What Standard Chartered Taught Us About Speed—and How to Apply It to Loan Growth

By Devon Kinkead

When Nelson Repenning, my former professor at MITSloan, business partner, and friend and Don Kieffer tell the Standard Chartered story in their new book, There’s Got to Be a Better Way, the headline isn’t “more meetings fixed everything.” It’s that good work design turned a 120-day approval slog into a 20-day flow, unlocking >$250M/year in otherwise foregone revenue. They did it by (1) connecting the human chain—putting all 16 risk owners and project leads in a single weekly huddle guided by a rank-ordered “common backlog”—and (2) regulating the flow so the top one or two items got finished every week before starting more.

That one design change eliminated the asynchronous back-and-forth (conflicting asks from separate risk functions, local reprioritization, task-switching) that was burning calendar and cash. And because work flowed in a shared lane, problems surfaced immediately and were handled in a separate weekly “improvement hour.”

There’s a second lesson embedded earlier in the book: start small, let results travel. At Standard Chartered, thousands of bite-size problem-solving projects compounded to $150M impact in <2 years and 10,000 colleagues using the method.

Now, what does that imply for loan growth using automated prescreen marketing?

Prescreen has the same failure modes—and the same fixes

Automated prescreen lives at the intersection of lending (underwriting, rates), marketing (creatives, cadence), risk/compliance (FCRA), data (Experian ADS), and channels (email, direct mail, digital banking, SMS). The work crosses functions, so static, serial handoffs create the exact gridlock, task-switching, and local prioritization that slowed Standard Chartered’s approvals.

Micronotes Prescreen is built to automate the mechanics—eligibility, offer generation, file exchange with Experian, compliant creatives, launch and reporting—but organizational flow decisions still determine your cycle time from “market signal” to “offer in-hand.”

Here’s how to apply Standard Chartered’s moves to prescreen—verbatim, this quarter.

1) Create a single, rank-ordered Prescreen Backlog (the “common backlog”)

- Make one list of the top 3 prescreen “slices” (e.g., Auto Refi for existing customers, HELOC consolidation within geo X, Personal Consolidation to attriters). Order by NPV per calendar day so every day of delay is visible cost—just as Standard Chartered priced each day of approval slip. Then, finish the top 1–2 slices every week.

- Tie each slice to concrete inputs Micronotes Prescreen needs: underwriting criteria, rate/fee sheets, campaign settings. Don’t start the slice until those inputs are “clean.”

- If you don’t have the data to start building a Prescreen Backlog, get a free near-branch loan growth opportunity analysis here.

Why this works: a common backlog kills local reprioritization (“my campaign first”) and channels everyone to the system’s critical path—exactly what drove the 120→20-day drop at Standard Chartered.

