growth for community financial institutions.