2) Run a weekly Prescreen Huddle plus a separate Improvement Hour

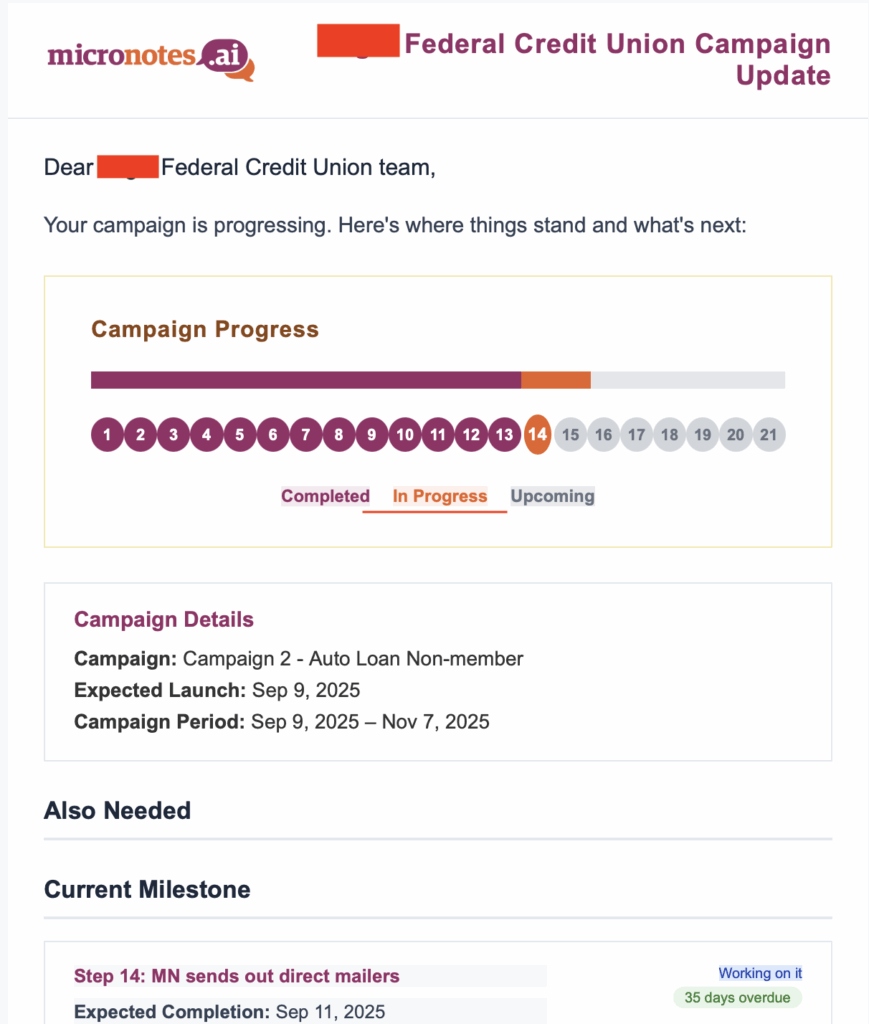

- Huddle (45–60 min): CLO, CMO, Compliance, Risk/CRO, IT/Data, and Campaign Ops meet once, live. Review the top of the backlog: Did last week’s slices ship? What’s blocking the next two? No status theater; demo the actual deliverable (selection file generated, creatives FCRA-checked, Experian file returned, comms in the queue). Micronotes enable this process through a weekly campaign update email as shown below in figure 1.

Figure 1

- Improvement Hour (30–60 min): Pick one change you can make this week to remove the biggest blocker (e.g., rate-sheet version control; faster compliance template path, faster responses on creative updates). This mirrors Standard Chartered’s second weekly ritual.

Why this works: separating delivery from improvement keeps flow moving while also increasing capacity week-over-week.

3) Visualize the work with a simple wall/board tied to the tool’s artifacts

Map the end-to-end Micronotes Prescreen flow for each slice and move a single card left-to-right only when the real artifact exists:

- Inputs locked (underwriting, rates/fees, campaign settings) → 2) Selection file generated & sent → 3) Prescreen file received (PII) → 4) Compliant creatives approved → 5) Channel queued → 6) Launched → 7) Results posted (opens/CTR/response, booked loans/HELOCs, NPV).

This keeps everyone aligned to the actual mechanics of the platform—Experian ADS, selection/prescreen file exchange, FCRA-checked creatives, and deployment/reporting—so you’re visualizing truth, not opinions. Micronotes facilitates this process with a Monday.com work board.

4) Limit WIP: fewer slices in process → faster cycle times

If the board “goes pink” (everything is late), you’ve overloaded the system. Cancel or pause slices until work moves. Don’t confuse busy people with a productive system—a misconception Standard Chartered had to dismantle.

5) Start small and scale

Pilot with one campaign (e.g., ALR to existing members via email). Prove cycle-time and revenue gains, then replicate. That’s how impact spread inside Standard Chartered—thousands of small wins rolling up to nine-figure value.

A 90-day prescreen playbook (field-tested)

Weeks 1–2: Design for flow

- Stand up the single backlog (top 20 slices ranked by NPV/day).

- Establish the weekly huddle + improvement hour; publish attendance and rules of engagement.

- Finalize the wall/board mapping the Micronotes Prescreen stages to visible artifacts.

Weeks 3–6: Ship two slices

- Lock underwriting criteria + rate/fee sheets for slice #1 and #2.

- Generate Selection File → send to Experian → receive Prescreen File (PII); stage compliant creatives; launch.

Weeks 7–10: Raise the ceiling

- Use Improvement Hour to remove the biggest blocker (e.g., rate-sheet freshness, compliance templates).

- Review post campaign analytics and determine what’s winning market share and what isn’t.

Weeks 11–13: Scale what works

- Keep backlog strictly ordered; finish the top 1–2 every quarter.

- Publish results: cycle time (days from slice start→launch), booked balance/loans, NPV/day freed by faster flow. Tie back to objectives: marketing share, wallet share, conversion, compliance, reporting.

What to measure (and why finance will love it)

- Cycle time per slice (days): Your version of Standard Chartered’s “120→20.”

- $ per calendar day: NPV of incremental bookings divided by elapsed days, so the backlog is ordered by value of speed (not politics).

- Right-first-time rate: % of slices that launch without rework (proxy for clean inputs & compliance).

- Throughput: slices shipped per week.

- FCRA compliance adherence via templated creatives & approvals in the tool.

Bottom line

Standard Chartered’s results didn’t come from heroics—they came from designing the work to flow across functions: a single backlog, one weekly lane to finish work, and a habit of fixing the system every week. Automated prescreen has the same cross-functional anatomy and benefits from the same operating system. Wire these principles on top of Micronotes Automated Prescreen—clean inputs → selection → Experian → PII → compliant creatives → launch → learn—and you’ll reduce time-to-offer, raise conversion, and create space for discovery instead of firefighting.

Source: Repenning & Kieffer, There’s Got to Be a Better Way (Standard Chartered approvals flow, common backlog, improvement hour, and quantified impact).